Gadoon Textile Mills Limited (PSX: GADT) was established in 1988 as part of the larger Yunus Brother group. The latter was established in 1962 with businesses spanning textiles, cement and power generation. Gadoon Textiles primarily operates in the fiber spinning sector, manufacturing and processing cotton and man-made fibers; thus, catering to B2B clients.

Shareholding pattern

A major shareholding of the company is with the associated companies, undertakings and related parties. This category solely includes Y.B Holdings (Pvt) Limited. A little over 21 percent is distributed with the local general public, followed by banks, DFIs and NBFIs that own nearly 8 percent of the shares. The directors, CEO, their spouses and minor children own less than 1 percent of the total shares of the company.

Historical operational performance

For the most part since FY08, Gadoon Textile Mills have witnessed positive growth rate in its topline, while profit margins reached a peak in FY11, after which they fell consistently before rising again in the last three years, i.e. FY17 and onwards.

In FY15, the company saw a 14.6 percent increase in its topline. By the start of the second quarter of FY15, the company was merged with Fazal Textile Mills Limited. However, cost of production stood to consume 95 of the revenue, leaving little room for other costs be covered. This was mostly dominated by raw material cost which made up more than 50 percent of the total cost of production. Although the price of raw material had reduced during the year, GADT “had to rationalize the higher cost of inventory in hand and therefore has written down to its net realizable value (NRV)”, charging Rs 317 million as expense.

Gadoon Textile Mills experienced a decline in sales revenue for the second time during FY16, since FY08. This was in line with the reduced global demand seen in 2016. It was particularly difficult for Pakistan as the local cotton crop was destroyed due to floods, which meant that imported raw material had to be procured. This kept the cost of production high as is the case with Gadoon Textile Mills. Its cost of production rose to consume almost 97 percent of the revenue. Although the rationale remains unexplained since raw material purchases has declined between FY15 and FY16, both in terms of rupee as well as a percentage of total cost. Despite the economies of scale kicking in, as per expectations, margins were low due to lower revenue.

Some recovery was seen in FY17, as topline grew at more than 9 percent. Most of this incline was contributed by increase in local sales, as exports became uncompetitive; the country faced intense competition from regional players such as India, Bangladesh and Vietnam that offered prices below what players from Pakistan could. There was a decline in cost of production, which allowed gross margins to improve, while other income provided the boost to operating and net margins; bottomline clocked in at Rs807 million compared to a loss of Rs274 million in FY16. Other income mostly came from ‘realised gain on short-term investment’ and rebate on export sales.

Topline grew by almost 19 percent in FY18, the highest seen since FY13. Export sales made a significant contribution as it grew by 36 percent whereas local sales grew by 10 percent. This was brought about due to government export package ‘with softening conditions’ in addition to currency devaluation which made exports favourable. Local sales increased since demand for value added textile products increased which meant demand for raw material, that is, Gadoon Textiles fabric. With costs only increasing marginally, profit margins were lifted, to reach their highest level at a net profit of Rs1.2 billion.

Topline further grew in FY19 at a little over 13 percent. Growth has been relatively subdued since during the first half of FY19 the trade war that involved China led to fewer orders from China which is one of the major export markets for Pakistan for yarn. Cost of production further reduced to take up 91 percent of the revenue since the company has diversified its sources of procuring imported cotton, along with using local product as well. While this helped to improve gross and operating margins, finance cost contracted the net margins. This was due toa higher interest rate which caused finance cost to nearly double year on year. As a result, net margin reduced.

Quarterly results and future outlook

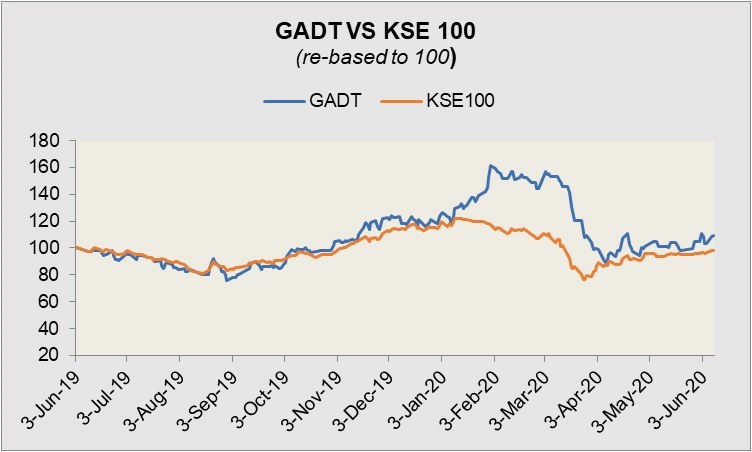

The company remained on its growth trajectory to grow its topline by 11 percent year on year during 9MFY20. Export sales continued to rise while local sales were marred due to inability of the government and businessmen to resolve the issue of CNIC. So while gross margins improved, operating and net margins were affected due to currency devaluation, specifically in the month of March 2020 which led to a next exchange loss of Rs911 million of which Rs830 million is unrealized. The company attempted to reduce its finance cost by obtaining foreign exchange loans, however the benefit of this was offset by the currency devaluation, causing operating and net margins to decline.

Given that there is a lot of uncertainty with regards to the ongoing pandemic, it cannot be quite ascertained when business activity would normalize. However, the company is hoping to capitalize on the developing demand for other textile related products such as masks, gowns, gloves etc. to generate positive cash flows.

Comments

Comments are closed.