Buxly Paints Limited (PSX: BUXL) was established as a private limited company in 1954 under the Companies Act, 1913 (now Companies Act, 2017). Later in 1985, it was converted into a public limited company. The company manufactures and sells paints, pigments, protective surface coating, varnishes and other related products. It does so under a toll manufacturing agreement with Berger Paints Limited.

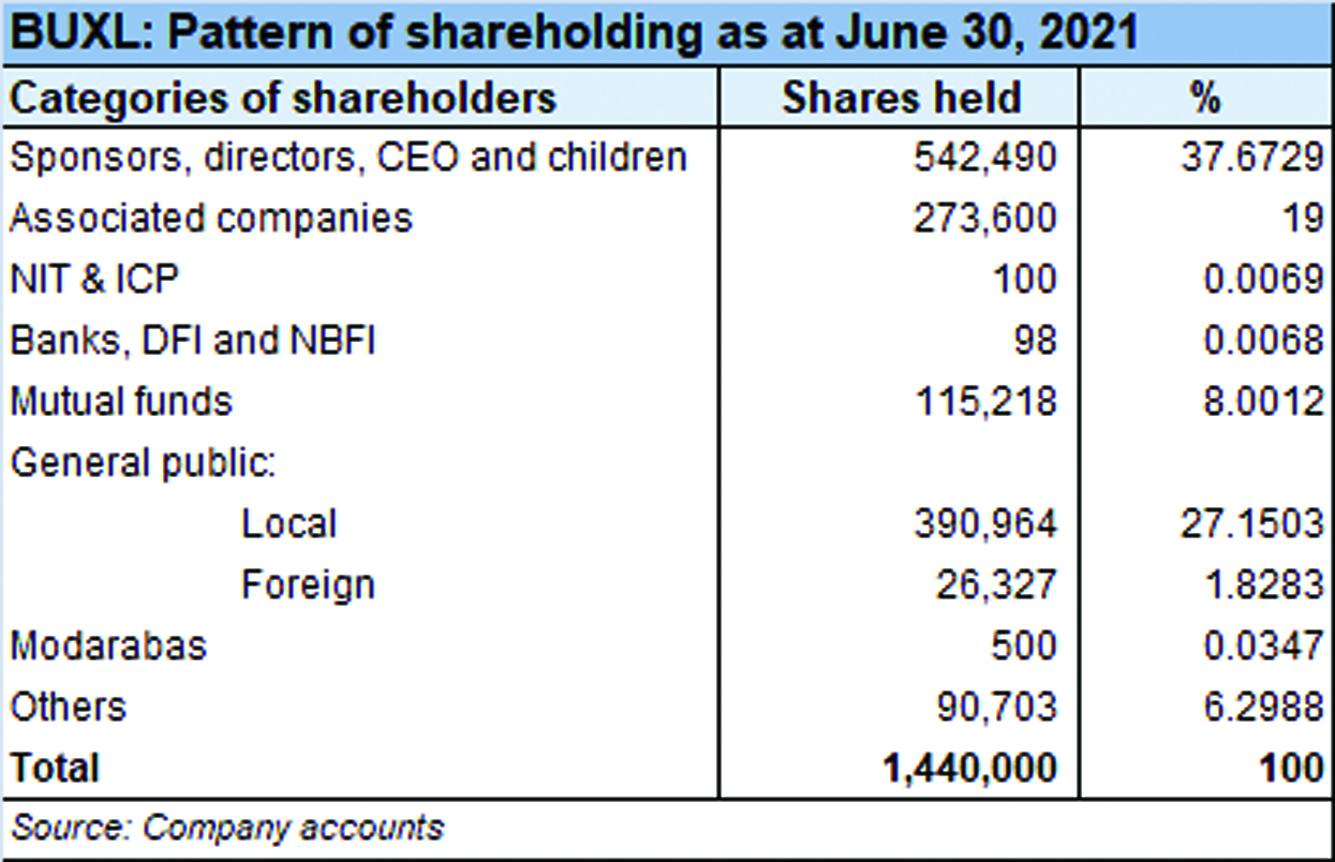

Shareholding pattern

As at June 30, 2021, close to 38 percent shares were held by the sponsors, directors, CEO and their children, followed by over 27 percent shares held by the local general public. The associated companies own 19 percent shares in the company while another 8 percent shares are held in mutual funds. Over 6 percent shares are categorized under “others” while the remaining roughly 2 percent shares are with the rest of the shareholder categories.

Historical operational performance

Buxly Paints Limited has mostly seen a growing topline while the profit margins in the last six years have fluctuated.

During FY18 the company witnessed a 16.7 percent growth in its topline to reach Rs 314 million in value terms. But this did not translate into higher profitability as cost of production consumed almost 85 percent of revenue, compared to almost 76 percent seen in the previous year. The increase in costs was due to increase in prices of raw materials and currency devaluation. The entire burden of higher costs could not passed on to the consumers therefore, gross margin reduced to 15 percent, from last year’s 24 percent. Although the company earned a significant Rs 5 million in other income, it could not offset the escalation in finance expense that rose to Rs 4 million compared to Rs 1.5 million in FY17. Thus, the company incurred a loss of Rs 5.4 million for the year.

After seven consecutive years of increasing revenue, the latter contracted by over 18 percent in FY19. This was the biggest decline in topline seen since FY09. The loss in revenue resulted in gross margin decreasing further to 12 percent. In addition, the business environment had generally been impacted by the general elections and the political uncertainty associated with it. The economy also witnessed inflationary pressure and currency devaluation that discouraged spending. Similar to the previous year, the support from other income could not offset the continuously rising finance expense owing to rising interest rates. Thus, net loss escalated to an all-time high of Rs 15.7 million.

There was some recovery in FY20 as revenue grew by 7 percent to reach Rs 275 million. This was also reflected in the improved profit margins as noted by a gross margin of over 19 percent, with cost of production also consuming near 81 percent of revenue, an improvement from last year’s near 88 percent. This made room for better absorption of further costs. Although finance expense also increased to Rs 7 million, the company was able to post a net profit, albeit marginal, of Rs 52,000. However, it was a significant improvement from last year’s net loss of Rs 15.7 million.

At nearly 29 percent, the company witnessed the largest growth in net revenue in FY21 seen since FY13. Gross sales had registered an almost 32 percent rise as the economy saw a V-shaped recovery and business activities resumed after the strict lockdowns placed following the outbreak of the Covid-19 pandemic. However, cost of production continued to shrink gross margin that was recorded at 16.3 percent for the year. But it was the major reduction in distribution expenses as a share in revenue that allowed for an improved bottomline at Rs 2.8 million. Majority of the decrease in distribution expense was associated with salaries and other benefits.

Quarterly results and future outlook

The first quarter of FY22 saw revenue higher by over 32 percent year on year. However, owing to inflationary pressures and currency devaluation, the cost of production continued to increase, at over 86 percent of revenue, keeping gross margin lower at 13.2 percent compared to 15.5 percent in the same period last year. This also trickled to the bottomline as operating expenses also increased as a share in revenue. Thus, the quarter ended with a net loss of Rs 1.7 million versus a net profit of Rs 1.6 million in 1QFY21.

The second quarter also saw an increase in revenue by 50 percent year on year. This was attributed to a rise in volumes as well as a better sales mix. Cost of production as a share in revenue was again higher keeping gross margin lower at 14 percent. However, the decline in administrative expense made room for profitability as the company posted a net profit of Rs 2.7 million compared to a net loss of Rs 1.1 million. While the topline has been growing for a large part of the decade and is expected to continue to rise, it is the cost of production and increases in input prices that have posed a challenge.