2023-24: Finance Minister Ishaq Dar says 3.5% growth targeted in ‘responsible budget’

- Becomes fourth finance minister in four years to present federal budget

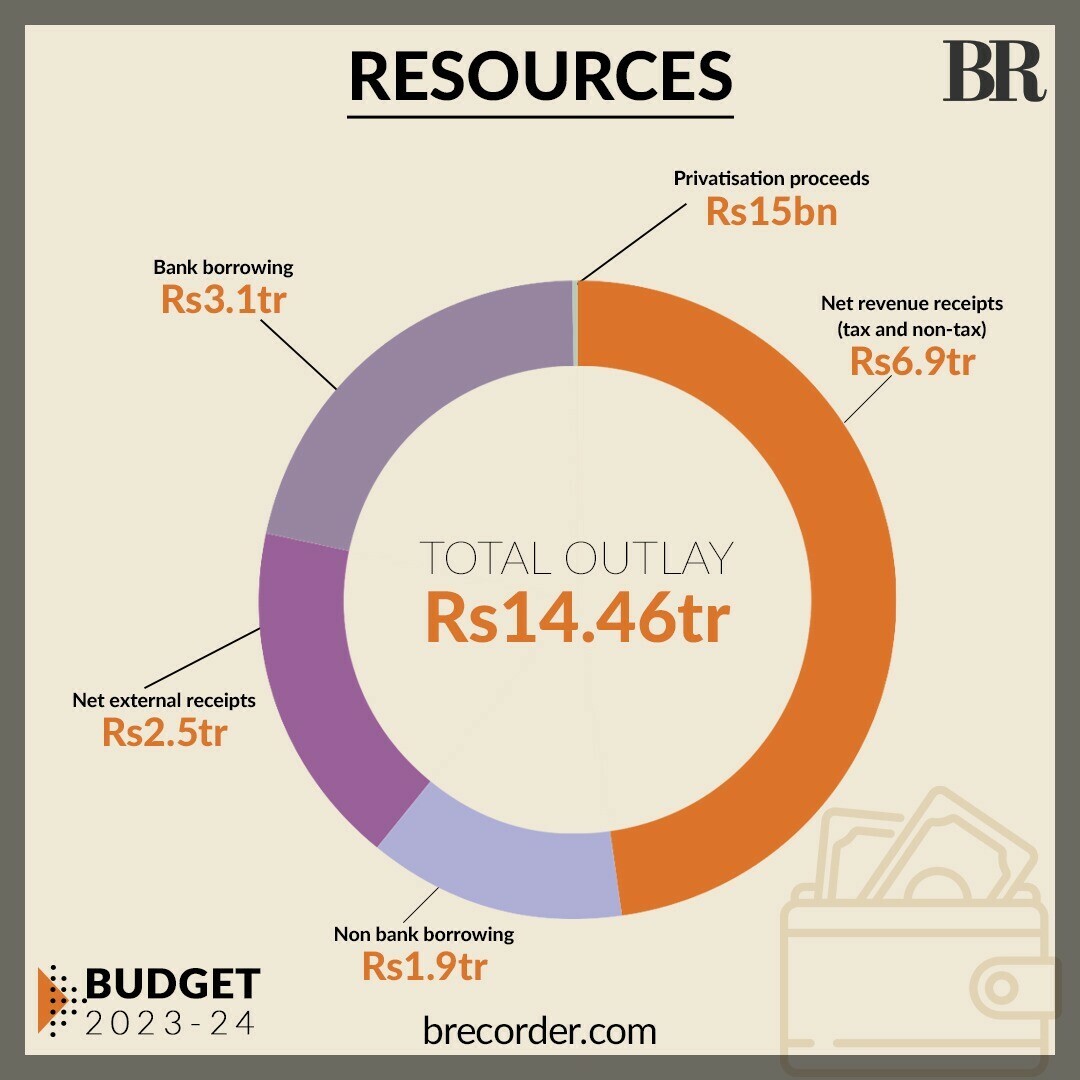

The government of Pakistan presented budget for fiscal year 2023-24 on Friday. Business Recorder takes a look at some of the key highlights of the documents.

Economic growth target fixed at 3.5% for fiscal year 2023-24

Inflation forecasted to average at 21%

Tax-to-GDP ratio to stand at 8.7%

Current account deficit to stand at $6 billion by end of fiscal year 2023-24

Government has allocated Rs1.8 trillion for defence spending

Rs1.1 trillion earmarked for subsidies

Rs761 billion allocated for pension

Government will spend Rs950 billion on account of Public Sector Development Programme

Rs22.7 billion earmarked for health sector

Agriculture credit limit enhanced from Rs1,800 billion to Rs2,250 billion

Solarisation of 50,000 agriculture tubewells through Rs30 billion

Withdrawal of all duties and taxes on imported seeds, combined harvesters, dryers and rice planters

Rs10 billion earmarked for PM’s Youth Business and Agriculture Loans scheme

Rs6 billion subsidy announced on imported urea

Targeted subsidy announced on wheat flour, ghee, pulses and rice

35% increase in salaries of government servants of grade 1-16 in the form of ad-hoc relief

30% increase in salaries of government servants of grade 17-22 in the form of ad-hoc relief

Tax free imports of software and hardware by IT and IT enabled services equal to 1% of their exports with a ceiling of $50,000

No sales tax return by freelancers with exports of $2,000 per month

Increase in Benazir Income Support Programme allocation from Rs400 billion to Rs450 billion

Upward revision in pensions and increase in minimum pension to Rs12,000

Rs10 billion set aside for provisions of 100,000 laptops for students

Exemption of custom duty on import of raw material for batteries, solar panels and inverters