The market participated with full heart in the recent PIB auction, indicating that the pulse in rates is peaked. Market perception is changing; the view is building that current account deficit and reserves will be managed, and interest rates will start coming down in 6-9 months. This space has already highlighted the fact that due to global economic slowdown and changing stance of central banks, it is time to rethink policies at home – (read “Enough tightening-time to change signals”).

In a PIB auction earlier this week, market showed interest to the tune of Rs1 trillion in PIBs while the government picked up almost half of it (Rs495 bn), and in the last two auctions combined, the issue stood at Rs821 billion. This heightened interest was last seen in 2014 – one commonality is the IMF programme – condition of lengthening maturity profile. The other could be investment by commercial banks at peaked interest rates. Now banks perceive that rates are peaked and it is time to grab PIBs as much they can.

A couple of months back, the market was talking about another rate hike – and the divide was whether interest rates are peaked or will move up further. Today, the tightening possibility is out, and the bet is when will rates start coming down – some are saying in November while other are saying in second or third quarter of next calendar year. The shift is there, but the SBP might wait till a few quarters before becoming dovish – as the fiscal slippages are likely, so some caution is warranted.

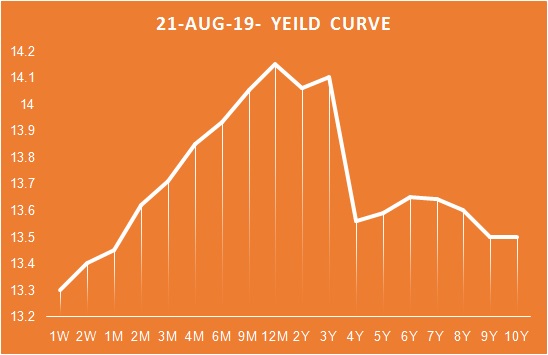

The government picked up major chunk (Rs415bn) in 3-year paper at 14.25 percent (unchanged from last auction) – the maturity of the paper is around 2 years; hence the bonanza of commercial banks would not be much. In case of 5 and 10 year papers, the MoF has moved smartly to accept less amount to lower the yields – cut off down by 25 bps and 40 bps to 13.55 percent and 13.14 percent respectively in 5Y and 10Y PIBs.

One reason for higher participation and relatively lower rate is conversion of SBP’s short term debt into PIBs – IMF condition, and that gave a signal to market that changing maturity profile is not solely dependent on commercial banks; and that is why government is picking up longer term at lower rates.

The yield curve inversion has magnified. Inverted yield curve, at the time of peaking interest rates, in an economy like Pakistan, is not a bad thing (read “Inverted yield curve – a healthy sign”). What the yield curve is depicting that the economic slowdown (recession) is there for short to medium term and long term outlook is improving. The market rates are likely to remain high in 3 months to 2 years papers, and beyond that, rates will keep on falling.

Comments

Comments are closed.