Sugar Industry: A case of Policy and Institutional Failure

Dr. Mahmood Ahmad, Visiting Researcher, Center for Water Informatics and Technology (WIT)/Lahore University of Management Science (LUMS) and Senior Policy Officer, FAO Regional Office, Cairo (Retired). and Tabeer Riaz, Research Assistant, Center for Water Informatics and Technology (WIT)/Lahore University of Management Science (LUMS).

1. Background and Context

As a professional working in agriculture and water policies for last 25 years, I believe If Imran Khan can rationalize sugarcane and wheat policies, it would be one of his greatest contribution to the development of agriculture and agro-industrial sector of Pakistan. The interest groups both sitting in parliaments (who are large farmers and mill owners), supported by Bureaucracy/relevant institutions and All Pakistan Sugar Mills Association (APSMA) having huge stake in this commodity, under one pretext or the other have tilted past policies in their favor largely at tax payers cost. Expecting a right policy discourse is not possible as long as this powerful group is both the policy makers and their execution.

Recent Sugar Inquiry Report which was made public cannot be described as an in-depth analysis covering all bases of sugar industry, it is only one aspect -- sugar price hike was the result of government’s decision to allow export of sugar unjustified as it caused a 30% increase in its price. The report highlights that main beneficiaries were among other, key persons of the ruling party with Rs1.03 billion subsidies on the export of sugar, paid out from the taxpayer’s money, which was equal to 41% of the total subsidy the government of Punjab paid to sugar barons. The hope is that accountability process started will lead to a major shift in way the business operates in sugar industry and act as a model for reforms in other commodity like wheat. It would be a missed opportunity if accountability process is long drawn and slowly forgotten and business as usual returns. We have tried in this paper to bring a balanced view of all stakeholders based on extensive review of literature, vast global experience and ongoing pilot work on sugarcane and other crops initiated at WIT/LUMS.

2. Stake Holders Perspectives

This sugar crisis is not happening for the first time as every year at the start of the crushing season a perpetual conflict between two main stakes holders’ farmers and millers plague the industry. But in our view, there is need to document views and roles of all actors in the supply chain in getting better understanding of industry and who are more often the winners and losers. Our paper is largely based on stakeholder’s views including academia independent take and leaving readers to draw conclusions. This is a typical Harvard Business School case study in the making for policy makers and also as a teaching material.

2.1 Farmer

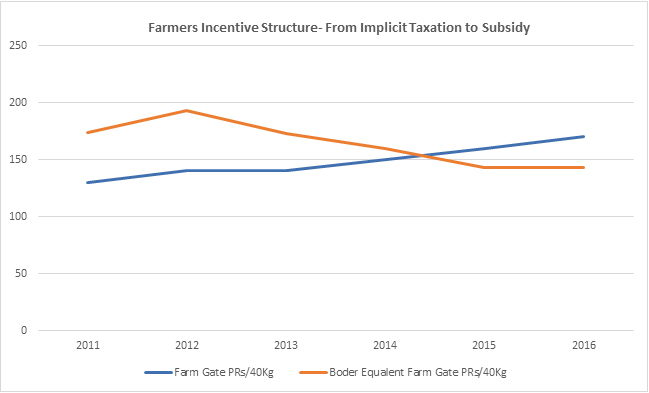

Farmers often claim that procurement practices used by sugar processors such as delaying the crushing season, buying cane at less than the support price, and withholding payments hurt their profitability. Every year at the start of the crushing season millers deliberately delay crushing for one reason or the other, often forcing growers to sell their crop for less than the fixed price which has been set higher than international price equivalent since 2013 (figure1). For example farmers in year 2017-18 received a price as low as Rs 120, against the fixed price of Rs 180 per 40 Kg, again in 2013–14 as reported in World Bank study, farmers received an average price of PRs 3.75/kg against support price of PRs 4.25/kg, a clear case of policy and institutional failure in setting base price for farmers. Only two mills, JDW Group and Shahtaj Sugar Mills Ltd. paid farmers the announced price, strongly supports farmer allegation. Farmers also complain that even when they sell to mills, they don’t get paid immediately and delay results in huge debt to farmers. Again, it’s a major challenge before the Sugar Industry to off load dues accumulated and paid to farmers over the years – a fact well documented. On the other hand, studies show that sugarcane profitability is highest among other competing crops, meaning even under reported price distortions, farmers prefer its cultivation. (See 3.2 Section Relative Profitability of Sugarcane)

Figure 1

2.2 Millers

On the other hand, sugar processors complain that farmers grow unapproved varieties that produce low sucrose content resulting in lower sugar production and recovery rates. As a result of the fluctuations in quantity and quality of the raw material, sugar mills have been required to operate at 50 percent of their installed capacity. Figure 2 and 3 below shows how extraction rate and price of sugarcane effects ex-mill price, both these policy instruments carry huge impact on retail prices. Furthermore, the lower sugarcane supplies have also forced most of the mills in cane producing areas to close 1-2 months earlier than normal. Further, they make a case that sugarcane is the only crop that gets paid by weight and not by quality. They claim that loss is generally borne by the mills. Instead, the government just keeps increasing the support price that results in producing most expensive sugar in the world.

Is there a sugar mafia? The millers deny with an argument that in sugar production, 80 percent of the cost is the cane, and 10 percent is in the form of taxes. So, 90 percent of the cost of sugar is fixed by the government, what can they do anyway in 10 percent opportunity space? (PSMA Chairman 2015). On the other hand, N. A. Mangi, (dawn 20/2/2006) a sugar industry expert holds the view that massive unregistered buying of sugar cane take place in the Punjab. Instead of growers selling their cane at the gate of the mills and receiving a receipt assuring payment at a later date, the representatives of mills bought sugarcane from the field. According to his article, the process enables grower to receive cash payments rather than wait for delayed payments and they accept lower prices to save to the hassles of chasing payments later. It also enables them to evade income taxes. At the same time, it enables the mills to pay less for cane and easily evade sales tax and provincial taxes. The massive tax evasion goes entirely unchecked by the Central Board of Revenue.

Figure 2

Figure 3

Then strongest and convincing arguments from Millers is that sugarcane productivity is around 54.6 ton per acre compared to as high as 120 ton per acre in Egypt. Pakistan is the only country in the world where sugarcane pricing is not based on recovery; cane with 8 percent recovery is worth the same as cane with 13 percent recovery. The average sucrose recovery in Pakistan is less than 10% that can go as high as 12. Our simulation based (figure 2) on Inquiry Report data reveal that 12 % recovery ex-mill price can drop to 62.86 proving a fiscal space to reduce retail sugar prices. Increase in cane yield and recovery through better cane varieties and good crop management practices are needed.

2.3 Trader

Sugar exports cannot not be economically viable as long as international price is lower than retail prices of sugar (figure 5) which has been the case in Pakistan since 2013, it can only be exported with a subsidy, authorized by Economic Coordination Committee (ECC)/Trading Cooperation Pakistan (TCP) and provinces are taking financial undertaking. The question is who benefited all these years from a misguided policy, obviously not the consumers who could have access to low cost sugar if it was imported. All these years exports were only possible with export subsidy a fiscal cost borne by tax payers especially when this huge outlay could have been used to improve crop productivity and competitiveness. The policy decision lies with ECC, either to store excess supply or export with subsidy, it has been their call and should be responsible for taking credit or criticism for the outcome. It makes perfect economic rationale for traders or millers to make use subsidy for export and make abnormal profits. What is the role of Competition Commission of Pakistan (CCP) in all this is a guess? It openly allows the menace of hoarding to liberally take place without so much as conceptualizing that mass-scale raids and tough penalties should be imposed on hoarders and profiteering. We believe the present inquiry report in our view, TCP, CCP and ECC role in this debacle should also be audited.

Figure 4

Figure 5

2.4. Consumer

In other countries the voice of consumer is often very powerful, especially more in the urban areas, so government keeps the prices of sensitive items like sugar low through imports or releasing buffer stocks. Here it seems sugar lobby being so powerful that even they can tilt policies in their favor as reflected in figure 5. As explained above, retail prices of sugar are insulated from international markets, thus consumers often end up paying a high price for relatively poor-quality sugar. The instruments used for such a market outcome range from high ex-mill price and element of hording taking place by middleman or mills, translating in price hikes at retail levels, a basis for present sugar crisis in the country.

2.5 Government or Tax Payers

There is no specific Govt perspective – they simply roll out the policies designed long time ago. Ministry of National Food Security and Research (MNFS&R) sends its recommendations for support price of sugarcane in October each year following the request of provinces; however, the provinces take their time in announcing the prices. It needs to be appreciated that Pakistan’s sugar sector has witnessed turmoil time and again. Interim measures used to address sugar production and prices include, inter alia, fixing the sugarcane support price by the Government, intervening in open market supply of sugar through the Trading Corporation of Pakistan (TCP), exporting sugar with subsidy and providing sugar on subsidized rates through government owned Utility Stores Corporation of Pakistan. While such measures are likely to be competition adverse, they may have some merit on grounds of consumer protection/welfare. But question is doing consumer benefited or the interest of sugar baron was protected. Further,

the policies formulated at Federal level are without giving much weight to competitiveness of sugarcane in domestic and export markets. Enhancing productivity is key to competitiveness, no efforts have been made by Research Institutions to produce varieties yielding higher recovery rate.

In our view a great deal of bias exists both at provincial and federal levels as revealed by lack of credible policy studies on sugarcane and one gets the impression as “no go area” for in-depth policy analysis in comparison to rice, cotton, maize etc. Two examples may bring more clarity. First, the most recent documents coming out is “Punjab Agriculture Growth Strategy 2018-19, very impressive forward looking, if you go over the report and it very well lays out roadmap for crop diversifications and value addition, but sugarcane as key crop is touched sparsely. How crop diversification can be considered if most water thirty crop is not in your calculus?

Second is based on author’s personal experience, in 2017, the Secretary for Industries Punjab contracted me to carry out comprehensive study on Sugar Industry with focus on byproducts –perhaps recruited given my experience in Egypt – professionally one of my excited moments. As work was progressing well, to our surprise/shock with change in administrative within Ministry our contract was terminated, showing clearly, we were stepping out of bounds in doing evidence-based research on sugarcane.

3. Independent Researcher

This section would present some aspects of sugar policies not well documented in Pakistan context - but in our view are important in developing a long-term sustainable policy for sugar industry.

3.1 Global Perspective – Huge Export Subsidy Distorts Market

Sugar is among the most traded commodities with exports accounting for over one quarter of global production- but it also has one of the most distorted global markets in terms of output prices and export subsidy – surprisingly this is the central point of Pakistan Sugar inquiry report. With this huge subsidy, Europe sugar costs more than three times the world market price, and like in Pakistan this excess supply can only be exported with subsidy, thus Europeans farmers and processors are the world’s biggest recipients of sugar subsidies. This is contradictory to what World Trade Organization (WTO) rules are, what World Bank and International Monetary Fund (IMF) preach developing countries. Not only that this policy carries major negative impact on developing countries especially for those having cost advantage in sugar exports and badly need of foreign exchange. The argument defending such policies from export countries like Europe and USA is the huge fiscal space they carry– can afford export subsidy compared to developing countries, as it is very small percentage of their GDP.

3.2 Relative profitability of sugarcane is due to announced support price.

The profitability of sugarcane is highest; and from farmer perspective it makes economic sense to grow and promote sugarcane, especially when relative profitability of other crops is on the decline (figure 6). So why farmers give up growing sugarcane as long as support price is there and canal water is almost free?

Figure 6

Source: For 2006, from Agriculture Price Commission Report, for 2016 Agriculture Marketing Information Service (AMIS), Directorate of Agriculture (Economics & Marketing) Punjab, Lahore.

The cotton belt, i.e. the South Punjab area is also very conducive to sugarcane production. A rough study showed that the farmers and the national economy suffered substantial losses running into billions of rupees by this shift from cotton to sugar cane. During the past ten years, the area under sugarcane cultivation increased by sizable margin, mainly because the cotton crop was considered risky with low returns. Furthermore, the better draining soils are also less prone to Redroot disease, which is a major sugarcane disease in Pakistan.

3.3 Growing sugarcane under irrigated agriculture does have a comparative advantage, putting in lay man language this means if value of our domestic resources - land, water, labour and capital are priced at true cost (economic not financial), growing sugarcane (widely traded commodity) does not make economic sense as reflected in high domestic resource cost (DRC) estimated by few studies. Appleyard (1987), Haq, Khan and Ahmad (1988) and Longmire and Debord (1993) all show DRC in range of 1.1 to 1.5 meaning, meaning spending Rs 110 to 115 for a return of Rs 100 – important question is who is bearing this cost -- none other than the tax payers. On the contrary, cotton has a sound comparative advantage with DRC values in the range of .26 to .28. These numbers tell us the degree of policy failure, which now reached its limits as our export performance getting worst, sugarcane taking over cotton overtime is simply due to incentive structure being in favour of sugarcane.

3.4 But Sugarcane can be grown at no Cost - Promotion of Sugarcane intercropping and improved practices.

The biggest untold story comes from innovative idea floated by PEDAVER (PA/PQNK) based on their technical support to group of small and large farmers – advocating farmer to adopt good agriculture practices that include raise bed cultivation; optimizing plant population; use of good quality and treated seed and also include legume as intercropped. Sugarcane is produced from single bud, meaning using less than 60 kg seed per acre in place of 150 mounds (6,000 kg) in a conventional system. One gets 2,000 mounds yield. On top of it ratoon crop gives up to 8 crops in place of 2 or 3 low yielding crops under conventional system. Sugar recovery is improved by 2 percent, which means 22% more sugar produced from the same amount/volume/weightage of sugarcane. Then benefits from by products (molasses, co-generation, mud cake and others) provides further income and cost reduction. These good agriculture practices are combined with a legume crop intercropped generates enough revenues that can pay off all the cost of sugarcane cultivation. The upshot being, farmer’s income would increase at no cost with large volumes of saved water. Figure 7 shares a bit of our innovative policy work underway at WIT/LUMS for Rice and Sugarcane showcasing how adopting good agriculture practices can put sugarcane in class of crops having tremendous comparative advantage, in fact this kind of Domestic Resource Cost (DRC) is often registered for horticulture crops.

Figure 7

This would provide an opportunity by reducing area from sugarcane cultivation (in the long run) and its subsequent allocation to oil seeds and high value crops. There is a need to undertake a comprehensive study to look at technical, economic, environmental and social aspect of sugarcane cultivation. The only information/data comes from articles in newspaper as a response to recurring crisis.

3.5 Need to rationalize water use in Sugarcane.

When water is used for production, low water costs may permit the cultivation of water-intensive crops (rice and sugarcane), which cannot be economically grown if water commands a high cost, unless productivity is enhanced or other costs are reduced. In Punjab approximately 90% of sugarcane is grown under irrigation and there is increasing pressure to demonstrate efficient use of limited water resources, we produce one ton of cane, 200-250 tons of water is required, and often produced where the cost of irrigation water is low, if we price water right, we can rationalize its production at no cost, in fact policy action will yield social benefits. Thus, the cost of water may be a factor, which determines the cropping pattern of an irrigated area, and farmers’ capacity to produce certain crops, particularly popular food-crops. The present flat rate system is allocative neutral leading to misallocation of this scarce resource. Therefore, the water pricing is imperative for rationalizing water use and cropping pattern. Further, technology adoption, crops diversification and promoting high value crops will never happen if farmers do not see (1) rise in income by adopting the new technology and (2) value/cost of water is high – on both accounts, present policy prescription fails.

3.6 Cogeneration and other benefits form Sugar Industrial

There are very few sugar mills currently in Pakistan which produce enough electricity through bagasse cogeneration to supply the national grid, let alone meet their complete internal needs. A firm policy/commitment is needed on part of Government, during our field work almost three years ago for above sugarcane pilot, Shahtaj Sugar Mills Ltd story must be documented – the mill invested 3 to 4 crore in state of art cogeneration plant with government agreement to buy excess electricity, we were told that govt nudged out of the contract, shattering the investment confidence from private sector – hope that dispute has been settled paving the way for further investments. The installed capacity is gradually increasing as more mill owners look towards investing in efficient plants and connecting to the grid as well. Electricity generation through sugarcane bagasse has an extraordinary worth for energy scarce country like Pakistan, further sugarcane crop can provide food, feed, fuel, fiber, fodder, and fertilizer for improving its comparative and competitive advantage. The vertical integration rather than horizontal expansion of the sugar industry is the need of the hour. The value-added products e.g. spirits, yeast, acetic acid, citric acid, glucose etc., must be produced. The development of these products would help reduce the cost of sugar which remains the principal produce. (Hussain, Anwar and Hussain 2006,)

3.7 There are number of options for price reforms

The center of policy debate is getting right price for farmers, millers and consumers. As jury is still out, we can learn much from expert views and international experience to propose a healthy policy debate. Our analysis clearly shows that farm price for sugarcane has implications for ex-mill and retail prices and key to industry reform process.

Given the high volatility of sugar prices in world markets and the political sensitivity of import-competing crops, a price band policy with price floors and ceilings might be an attractive option to evaluate. There is an ongoing debate in many countries over what might governments do to deal with the recent increase in volatility of commodity prices, especially of food prices[1]. Valdes (2013) also advise using a type of variable tariff based on moving averages of world prices. When world prices rise in short term, the tariffs would fall, cushioning the negative impacts on domestic buyers. When world prices fall, the tariffs would increase, cushioning the negative impacts on domestic producers. Such a possibility would have to be exceptional and administered with a credible commitment to focus this deviation from tariff uniformity on these few import-competing products only, with pre-established and transparent rules.

Then there is school of thought advocating that by replacing the current pricing mechanism with a new system that would connect sugarcane price with the wholesale price of sugar in an attempt to ensure a level playing field for all commodities. Sugarcane comprises 80% of the wholesale price of sugar. The suggestion is that sugar millers should pay 75% of the sugarcane price in advance and 5% after a year keeping in view the average wholesale price of sugar.

India has been debating sugarcane prices for some time, the latest suggestion come from the Commission for Agriculture Costs and Prices, 2016, that recommends the Government on partially decontrolling the sugar sector (abolishing levy and freeing the monthly release system) and then cane price and sugar price realization linkage to create the Hybrid Formula for pricing of sugarcane, which is composed of revenue sharing principle dovetailed with some Minimum Fair Reference Price (MFRP). The revenue sharing principle will be to distribute the total revenue generated in the cane-sugar value chain from sugar and its first stage by-products (molasses, bagasse and press mud) produced from a ton of sugarcane, between farmers and millers in the ratio of their relative costs (70:30) incurred in producing sugarcane and converting that sugarcane into sugar and by-products. If the value of by-products is loaded on the value of sugar, then this ratio comes to 75:25. Given the uncertainty about future sugar prices, this revenue sharing principle needs to be combined with MFRP so that farmers are ensured of a minimum price. Adoption of this transparent and scientific Hybrid Formula as the basis of pricing of sugarcane will bring greater stability and rationality in the sugar sector. (Price Policy for Sugarcane, Commission for Agriculture Costs and Prices, MOA, Govt of India, 2013)

As concluding remarks the excess supply or excess demand comes at a heavy cost to tax payers. There is an over-production of sugar in the country, creating situation like what is happening to wheat – which cannot be exported at a competitive price and entails large subsidies which we cannot afford. Inquiry report very well spells this out as large amounts have been provided in subsidies to sugar manufacturers for export. The committee also reported that the Punjab government allocated Rs3 billion at a time when the price of the commodity was increasing in the domestic market clearly a case of institutional failure. On the other hand, policy failure is very clear – farmers are getting price higher than international price in Government accounts but this might not be the case as role of middleman (mills agents) is well known. Consumer are major looser as sugar price is insulated from world markets and paying high prices for a poor-quality sugar. Then hidden environmental cost is not accounted -- paid by present and future generation for water scarcity and its poor quality. Rationalization of output and input prices along with adopting PEDAVER (PA/PQNK) supported good agriculture practices is the best pathway in developing a profitable, competitive, sustainable and inclusive agriculture. Decontrolling sugar industry and incrementally moving towards full cost water pricing can address issues related to Policy, Institutional and Market Failure in Sugar Industry. Hope inquiry report leads to a forward-looking policy discourse.

[1] Valdes A, 2013, Agriculture Trade and Price Policy in Pakistan, Policy Series Paper on Pakistan, World Bank

Comments

Comments are closed.