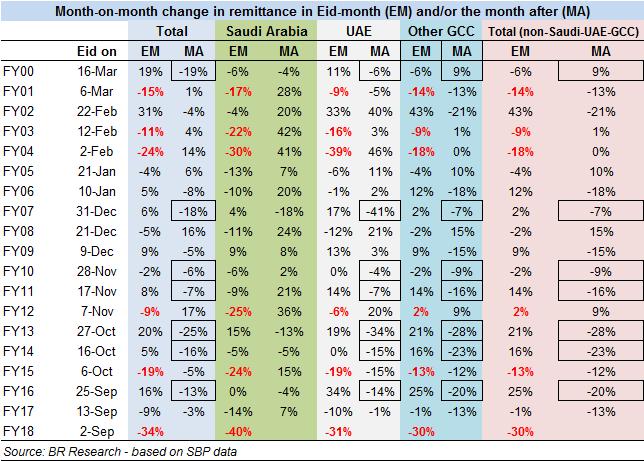

Earlier this month, BR Research highlighted how remittances inflow dropped by a third on month-on-month basis due to what is oft known as the seasonal Eid affect. Upon closer inspection, however, it appears there is more to the drop in remittance than just the seasonal affect.

Recall that total remittance inflows in September 2017 $1294 million, its lowest monthly flow since February 2016. Country-wise examination revealed that the drop was the highest in the case of Saudi Arabia - a whopping 40 percent month-on-month. September 2017 inflow from Saudi Arabia stood at $308 million – the lowest since November 2012. That raised flags.

The story, based on banking sector sources who request anonymity, is this. Soon after HBL was fined by American authorities, the bank decided to cut its ties with the Saudi-based Al-Rajhi Bank. The exact date of the severance of those ties is not known but it its impact became visible in September 2017 remittance data. Sources another say leading local lender has cut off ties, whereas some bankers were also thinking along the same lines, before they realized that it’s better to improve risk management and due diligence instead of cutting of banking relations.

Meanwhile, sources add, after severing ties with Al-Rajhi, HBL has kept a low profile on remittance business until the dust settles over the fine saga. Bear also in mind that in late August 2017 HBL had decided to close its New York branch.

While other banks are still doing business with Al-Rajhi, the fact is that HBL is one of the top players in remittance business, and also has the biggest branch network in the country with nearly 1700 country-wide branches as of June 2017, according to SBP data. Quite naturally, domestic capacity to absorb HBL’s thinning remittance business would be low. Also, when it comes to remittances, anecdotal evidence suggests that remitters are rather loyal to whatever local bank or foreign banks/tie-ups they do their business with.

The impact of this development is noticeably visible in remittance flows from Saudi Arabia (see graph and table). And from the looks of it, it might remain weak till October or November 2017 depending upon how soon the Saudi channel is strengthened to previous levels.

However, this doesn’t mean that remittance flows will start growing sharply after the Saudi channel gets back to previous capacity. A host of demand/supply factors and structural issues are behind the remittance slowdown. This is clear from the multi-month lows in remittance flows from other major channels. The lows visible in other remittance channels appear too much to be a seasonal Eid affect; nor can the weakness in all corridors be attributed to the HBL saga.

Still, not all hopes are lost just yet as the PRI – the collaboration of SBP and FinMin – has a host of initiatives planned to boost remittances (See PRI head’s interview in this paper’s Brief Recording section Aug 21, 2017). Here is hoping that the finance ministry, the lead on PRI, will be implementing those plans, and soon.

Comments

Comments are closed.