It is a bold move for a company to launch a brand-new vehicle in the midst of a pandemic but that is exactly what Indus Motors (PSX: INDU) did. In fact, the country was going into strict lockdowns and factories were temporarily ordered to be shut down by the government as Toyota Yaris was introduced to the market. Surprisingly, Indus Motors actually sold over 1300 units of the model in May and June. This also summarizes the biggest automakers’ outgoing financial year—down but still very much in the game.

Earnings during FY20 for the company dropped 63 percent after a marked decline in volumes and consequently the top line. But unlike its peer Honda Atlas, Indus Motors still turned a profit and managed to give its shareholders a final payout of 70 percent in addition to the interim dividend of 230 percent.

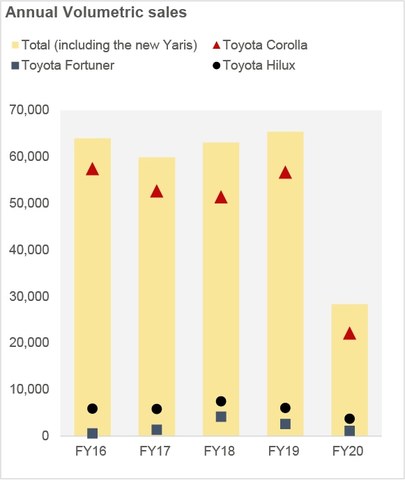

There was a substantial reduction in volumes (down 57 percent) due to reduced demand. Some blame could be levied on the lockdown months where plants were shut down but that was a mere case of bad timing becoming worse. Loss in demand was a long time coming and a direct result of a slowing down economy.

Bad economic fundamentals meant purchasing power had shrunk, inflation was high, bank borrowing was high which together chipped away at car buying prospects. It also did not help that car prices sky-rocketed over the past two years since the rupee took a hit against the dollar. Though demand persevered for nearly a year of this economic climate—as Toyota buyers are typically well-off and any changes in income and prices have delayed effects on their demand—consumers finally caught onto these factors and demand decelerated.

Monthly Toyota sales over the past five years show volumes have remained between 3000 and 6000 until Jul-19 when sales suddenly dropped below 2000 units, further down in August and recovered only slowly the successive months.

The drop in revenues of 45 percent in FY20 however was lower than the volumetric decline—as revenue per unit sold rose to 26 percent. Despite price hikes, margins seemingly could not be shielded as input costs due to higher import costs (rupee depreciation) and inflationary pressures locally all led to a higher cost of production.

Overheads took up nearly 4 percent of the revenue stream during the year (FY19: ~2%) which together with slightly higher finance costs—0.1 percent of revenue in FY20 against 0.04 percent of revenue in the preceding year—sliced the bottom-line.

Undoubtedly, this the lowest profits the company has earned over the past five years while a dividend per share of Rs30 during the year against Rs115 in FY19 and Rs140 in FY18 are not exactly confidence boosting. But the worse might be over. Post-corona, Toyota has few challenges ahead. Until such a time when real competitors in combustion engines and electric vehicles step into the domain, Toyota has a strong market presence and a brand loyalty to boot. Since prices of cars across the board have been raised, consumers will just have to cough up extra for the same cars—but if history is any guide, they would do so gladly.

Comments

Comments are closed.