Attock Petroleum Limited (PSX: APL) is an oil marketing company and is part of the Attock Oil Group of Companies. APL was incorporated in 1998, and its portfolio consists of lubricants, commercial and industrial fuels. The company markets and supplies fuels to manufacturing industry, armed forces, power producers, government/semi-government entities, FMCG companies, developmental sector, and agricultural customers.

APL has a strong retail network with over 660 outlets nationwide. Its fuel portfolio consists of high-speed diesel, motor spirit, jet fuel, kerosene oil, asphalt, furnace oil, light diesel oil and lubricants. It also offers a range of lubricants that include both automotive and industrial grades blended with base oils and additives. The exports include naphtha to the Middle East, Far East and South Asia, and some petroleum products to Afghanistan.

Shareholding pattern

APL is part of the Attock Oil Group of Companies, which is a fully vertically integrated group covering all aspects of the oil and gas sectors of Pakistan, ranging from exploration, production, refining to marketing of a wide range of petroleum products. Besides oil and gas, Attock Group is also involved in other diversified businesses, like cement, energy & information technology.

APL is largely held by Attock Group’s Attock Refinery, Pakistan Oilfields Limited, and Attock Oil Company, that together make up over 38 percent of the shareholding. APL’s sponsor, Pharaon Investment Group Limited Holding s.a.l holds around 34 percent of the shareholding. It is a Lebanese holding company and initially was R. Pharaon. & Fils, which was established in 1868 in Beirut, Lebanon and continually expanded and developed its activities in diversified fields such as insurance, household appliances, consumer electronics, agrochemicals, industrial and domestic gases, flavours and fragrances, pharmaceuticals and medical equipment. For a breakup of shareholding, refer to the illustration.

Past performance

The oil marketing sector’s performance has been hinged on how demand of petroleum products has taken shape over the years. Factors that impact consumption patterns include international oil prices and hence prices at home; government policies and preferences like the furnace oil curtailment; power sector merit order etc. and industrial activity at large.

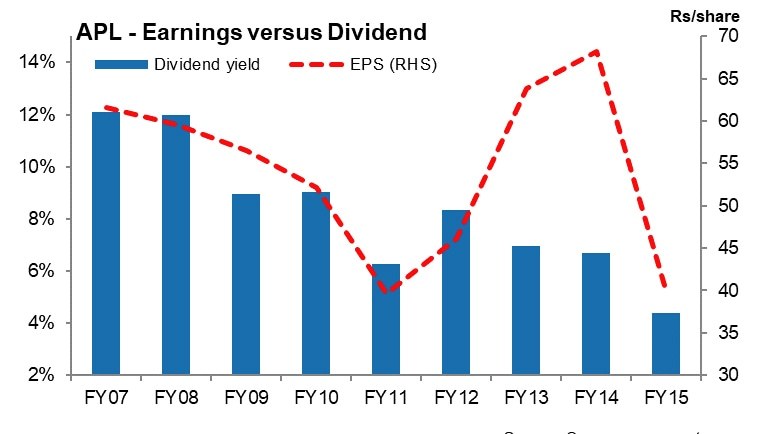

Back in FY14, the OMC sector came in the limelight driven largely by volumetric growth in retail fuels. At the same time, furnace oil consumption continued to peak in the power sector. Growth in retail fuels was because of improvement in the liquidity of the companies and rising petroleum product consumption in the country amid lower oil prices. APL was able to increase its market share from 9.3 percent in FY13 to 10.1 percent in FY14 due to its better product sales. In terms of profitability, FY14 was good for APL where revenues improved on the back of volumetric growth in fuels. However, rising inventory losses kept earnings restricted.

The growth in retail sector continued in FY15 as oil prices continued to decline and the economic activity flowed. However, lower oil prices also brought inventory losses and affected the liquidity position of the downstream oil marketing companies. APL was able to achieve 8 percent year-on-year increase in sales volume. Its market share increased slightly from 10.1 percent in FY14 to 10.4 percent in FY15. However, higher inventory losses cut the revenues where APL’s topline declined by 16 percent year-on-year, and Its botomline dropped by 24 percent year-on-year due to the overall impact of inventory losses, the reduction in HSD volumes, petroleum prices, and decline in other income.

In FY16 higher oil prices resulted in inventory gains that lifted revenues, and hence gross margins for APL. Moreover, the retail drive continued in FY16, and APL was able to add 35 new outlets to its retail network. Despite motor gasoline increasing its share in volumes and margins for APL, the firm’s overall volumes were adversely affected by the phasing out of furnace oil - like the rest of the players. As a result, APL lost market share in attempt to reduce exposure in furnace oil due to unattractive margins.

In FY17, revenue growth for APL was almost 27 percent year-on-year, which was largely brought by strong growth in volumetric flows; diesel and petrol sales grew by around 17 percent and 38 percent, respectively on a year-on-year basis. However, a subsequent growth in cost of sales restricted the gross margins. Overall, APL’s earnings were up by 38 percent year-on-year.

In FY 18, APL continued its revenue growth (28 percent) as petroleum prices remained high and volumes grew as well. Increase in sales volume and inventory gains due to rising price trend of petroleum products during the year resulted in higher gross margins. However, earnings increased by only 7 percent, year-on-year due to reversal of provision of other charges and higher exchange losses due significant currency depreciation during the year. The liquidity in FY18 was affected by the increase in trade debts and corresponding trade payable due to supply of products to the IPPs and increase in stock and corresponding liabilities as per the company’s annual accounts.

FY19 performance

FY19 was not a prosperous year for the OMC sector including APL. With falling crude oil prices and domestic currency nosediving, the downstream oil marketing sector was hit hard. Where the falling crude oil prices resulted in significant inventory losses for the OMCs, the depreciating rupee brought in substantial exchange losses. And the effects of monetary and fiscal tightening have been adversely affecting the OMC sector in FY19.

APL’s topline grew by around 26 percent year-on-year, which was entirely due to higher petroleum product prices, because voluemtric growth remained subdued in FY19. APL’s volumes declined by 11 percent year-on-year decline led by furnace oil and high speed diesel sales

The company also faced higher invenotry losses due to fallign crude oil prices. APL’s net earnings for FY19 came down by 30 percent, year-on-year. And besides the higher inventory losses, the OMC’s earnigns were injured by substantial exchange losses incurred due to currency depreciation.

Finace cost further aggravated the decline in earnings amid high interest rate environment, and nearly 6.5 times increase in share of losses from associates – due to losses incurred by the Attock Refinery and Natiaonal Refinery in FY19. While there has been a decline in profitability in FY19 along with a decrease in volumetric sales, APL saw its market share increase from 9.7 percent in FY18 to 10.8 percent in FY19.

Outlook

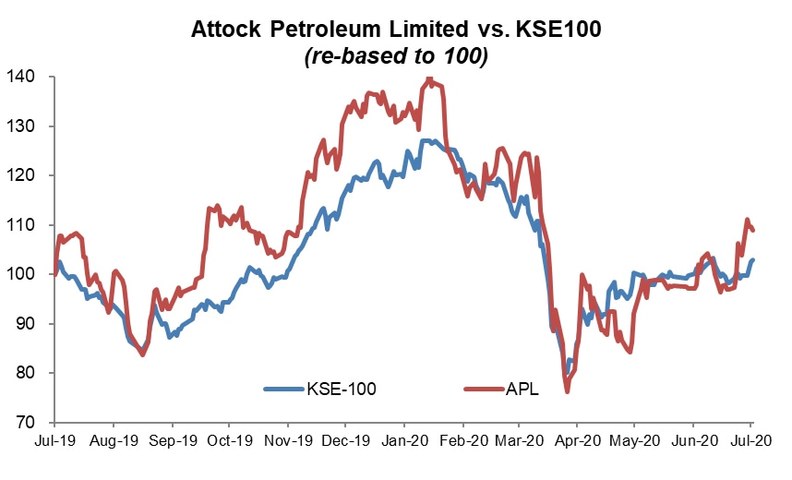

The OMCs are yet to announce their FY20 financial performance, but it is no brainer that FY20 has been another difficult year for the OMC sector because of COVID-19 and the resulting slowdown in the economy. Even before COVID-19, economic growth had stalled, which was resulting in no growth in volumes.

APL in9MFY20 saw it revenues remain static despite the increase in petroleum prices because volumetric growth remained subdued. The average selling prices of petroleum products across the country increased by 14 percent, however, APL’s net sales revenue remained at same level n a year-on-year basis as the firm recorded a 10 percent slide in sales volume. Earnings of the OMC saw a decline of over 63 percent year-on-year.

Repercussions of the lockdown due to COVID-19 have been felt across the OMC sector; mass-scale reduction in public movement, reduced business activity and a complete halt on public transport and interprovincial movement pushed petroleum product sales down. However, despite the challenges, APL managed to restrict the drop in sales volume and slightly increased the market share from 11 percent to 11.2 percent.

Comments

Comments are closed.