Getting a theme or trend in foreign direct investment these days is difficult; the last few months have been chaotic not only because of Covid-19 but also because of confusion in policy direction. The CPEC theme is also fading away as projects under it are reaching completion in many instances. As per SBP’s latest data, net FDI in 2MFY21 has increased by around 40 percent year-on-year, while net FDI in August 2020 alone was seen to increase by 24 percent year-on-year. However, FDI from China saw a net outflow of over $20 million in August 2020, which took overall FDI from China in 2MFY21 to $6.6 million only.

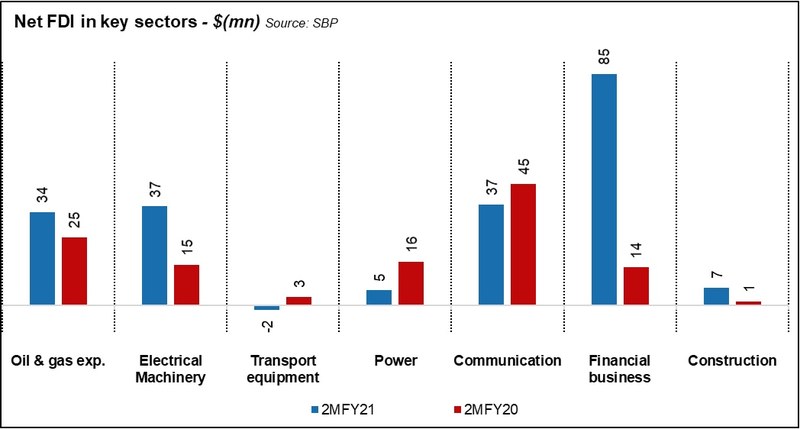

Country-wise, the largest investor in 2MFY21 was Norway with $45 million net FDI in August, and Netherlands with over $39 million in 2MFY21. In terms of sectors, net FDI in power sector was only $5.5 million due to $28 million FDI outflow in August, plausibly to China. Sectors that led net FDI in 2MFY21 were financial businesses, oil and gas exploration, electrical machinery, and telecom.

Despite the growth seen in overall FDI in two months of FY21, foreign direct investment has been on a slippery road. It has missed government’s attention amid austerity measures, exchange rate, interest rate environment, taxation policies while the global pandemic has added further to the woes. FDI in the country lacks diversification and is still a challenge despite an open investment policy due to grim business climate, inconsistent taxation policies, long dispute resolution processes, and poor intellectual property rights (IPR) enforcement as highlighted by the US State Department in its Investment Climate Statements for 2020.

With general business environment still not investor friendly, a silver lining perhaps could be the special economic zones under CPEC that have the goal to provide a conducive business environment to investors to attract FDI. Pakistan and China had recently signed a development agreement for the Rashakai SEZ in Nowshera under China Pakistan Economic Corridor (CPEC), while other like Dhabeji (Thatta), Allama Iqbal Industrial City (Faisalabad), and a science & technology park in National University Science and Technology have been approved as well.

Comments

Comments are closed.