Ghani Global Glass Limited (PSX: GGGL) was established in 2007 as a private limited company under the Companies Act, 2017. It manufactures and sells glass tubes, glassware, vials, and ampules.

It is part of the Ghani Global group of companies. Other companies under the group are Ghani Chemicals and Airghani.

Shareholding pattern

About 52 percent of the total shares of the company are held by the joint stock companies followed by individuals owning close to 39 percent. The directors, CEO, their spouses, and minor children hold a little over 1 percent shares while the remaining about 7 percent shares are distributed with the rest of the categories of shareholders.

Historical operational performance

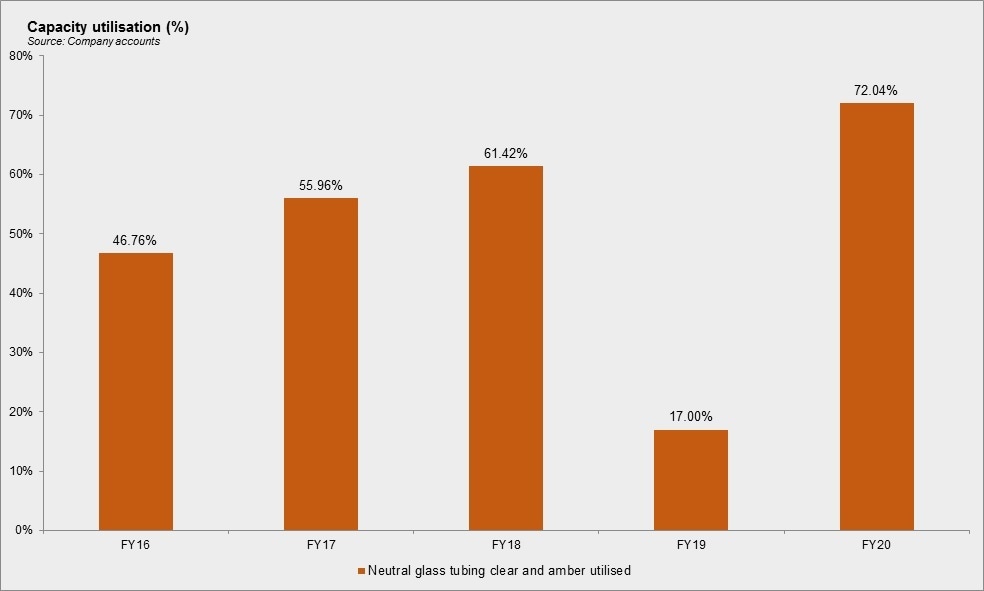

The company’s financial accounts did not show any sales during FY15; however, in FY16, the company put up a new glass tubing plant. Tubing finds its utility in manufacturing of ampoules and vials either by the pharmaceutical industry itself or by ampoules and vial manufacturers that supply to the pharmaceutical industry. Commercial production from this plant began in the last quarter of FY16. Within this short period, from the beginning of the last quarter of FY16 to the end of FY16, the company managed to record net sales of Rs 66 million. Cost of production during this year was considerably high at nearly 94 percent of production, therefore with more operating expenses incurred, the company posted a loss of Rs 51 million.

Ghani Global Glass has been the first to set up to set up this plant with technological supervision from European experts. The company claims its product to be an import substitute. Thus far, their competition comes from cheaper Chinese products. Ghani Global Glass continues to add to its capacity and further its manufacturing line for value addition. Thus, year on year the company was able to increase net sales to Rs 330 million during FY17. Given that the company is only in its second year of commercial production, cost of production remained high at 96 percent of production. Therefore, company’s net loss increased to Rs 116 million.

Looking at the topline, the company seems to be faring well as net sales amounted to Rs 496 million during FY18, a 50 percent rise year on year. However, cost of production continued to increase to make up 98 percent of revenue. This was because the company was producing a European quality product, which meant it had to incur higher costs as compared to the cost incurred by the competitors- the cheaper Chinese substitute. In order to penetrate the market, the company had to sell at a price that did not match the costs incurred to produce it. Therefore, margins remained low, and Ghani Glass /global posted yet another year of loss at Rs 123 million.

As the company’s product was accepted in the market, sales continued to grow; there was a near 60 percent rise in net sales during FY19. While of cost of production kept escalating, it reduced as a percentage of revenue for the first time, although it was still beyond the 90 percent mark. Apart from the fact that it costed the company more to produce the product, while it had to sell at a lower margin in order to establish itself in the market, there was a rise in electricity and gas costs given that it is a power-intensive industry. In addition, profitability was also hampered by intermittent supply. To counter gas consumption, and hence costs, Ghani Global Glass “developed and installed environment friendly silica Sand Drying System by utilizing Furnace Hot Air exhaust to dry the wet silica”. With the higher discount rate, finance expense also rose, therefore the company’s losses escalated to Rs 148 million.

During FY20, the company crossed the Rs 1 billion mark in sales. The company’s customer base expanded to 80 pharmaceutical companies while it also managed to make some export sales to Bangladesh, Egypt, Argentina, Mexico, and the Middle East. It also undertook some research and development, the implementation of which helped to reduce costs and improve process efficiency. This is evident from a cost reduction to 78 percent of revenue, and hence a gross profit margin of 22 percent. Although finance expense continued to rise, the effect of an improved gross margin trickled down to the bottomline as the company posted a profit for the first time at Rs 40 million.

Recent results and future outlook

During 1QFY21, net sales saw an increase of 21 percent. Apart from a continuous rise in local sales, the company also added revenue from export sales that was absent during the first quarter of FY20. Cost of production also lowered as it saw effect of cost reduction measures, thereby improving profit margins. A decrease in finance expense due to reduction in discount rate also contributed to the bottomline, thus the company posted a net margin of 11 percent in 1QFY21, up from close to 6 percent in 1QFY20.

The company plans to undertake BMR activities in addition to setting up another melting furnace for glass tubes in order to enhance capacity and fulfil the rising demand. It also plans to diversify into newer markets in the international arena and hopes for a reduction in SBP rate that would help to decrease the cost of doing business.

Comments

Comments are closed.