Power Cement Limited (PSX: POWER) was set up in 1981 as a private limited company. It was later converted into a public limited company in 1987.

The company manufactures, markets and sells cement and has three cement manufacturing lines. Power Cement was formerly known as Al-Abbas Cement Limited until it was acquired by Arif Habib group in 2010. By 2013, the name was changed to Power Cement Limited.

Shareholding pattern

More than 50 percent shares are held by the associated companies, undertakings and related parties, that majorly includes Mr. Arif Habib owning 21 percent shares and Arif Habib Equity (Private) Limited owning 19 percent. The local general public owns 24.6 percent shares followed by 11 percent in “foreign”. The directors, CEO, their spouses and minor children collectively own 6 percent shares. Of this Mr. Syed Salman Rashid owns 5.6 percent. The remaining 8 percent of the shares are distributed with the rest of the shareholder categories.

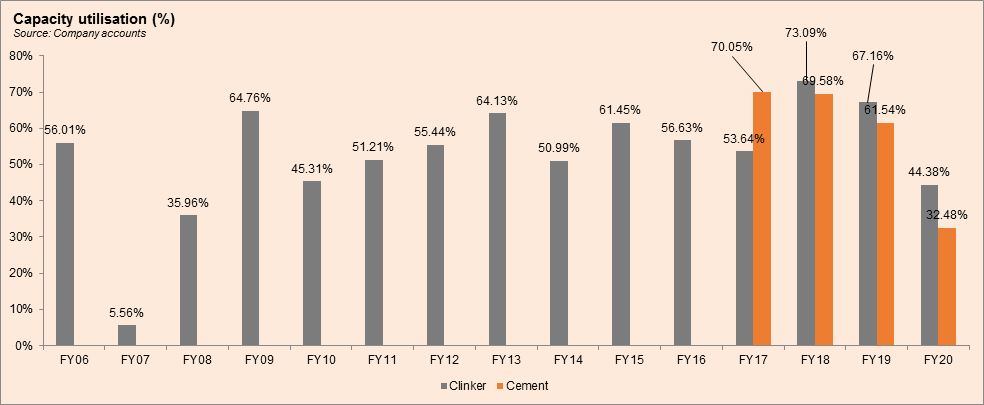

Historical operational performance

The topline of Power Cement has been fluctuating over the years at varying rates, while profit margins have also followed a similar trend; however, from FY15 onwards, it has declined gradually.

During FY17, sales revenue grew by 8 percent; volumetrically, the local dispatches for the company saw a 10 percent rise while export dispatches contracted by 57 percent. Export dispatches for the industry as a whole also saw a decline, with North zone seeing an 18.2 percent fall and South zone seeing a 25 percent fall. During the year, the company installed an air pollution control system for which it had to shut down its plant, and hence had to procure clinker from other cement companies. Increase in cost of production was marginal at 78 percent, therefore gross margin was relatively flat year on year. Operating profit was backed by the reduction in other expenses, whereas an escalation in finance cost adversely affected net margin that decreased to 10.4 percent. In FY16, finance expense was significantly lower due to “gain on derecognition of financial liability”, in the absence of which, finance expense returned to its previous levels in FY17.

Cement industry grew by 13.5 percent during FY18, with local dispatches growing by 15.4 percent and exports by 1.77 percent. The company’s total dispatches grew by 1 percent, with local dispatches increasing by 3 percent, while export fell by 28 percent; sales of grounded slag disappeared entirely. However, this translated into a reduction by 3 percent in sales revenue as the surge in dispatches for the industry kept prices in check. Cost of production, jumped to 84 percent of revenue; this was driven by increase in coal, fuel and packing material prices. The effect of this was also seen on net margin that decreased to 7 percent despite the drop in finance expense.

Growth for cement industry was subdued at 2 percent during FY19, in comparison to the double-digit growth seen in the previous year, with local sales contracting and export sales picking up. For the company, on the other hand, total dispatches saw a 12 percent reduction; 12 percent in local dispatches and 22 percent in export. This led to an 11 percent decrease in sales revenue. Combined with currency depreciation, high interest rates and inflation, profit margins were squeezed. Cost of production was steep at nearly 96 percent of revenue, whereas net margin was supported due to a positive tax figure while loss after tax was recorded at Rs412 million.

The overall cement industry witnessed a growth of 1.98 percent in FY20, whereas for the company, total dispatches saw a 75 percent incline; local cement dispatches saw a 3.7 percent increase and export dispatches grew from 5,130 tons in FY19 to 86,951 tons in FY20. During FY20, the company also exported 333,286 tons of clinker. This resulted in a 7 percent increase in revenue, mostly driven by exports. However, cost of production exceeded more than 100 percent of revenue, due to increase in transportation, fuel, power and packing material expenses. Finance expense also increased significantly due to “Rs1925 million mark up paid against the Syndicate Term Finance Facility”. Thus, the company posted a loss of Rs3.6 billion.

Quarterly results and future outlook

After a period of strict lock down, as economic activities resumed, the industry regained its momentum. The industry’s dispatches registered a 22 percent increase, whereas the company saw an unprecedented increase in its volumes owing to commencement of its new 7700 TPD plant; total dispatches for the company grew from 85,629 tons in 1QFY20 to 574,147 tons in 1QFY21. This also allowed revenue to grow from Rs583 million in 1QFY20 to over Rs3 billion in 1QFY21. Cost of production was also in check. Yet the quarter ended in a loss of Rs171 million owing to increased distribution expenses and finance expense.

The company foresees growth in demand owing to the construction package announced by the government. In addition, banks are also to provide long-term mortgage financing that will encourage demand for housing and hence, cement.

Comments

Comments are closed.