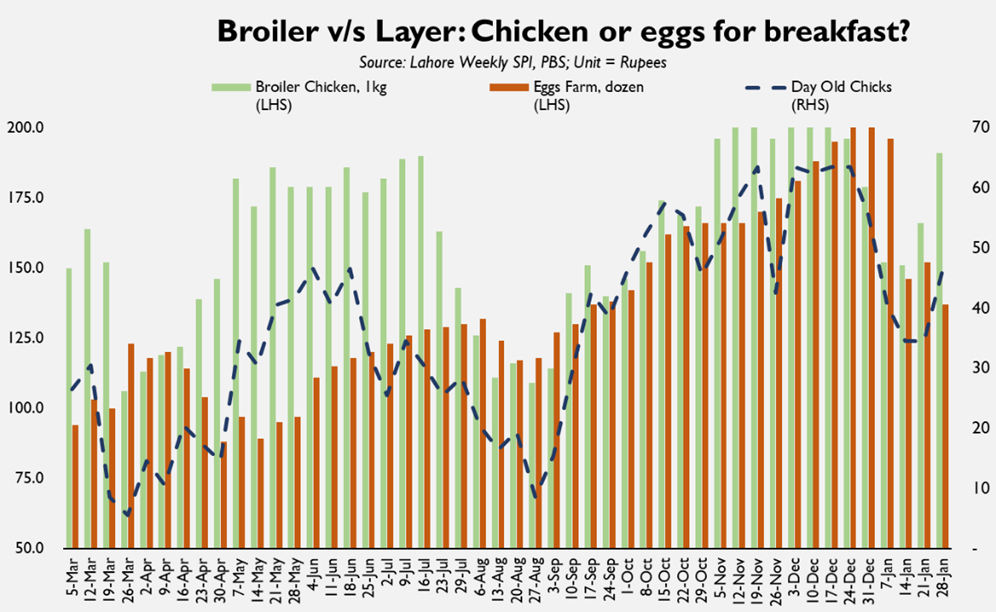

The volatility of broiler prices witnessed during 2020 has rendered double-digit increases old-news. National average chicken (live, per kg) prices are back in above Rs 200 territory, after a 15 percent rise in a week, yet no one has batted an eye. Is the roller-coaster ride the new normal?

Ask any poultry grower or supplier, and they would tell you that high input prices coupled with nascent demand recovery means prices will remain on the higher side for the foreseeable future. That appears spot on. With the exception of month-long prices crashes witnessed first during April and then August 2020, broiler prices have remained above Rs 195 nationally, with per kg price averaging above Rs 225 in some regions such as Karachi. That appears to be the new frontier for the poultry prices, and it appears that consumer behaviour is also fast adjusting to new reality.

Are the new price levels worrisome? Only when placed in the context of historic price averages. Until 2019, national broiler prices ranged between Rs 125 – 175; yet, a one-third increase in average price level becomes not-so-astonishing when juxtaposed against price leaps taken by other food commodities and kitchen essentials over past year. For context, consider that price of wheat, sugar, and even cooking oil have increased by more than 33 percent over the past 24 months.

Moreover, with the input prices on the higher side (see illustration), the poultry value chain has finally found common cause to rally around. In the past 6 months, price of inputs such as soybean and maize have recorded a sharp upsurge, both growing by nearly 40 percent. But there is one element still missing.

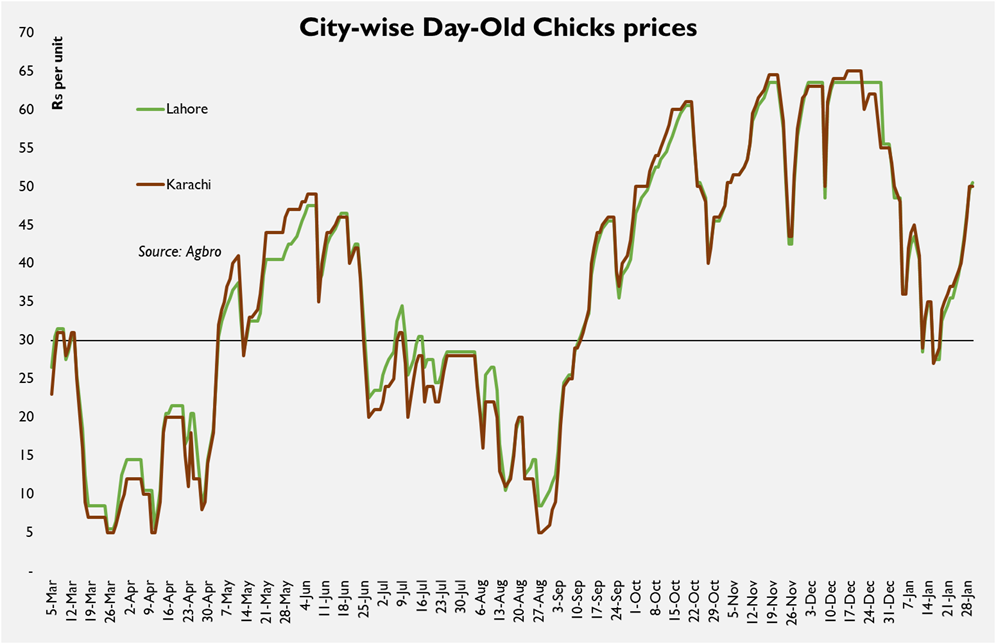

The missing link in the poultry dynamic remains the price of day-old-chicks, which has refused to fall below Rs 25 (per piece) since at least September 2020. Recall that before the nationwide lockdown was last lifted, DOC prices used to decline to as low as Rs 5 per piece seasonally. Instead, prices have averaged at Rs 50 across major consuming centres such as Karachi and Lahore.

Why is that a cause of concern? Firstly, because DOC prices are not directly related to cost of feed inputs such as maize or soybean. And two, historically, broiler prices on average trade at a 6-times multiple of DOC prices.

Thus, if the current levels of DOC prices is the new normal, it appears unclear whether broiler prices will self-adjust to a lower price multiple or consumer demand will. The third possibility – of course – is for the multiple to stay intact, meaning that broiler prices have yet more new frontiers to explore. A grim prospect – both for consumers and monitors of food inflation in the country.

Comments

Comments are closed.