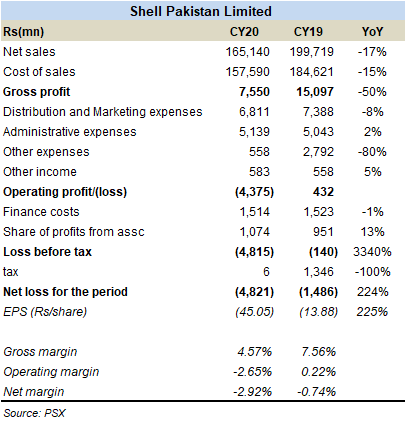

Shell Pakistan Limited (PSX: SHEL) announced its financial performance for 2020 this week and the earnings of the company slipped further into losses; from Rs1.5 billion in CY19 to Rs4.8 billion in CY20, the company’s loss after tax increased by more than 3 times.

However, the crimson streak in earnings continued primarily due to a staggeringly weak 1HCY20 that fell right in the midst of the coronavirus pandemic. The period is characterized by weak economic activity and demand as well as significant oil prices volatility along with currency depreciation – all of which impacted the OMC.

Compared to that, the second half of 2020 (2HCY20) was better as the company posted profit after tax in the last two quarters. This was due to recovery in petroleum product consumption – meaning rising OMC sales and Shell’s market share. During the six months from Jul-Dec 2020, Shell Pakistan Limited’s overall volumes grew by 20 percent, primarily driven by High-Speed Diesel and HOBC. And recently, in the last three to four months, the multinational oil marketing company has picked up market share in the retail fuels (specifically, petrol and diesel).

Nonetheless, first six month of pandemic-hit year bogged down the overall financial performance of the oil marketing company. 2020 was a tough year for the OMC sector due to slower economic activity amid coronavirus pandemic which led to dwindling petroleum demand in the country where all players in the oil marketing sector saw erosion of volumetric growth. Companies like Shell Pakistan that rely largely on imports were worse-off due to depreciation of PKR. Overall, in 2020, gross profits halved on a year-on-year basis, while operating profits turned into operating loss despite slower growth in expenses, lower finance cost or share of profits from associates could also not offset the net loss.

Comments

Comments are closed.