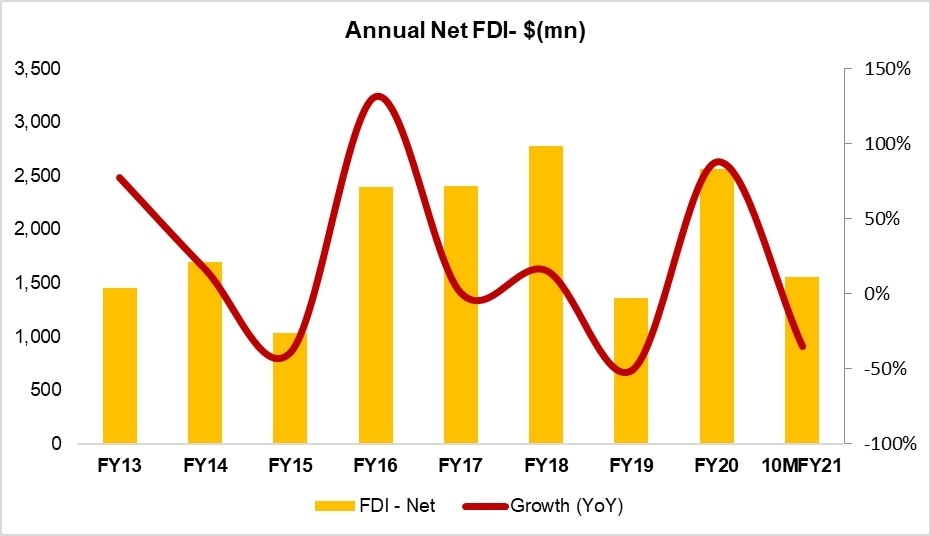

The latest central bank’s data shows nothing jovial about foreign direct invest; the needle is not moving for FDI and the latest April numbers don’t add much to the already small total. Pakistan attracted $158 million net flows under FDI in April-21 versus $151 million in April-20. Foreign direct investment continues to slip in the ongoing fiscal year. FDI during the 10MFY20 overall was down by 32 percent year-on-year at only $1.55 billion.

As highlighted in this space earlier this week, FDI levels are not only abysmal, but they are also restricted sector-wise as well by source country. Majority of the flows come from China under specific heads, while other sectors that hold potential remain banal. Add to this the Covid-19 pandemic, which has completely altered the global investor’s preferences and risk appetites. To read more about achieving sector diversification as well as sectoral depth, read Changing FDI dynamics (I).

A weaker economic growth in the last couple of years plus the global Covid event have been a double whammy for the FDI flow in Pakistan. it is high time that the policy makers and the BoI sit their heads together to making a policy that aims at prioritizing attracting FDI from all corners amid the global slump in investor confidence.

From the policy lens as well, the foreign direct investment climate is not at its best either. An analysis by Pakistan Business Council titled “FDI Attraction in a Transforming World: A Perspective on Pakistan” shows how Pakistan performs below average against regional peers like India, Bangladesh, Vietnam and Indonesia against four key policy areas for a strong investment policy: Tax policy, regulatory environment, business environment and investment promotion and facilitation policy. These findings also complement the country’s standings across various aspects of Doing Business rankings despite the efforts made by the governemnt in recent years. Tedious and costly contract enforcement or registration procedures; or complex taxation procedures, or lack of infrastructure become hindrances for the already weary investors who find better environment in peer economies.

Moreover, the policy initiatives must consider other motives investors have. Investor facilitation by the investment promotion authorities must be aware of the factors that are key for global investors such as innovation and technological advancement, R&D capabilities, existence and quality of digital infrastructure, the regulatory environment including trading agreements and accountability, and a comprehensive investment promotion strategy.

And then, the policy measures for attracting FDI are incomplete without a well thought out sectoral plan such as one for moving from horizontal to vertical FDI targeting exports and one that rests on value addition.

Comments

Comments are closed.