Pakistan Oilfields Limited (POL)

Pakistan Oilfields Limited (PSX: POL) is a key player in the local E&P oil and gas sector primarily engaged in the exploration, drilling and production of crude oil and gas in the country. It is a subsidiary of the Attock Oil Company Limited (AOC).

Its product portfolio includes crude oil and natural gas, and it also produces LPG that it markets under its brand name POLGAS as well as its subsidiary, CAPGAS (Private) Limited. POL also produces solvent oil and Sulphur and has a vast pipeline network for transporting the crude oil to the group’s refinery, and its associate company: Attock Refinery Limited (ATRL).

Company associates and shareholdings.

More than half of the company’s shareholding rests with the Attock Oil Company (AOC), which is the group. A category-wise breakup of the shareholding is shown in the illustration. Besides Attock Refinery Limited, POL’s other associate companies include National Refinery (NRL), Attock Petroleum Limited (APL), Attock Cement Limited, Attock Gen. Limited, and Attock Information Technology Services.

POL in the last 5 years

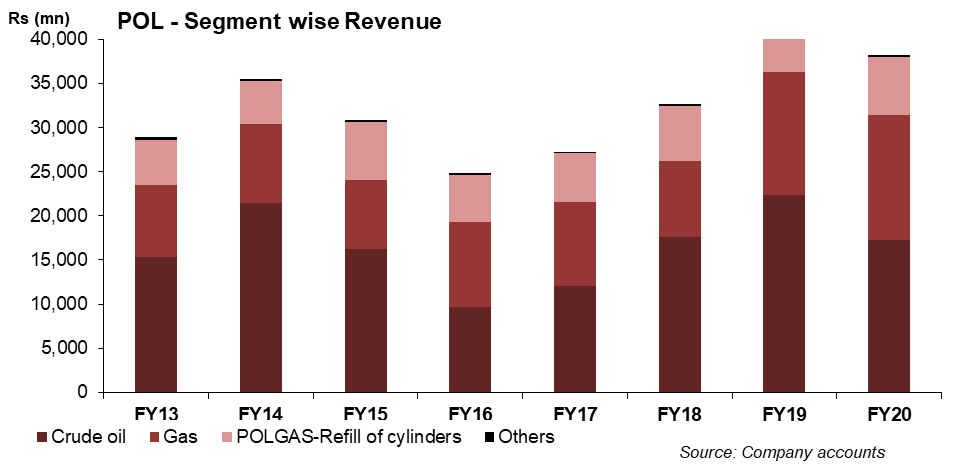

POL has been an oil heavy company where its crude oil revenues have accounted for over 55-60 percent in the past, while natural gas has accounted for 20-25 percent of the total sales; A look back at FY15 shows that even though the company witnessed positive growth on the volume side especially that of crude oil, POL suffered at the hands of declining crude oil prices; At the same time higher exploration and prospecting expenditure further axed the profits for the year.

The company’s revenue growth in FY16 remianed constrained as the oil prices touched historic lows, which also impacted the bottomline that declined by 14 percent, year-on-year. But unlike FY15 where the firm showed positive growth in production volumes, FY16 was marred with slowing down production by around 2-3 percent. This time however, some respite to the bottomline came from lower exploration and prospecting expenditure.

FY17 was a better year for the E&P sector as the oil prices rebounded and POL’s revenues and earnings were up by 10 percent and 34 percent, year-on-year respectively after continuously declining for the two years. Where exploration costs remained under control POL witnessed a drop in production flows from its key Tal block.

FY18 was successful for POL in terms of new finds and operations. In FY18, POL made four new exploratory successes. Three of its development wells were also successful in the fiscal year. Revenues climbed by over 19 percent, and earnings grew by 17.6 percent, year-on-year. Growth in the topline came from better crude oil prices as well as highest crude oil production in the company’s 10-year history. Exploration costs remained on the higher side for POL in FY18 due to seismic acquisition of Balkassar Lease, DG Khan and Gurgalot block, and dry and abandoned wells and some irrecoverable costs. What was an added factor to company’s profitability in FY18 was the in exchange gains due to depreciating currency.

FY19 was outlined as a better year for the oil and gas exploration and production companies not only because of higher average oil prices, but also a significant domestic currency devaluation. Both these factors were key drivers for earnings accretion for the E&P companies in FY19. POL also saw its topline grow by 25 percent, year-on-year, which came from around 14 percent year-on-year increase in international crude oil prices. On the other hand, volumetric sales remained tepid especially of crude oil with only slight increase in gas volumes. POL’s earnings for FY19 jumped by 48 percent, year-on-year; and apart from topline growth, lower exploration and prospecting costs and almost double other income helped lift the company’s bottomline. The main factor behind lower exploration and prospecting was the absence of a dry well and also lower seismic acquisition. And other income increased due to currency devaluation.

FY20 was marred by COVID-19 and the lockdown, as well as the crash in oil prices which were key reasons for slowing earnings growth for the oil and gas exploration and production sector. Overall, POL’s revenues came down by 13 percent, year-on-year, where the 4QFY20 saw a 48 percent decline in sales revenue. The decline in revenue was due to falling volumetric sales as well as oil prices. During FY20, oil and gas production for POL plummeted by 13 and 9 percent year-on-year, respectively, while the average oil prices tumbled by 25-26 percent year-on-year. On the expense side, exploration and prospecting expenditure remained lower in FY20 due to the absence of any dry well during the year. With lower interest rates during, other income and finance costs also decline for POL. POL’s earnings in FY20 were hence flat. During the first nine-months of FY20, the company posted a growth of over 24 percent year-on-year in its earnings, showing that the fourth quarter (4QFY20) was a drag on the bottomline.

The earnings growth depends largely on international oil prices to pick up as production volumes have been diminishing in the E&P sector for quite some time.

POL in FY21 and beyond

Amid falling reserves, and fewer as well as small discoveries in a low crude oil price environment FY21 started off weakfor the oil and gas sector. Decline in production flows has been a key factor for falling revenues for the sector.

POL’s revenues for 9MFY21 slipped by 13 percent year-on-year with 3QFY21 topline receding by 8 percent. While the 3QFY21 has been better in terms of oil prices that witnessed a recovery year-on-year, the production stats were weak with oil and gas production down by around 5 and 7 percent year-on-year.

The decline in Pakistan Oilfields Limited’s (PSX: POL) earnings was 31 percent year-on-year during 9MFY21. POL’s profitability was also affected by decrease in other income likely due to higher quantum of exchange losses.

Going forward, the fourth quarter is likelyto fare better for the oil andgas exploration and production sector due to jump in crude oil prices.

Comments

Comments are closed.