Shadab Textile Mills Limited

Shadab Textile Mills Limited (PSX: SHDT) was set up in 1979 as a public limited company under the Companies Act 2013. It deals with and manufactures, sells and buys all types of yarn. It set up its first spinning plant at Sheikhupura, Punjab and since then has expanded its capacity.

Shareholding pattern

As at June 30, 2020, over 50 percent shares are owned by the directors, CEO, their spouses and minor children. Of this, nearly 15percent are held by the CEO, Mr. Aamir Naseem, followed by nearly 14 percent by Mrs. Fatima Aamir, a non-executive director. Over 43 percent shares are with the local general public; the remaining about 6 percent shares are with the rest of the shareholder categories.

Historical operational performance

Shadab Textile Mills has mostly seen a rising topline over the years, with the exception of FY15 and more recently in FY20. Profit margins declined until FY15, remained more or less stable for a few years before improving again in FY19; they saw a decrease again in FY20.

In FY17, the company saw a nearly 10 percent rise in revenue, after witnessing a contracting topline and nominal revenue growth in the last two years. The rise in revenue was due to lower production losses due to continuous supply of energy. However, owing to declining yarn prices, both in the domestic and global market, a general recession in the textile sector and rising energy prices, the cost of production consumed more than 95 percent of revenue. This led the company to consume to post its lowest bottomline, at Rs 19 million, and profit margins seen; net margin was recorded at less than 1 percent for the year.

Revenue growth stood at over 11 percent during FY18. This is in part attributed to an increase in prices of yarn. Production also improved due to continuous supply of energy that minimized production losses. However, cost of production remained close to over 95 percent with high raw material prices, keeping gross margins more or less flat at around 4 percent. This also trickled down to the bottomline as other factors remained largely unchanged. Thus, net margin also remained close to 1 percent for the year. Finance expense of the company has gradually reduced over the years due to repayment of long-term loans.

The company witnessed the highest growth in revenue at nearly 24 percent during FY19. This was somewhat attributed to higher yarn prices; production was also higher year on year. cost of production went down to almost 93 percent of revenue, which is the lowest seen since FY14. The government also notified a lower electricity rate for zero rated textile industrial consumers that lowered the energy expense. Thus, the company was able to raise gross margin to 7 percent, the highest seen since FY14. With only distribution expense rising slightly, net margin for the company also improved to 2.8 percent.

Revenue declined for the first time in FY20 after four years, by over 18 percent. this was due to the outbreak of the Covid-19 pandemic that led to a strict lockdown. This caused the company’s mills to be shut down from the last week of March 2020 till mid-May 2020. This resulted in a production loss of 2.9 million kgs. converted to 20/s. even after the reopening of businesses and markets, the yarn market was dwindling. With the drop in revenue, cost of production consumed over 94 percent of revenue, bring gross margin down to 5.7 percent. The abnormally higher other income at Rs 27 million coming from profit on deposits with banks, provided some support to the bottomline, but it was not sufficient. Thus, net margin also fell, to nearly 2 percent for the year.

Quarterly results and future outlook

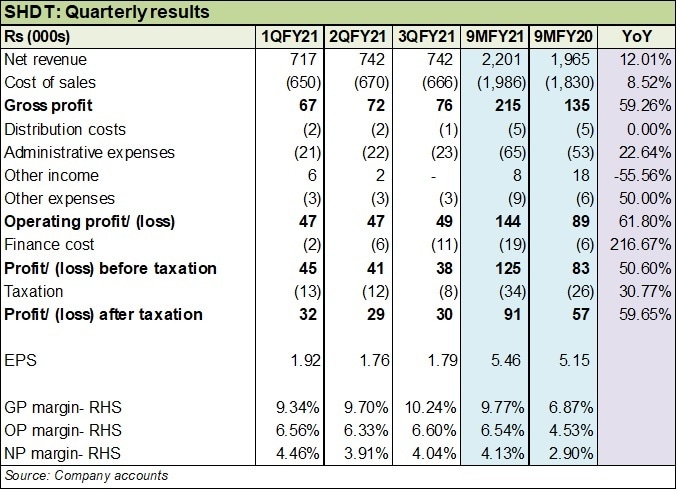

During the first quarter of FY21, revenue was higher by over 10 percent. This was attributed to better sales prices. Cost of production reduced considerably year on year that allowed gross margin to improve for the quarter compared to same period last year. The rise also reflected in the bottomline with net margin doubling year on year at 4.46 percent.

In the second quarter of FY21, similar trend followed, although, revenue was only marginally higher year on year. Cost of production as a share in revenue was again, substantially lower than the same period last year, thus increasing net margin to 3.9 percent for 2QFY21 compared to 1.9 percent in the same period last year.

The third quarter of FY21 saw revenue higher by over 27 percent year on year, while cumulatively the nine months of FY21 saw revenue higher by 12 percent year on year. Apart from better prices, this can be attributed to the gradual resumption of business activities a year after the Covid-19 pandemic was first detected in the country. Cost of production was also again lower year on year, but net margin was lower in 3QFY21 due to nearly zero other income compared to over Rs 10 million seen in 3QFY20. Cumulatively, however, profitability was better in 9MFY21.

The company has added to its capacity by installing 480 spindles MVS yarn at Unit 2 and imported two gas generators at Unit 1 with the aim to reduce cost of power generation. It is also looking to expand target markets in addition to reducing costs.

Comments

Comments are closed.