Ahmad Hassan Textile Mills Limited

Ahmad Hassan Textile Mills Limited (PSX: AHTM) was set up as a public limited company in 1989under the Companies Ordinance, 1984. The company essentially manufactures and sells yarn and fabric; it has its own in-house production capacity from ginning to weaving.

Shareholding pattern

As at June 30, 2020, more than 50 percent shares are with the directors, CEO, their spouses and minor children. Of this, nearly 18 percent is owned by Mr. Muhammad Haris, an executive director of the company. Close to 41 percent shares are held by the local general public, while the remaining about 7 percent shares are with the rest of the shareholder categories. Of this, more than 6 percent shares are concentrated in mutual funds.

Historical operational performance

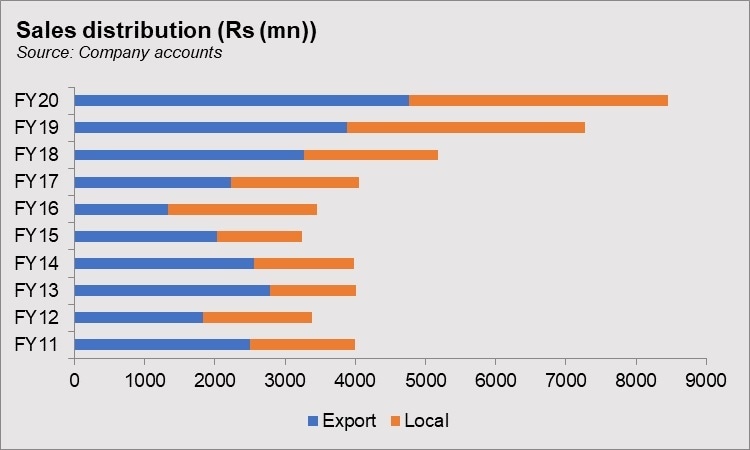

Ahmad Hassan Textile Mills has mostly seen a growing topline, particularly in the last five years, while profit margins have been more or less stable after FY15, increasing very gradually.

In FY17, the company witnessed an over 17 percent growth in revenue, after seeing a few years of a contracting topline. While local sales reduced by 14 percent, export sales grew by over 67 percent. Most of the growth in export sales was brought about by fabric sales that doubled year on year in value terms. Despite the growth in revenue, gross margin reduced to 6 percent due to cost of production increasing to nearly 94 percent of revenue. Raw material cost that made a major chunk of total cost, inclined due to costly cotton. However, with some control on costs along with unusually higher other income sourced from “duty drawback of taxes on export sales”, the company was able to reduce its losses, from Rs 18 million in FY16 to Rs 3 million in FY17.

FY18 saw further growth in revenue at 27.7 percent. While local sales grew marginally by 4.6 percent, export sales posted a 46 percent rise; both yarn sales and fabric sales picked up. Currency devaluation drove most of the export growth as it made exports more competitive in the global market. Cost of production, on the other hand, kept gross margin from increasing as the latter remained more or less flat at close to 6 percent. With some decreases seen in administrative and distribution expense as a percentage of revenue, coupled with other income also contributing towards the bottomline, more than last year, in value terms, the company was able to post a profit for the year at Rs 10 million, compared to the Rs 3 million loss seen last year.

Ahmad Hassan Textile Mills saw one of the highest growth rates in topline in FY19 at over 40 percent. Export sales increased by nearly 19 percent while local sales almost doubled in value terms, registering a growth of over 77 percent. Given the low economic growth following the change in government, along with stiff competition in the global market from regional countries, the company diverted its sales from export to the local market as is reflected in the local sales growth. While cost of production remained undeterred at around 94 percent, there was some decline in administrative and distribution expense. Thus, net margin improved marginally to 0.5 percent for the year.

Revenue growth in FY20 was relatively marginal at 1 percent; local sales grew by nearly 9 percent while export sales registered an over 22 percent growth. However, there was a higher incidence of tax year on year, therefore the growth in net revenue stood at 1 percent. On the other hand, cost of production reduced slightly to 92.7 percent, that allowed gross margin also to incline slightly to 7.3 percent. with further decrease in distribution expense as a percentage of revenue owing to decrease in direct export sale, operating margin also improved for the year. This also trickled down to the bottomline, with net margin at 1.65 percent- the highest seen in the last six years.

Quarterly results and future outlook

The first quarter of FY21 saw revenue lower by almost 10 percent year on year, with cost of production significantly higher at nearly 94 percent, compared to 88 percent in the same period last year. Combined with this was the considerably lower other income that also trimmed profitability. Thus, net margin 1 percent was lower than 4 percent seen in 1QFY20.

The second quarter saw revenue mostly flat year on year, contracting by close to 1 percent. However, the reduction in cost of production is largely responsible for better profitability during the period. Production cost made over 89 percent of revenue in 2QFY21 compared to 92 percent in 2QFY20. In addition to this, a lower finance expense year on year owing to a reduction in KIBOR also had a positive impact on bottomline. Thus, net margin in 2QFY21 was higher at 5.3 percent, compared to nearly 2 percent in 2QFY20.

Revenue was again only marginally higher by 2 percent year on year. Cost of production at close to 93 percent, also did not diverge too far from that seen in same period last year. Thus, gross margin decreased slightly to 7.4 percent. However, net margin was higher in 3QFY21 at 4 percent due to a lower finance expense as well as a positive tax figure. Cumulatively too, profitability in 9MFY21 was largely supported by lower finance and tax expense.

Along with the uncertainty due to Covid-19 pandemic that has impacted the world alike, the company is looking to reduce its cost of doing business by adopting solar energy system- to reduce energy expense in particular. Moreover, “the ‘Scheme of Arrangement’ for reconstruction of the company has been approved by the board of directors and members”.

Comments

Comments are closed.