Social media is abuzz with sharp critiques and counter-critiques over whether government’s administrative arm has successfully brought down poultry prices. Going by the long stretch of dampened market prices – 77 days since the broiler prices began their downward spiral – it would appear that the administration has indeed achieved semblance of success. But it would be a mistake to declare it as cause for celebration.

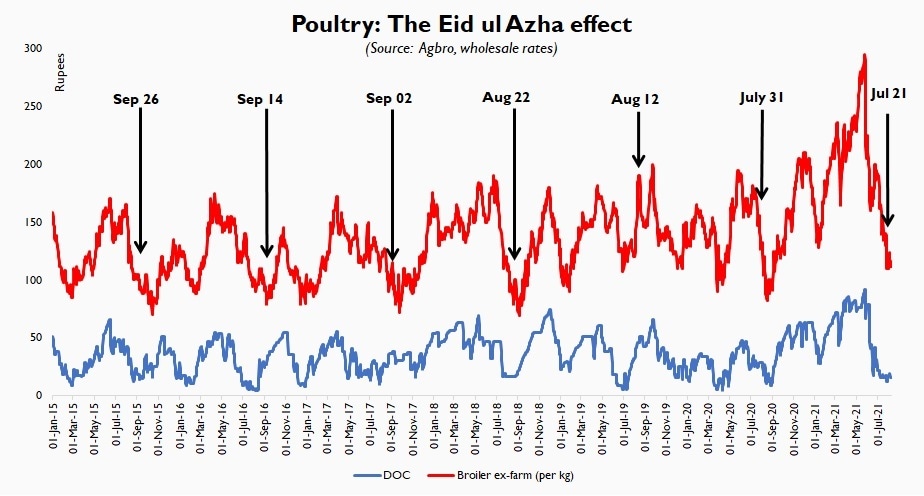

All partisan arguments, by nature, have slants. So it may be of little surprise that when high-flying poultry prices finally crashed in June, incumbent’s supporter – hungry for a win over food prices – declared an administrative coup against “poultry mafia”. But ordinary consumers are hard to fool; and many were quick to point out that prices fall precipitously around every Baqr-Eid, when Pakistani dietary preference makes a seasonal shift to red meat varieties.

But three weeks past Baqr Eid, ex-farm broiler prices have refused to reverse trajectory. Instead, both live chicken – and Day-Old Chick prices (widely considered a leading indicator of direction poultry prices may take over next cycle) – are at their lowest in almost a year. In fact, market prices are at their lowest since Baqr Eid 2020. Does that mean the Eid-ul-Adha effect is still at play?

Poultry price forecasting is a tough business, and one that may bring greatest shame to those who are most confident. Although it is accurate – for good reason – that prices crash every Eid ul Adha, the length of downward duration is rarely same. In 2017, market prices remained rangebound for almost 11 weeks before returning to pre-Eid levels; in 2019 they touched a fresh peak in less than two weeks after the religious festival was over. Last six-year average suggests that prices remain rangebound for nearly eight weeks before trudging towards the next peak.

But 2021 stands out on another account: prices began to decline long before Eid. In fact, per kg broiler prices (ex-farm) peaked at Rs 300 right after Ramzan, and then began their long downward trajectory which has continued till date. Which means that 2021 has possibly seen the longest stretch of declining poultry prices – one which has already lasted almost 12 weeks, and counting. And as industry leaders admit, it may be flawed to attribute the fall to Eid phenomenon alone.

Readers will recall that commercial poultry farmers have been on the receiving end of extreme volatility over the last 18 months ever since Covid induced lockdowns led to demand compression. This has already manifested itself in multiple non-cyclical precipitous downward price spirals, effects of which became further exacerbated after news of Newcastle disease was broadcasted over mainstream and social media. Because controversy surrounding Newcastle was most pronounced in June 2021, it appears farmers have chosen to stay on the side lines for rest of the monsoon period, instead of riding out more price uncertainty. Considering how fourth Covid wave has overtaken the country post-Eid ul Adha, one might argue that poultry farmers made a wise decision in retrospect, as various bans on social gatherings have once resurfaced, supressing commercial demand for poultry.

But sooner or later, this wave too shall pass – as will the seasonal lull in bird meat consumption. And when it does – whether that’s as early as October or as late as December, rest assured that prices shall return to pre-crash levels, if not chart fresh peaks altogether. Meanwhile, few contrarian consumers may very well take advantage, if only they can convince their families to switch to drumsticks when lambchops are still leftover in the freezer. But let’s not kid ourselves that the lull will last. Price volatility is no one’s friend, especially not consumers’.

Comments

Comments are closed.