Mapleleaf Cement re-balancing

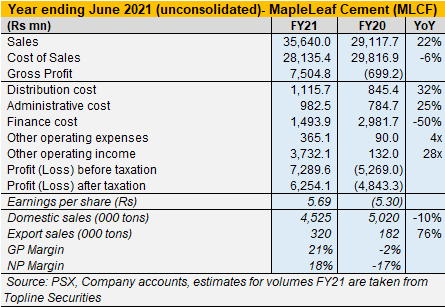

After a painful FY20, it is time for recovery for most, if not all, cement companies. In FY21, Mapleleaf cement (PSX: MLCF) has turned the highest ever top-line as well as after-tax profits. This has materialized on the back of strong retention prices, and significant reduction in finance costs. However, 51 percent of the company’s before-tax profits come from ‘other income’ component.

The 22 percent growth in revenue comes from an estimated 31 percent improvement in revenue per ton sold (this is assessed using a guesstimate of cement offtake as official numbers are unavailable). Gross margins soared to 21 percent which is slightly higher than FY19, though nowhere near the peaks of FY16 and FY17. But that’s where MapleLeaf and the rest of the industry is headed, granted coal prices get into control which have over the past year spiralled out.

Coal prices have ballooned—between Apr-20 and Jul-21—South African coal prices grew 169 percent. On average, coal importers in Pakistan importing South African coal paid 10 percent more per ton this year, assuming a one-month lag. Those cement companies that imported two or three months in advance—kudos to their demand forecasting models—may have incurred a lower cost. This is also where prudent inventory management comes in and knowing the right time to buy commodities.

Also take into consideration, the increase in freight over the past year due to covid related supply shocks which has raised costs substantially. Surprisingly, Mapleleaf’s cost of sales actually came down by 6 percent likely due to its reliance on captive power, increased use of pet coke, and the aforementioned prudent buying of inputs. Meanwhile, the company also saves on inland transportation costs (for coal imports from port to factory) owing to its contract with Pakistan Railway that ended Jun-21.

Another place Mapleleaf has benefited is reduced interest rates which was also supported by retiring of long-term debts. Finance costs as a share of revenue fell from 10 percent last year to single-digit 4 percent in FY21. The company’s overheads—7 percent of revenue in FY21 (FY20: 6%)—are still considerably high mainly due to high distribution costs.

With demand growing, retention prices in the domestic market will potentially continue to improve. Mapleleaf is not a huge exporter—last year, exports were 3-4 percent of total offtake which is a pretty small number (this year, the expected export share is around 7%). But that also means, the company targets a high-margin sales mix given prices abroad tend to be more competitive which works. With local demand expected to continue its growth streak with Naya Pakistan Housing, and several hydro power projects coming to fruition, the company won’t really have a lot of excess cement to export off. New capacities are not coming immediately, which means, prices will also remain robust in the domestic market—as long as demand does not falter.

Comments

Comments are closed.