Kohat Cement Company Limited

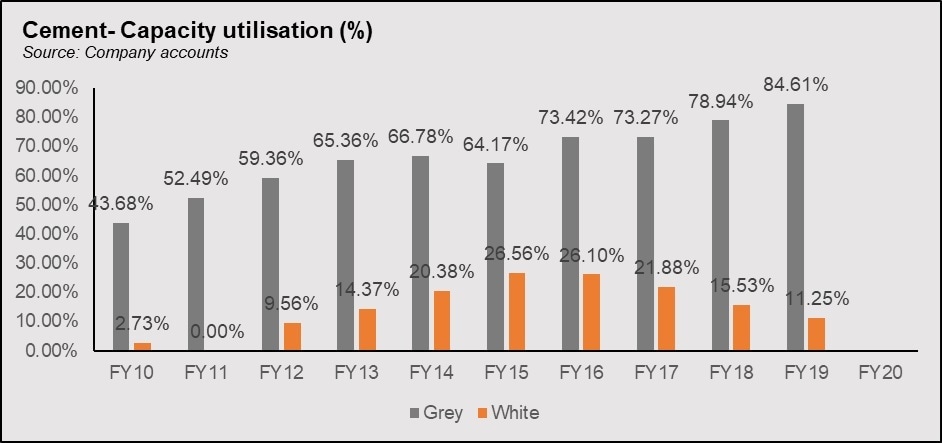

Kohat Cement Company Limited (PSX: KOHC) was set up under the Companies Act, 1913, in 1980. It produces and sells cement. Initially it was only present in the domestic market, but in 2002 it also entered the export market. As of June 2020, the production capacity of the company stood at 3.5 million metric ton grey clinker and 135,000 metric ton white clinker.

Shareholding pattern

As at June 30, 2020, 55 percent of the shares of the company are held by the associated companies, undertakings, and related parties. Within this, nearly all are held by ANS Capital (Pvt) Limited. The local general public holds over 11 percent shares while the directors, CEO, their spouses and minor children own 17 percent shares in the company. Within this category, majority shares are owned by Mrs. Hijab Tariq. Close to 11 percent shares are held in mutual funds, while the remaining about 6 percent shares are held by the rest of the shareholder categories.

Historical operational performance

Topline grew consecutively between FY11 and FY14; after that it has been rising and falling nearly every alternate year. Profit margins, on the other hand, reached a peak in FY16, after which it has followed a declining trend.

In FY17, revenue contracted by over 3 percent, falling to Rs 13 billion. The overall cement industry saw a 3.7 percent growth in terms of sales volumes. For the company, total dispatches were lower by less than 1 percent; export dispatches reduced by over 41 percent, while local dispatches were higher by almost 4 percent. The reduction in exports was due to the Pak-Afghan border closure for a large part of the year, in addition to a slow Afghan market. On the other hand, cost of production rose to almost 57 percent of revenue, up from last year’s 53.6 percent. This increase was mostly brought about by coal, gas and furnace oil expenses. Particularly, in the last quarter of the year, coal prices increased. This was combined with low cement prices. With little changes in other elements of the financial statements, except for a decline in other income, profitability reduced year on year; net margin was recorded at 26 percent.

Total dispatches for the industry grew by close to 14 percent in FY18. This was largely driven by the domestic consumption that saw a more than 15 percent growth in volumes. For the company, the total dispatches were 8.3 percent higher year on year with most of this growth associated with, again domestic consumption. Export dispatches have been lower due to Iranian cement coming into to the Afghan market, along with transit issues between Pakistan and Afghanistan. Revenue for the year, however, saw a less than 1 percent contraction. This could likely be due to prices remaining in check as a result of an increase in dispatches. Production cost went up considerably, consuming nearly 68 percent of revenue. This was attributed to the currency devaluation and a rise in coal prices. With little changes in other aspects, net margin further fell to 22 percent.

After contracting for two consecutive years, revenue in FY19 increased by over 16 percent. the total dispatches for the industry grew by over 2 percent. Domestic consumption took a back seat, while export dispatched registered a 37.7 percent rise. The company’s dispatches were 4.7 percent higher during the year. Production cost, at over 73 percent of revenue, restricted the higher revenue to translate into higher profit margins. The currency devaluation made imported expensive, in addition to rising electricity and packing material prices. This was further worsened by a reduction in cement prices, specifically in the last quarter. Thus, net margin was recorded at its lowest since FY12, at 15.8 percent.

Due to low demand, increased capacities, hence downward pressure on prices, and Covid-19 pandemic, revenue for FY20 fell by nearly 28 percent. Local dispatches for the company reduced by less than 1 percent, while a bigger decline of over 16 percent was seen in export dispatches. Experiencing the largest contraction in revenue in decade, the company inevitably incurred a gross loss. With further expenses incurred, a reduction in other income and an escalation in finance expense due to rising borrowing rates for a large part of the year, Kohat cement posted a net loss of Rs 443 million for the year.

Quarterly results and future outlook

After the slow economic activity combined with the impact of Covid-19, demand began to pick up in the first quarter of FY21, depicted by a nearly 73 percent growth in revenue year on year. with demand picking up, the downward movement of prices have also halted. Thus, the company posted a net margin of 9.8 percent in 1QFY21, compared to 2.9 percent in 1QFY20.

Revenue in the second quarter almost doubled year on year, as demand remained high. Production cost, at 72 percent, also went down considerably compared to same period last year when production cost nearly consumed the entire revenue. Therefore, profitability in 2QFY21 was significantly better than that in 2QFY20.

Revenue more than doubled in the third quarter year on year, due to better retention prices and higher volumes, latter a result of a new production line. The increase in prices of inputs could not be passed on to consumers, therefore profit margins were lower than that in 2QFY21, but better than 3QFY20 when the company incurred a loss of Rs 381 million. The recent announcement of FY21 results reveal that the year has ended substantially better with revenue more than double compared to the significantly lower revenue in FY20 that failed to cover costs.

With the announcement of relief packages and incentives for the construction industry, along with low-cost housing projects and subsidized housing financing, demand for cement is expected to remain robust

Comments

Comments are closed.