Matco Foods Limited (PSX: MFL) was set up as a private limited company in 1964 under the repealed Companies Ordinance, 1984. Three years later, in 1967, the company set up its first processing plant in Larkana, Sindh. By 1999, it had its own brand name under which it sold its products. As of today, Matco Foods has five processing plants where it processes and exports rice, rice glucose, rice protein; it trades biscuits, pink salt, bran oil, masala, kheer. In addition to catering to the domestic markets, it is also present in the international market, such as the USA, Netherlands, Italy, Greece, Middle East, Australia, and South Africa, etc.

Shareholding pattern

As at June 30, 2020, the over 60 percent shares are owned by the company’s directors, CEO, their spouses and minor children. Within this, the major shareholders are Dr. Tariq Ghori, Mr. Khalid Sarfaraz Ghori and Mr. Jawed Ali Ghori. The associated companies hold over 15 percent shares in the company. This category majorly includes the International Finance Corporation. Another 15 percent shares are owned by the local general public, while the remaining about 9 percent shares are with the rest of the shareholder categories.

Historical operational performance

Matco Foods has mostly seen a growing topline over the years, with the exception of FY15 and FY16 and more recently in FY20. It has grown from Rs 6.3 billion in FY13 to Rs 10.5 billion in FY21, reaching a peak in FY20 when it crossed Rs 11 billion. Profit margins, however, have seen a gradual declining trend after FY17.

In FY18, the company witnessed a topline growth of close to 10 percent. This was attributed to a number of factors, such as favorable prices in the international rice market, exchange gain on export sales owing to the currency devaluation, and the tax benefit as a result of an installation of Rice Glucose Plant (Phase 1), along with company listing. Matco Foods also exported its first rice glucose container in FY18. The increase in prices is evident from the fact that basmati per metric ton average export prices stood at $ 1,119.68 during the year, compared to $ 849.83 in the previous year. Given the improvement in prices of latter, therefore margins, the company focused more on exports of basmati rice, while it reduced export of IRRI rice due to lower margins. But cost of production at 87 percent of revenue, compared to 84 percent in FY17, kept gross margin low at 12.8 percent, while net margin, that was marginally higher at 4.6 percent, was somewhat supported by the exchange gain of Rs 73 million.\

Revenue grew by 17 percent in FY19. This was due to the continued focus on export of basmati rice that claimed higher profit margins. In volumetric terms, export sales registered a 2.45 percent growth. During the period the company also installed Rice Glucose Plant (Phase 2) that allowed for a tax benefit. In addition, there was also a gain on sale of land and building that contributed to the unusually high other income of Rs 107 million. Combined with currency devaluation and the resultant net exchange gain of Rs 153 million, bottomline received significant support. Production cost continued to rise that kept gross margin low, but net margin was supported by other income and exchange gain that allowed the company to post the highest net margin of 5.27 percent as well as the highest net profit of Rs 414 million.

Matco Foods witnessed the highest topline growth in FY20, at over 43 percent, taking the net revenue to beyond Rs 11 billion- also the highest seen. A major part of the revenue was earned during the last quarter of FY20 when the Covid-19 pandemic had just entered Pakistan. This was because a major regional rice exporter, India went under a strict lockdown because of which a lot of the international orders were directed towards Pakistan, particularly from the Middle East. This is also reflected in overall Pakistan’s rice exports crossing $ 2.1 billion. However, the higher revenue came at a significant production cost due to global supply chain disruptions, as seen by production cost consuming 91 percent of revenue. Net margin was further affected by the fall in other income and net exchange gain that had provided considerable support to the bottomline in the previous year. Coupled with this was the exorbitant rise in finance expense due to increase in interest rates. Thus, net margin fell to over 1 percent.

Recent results and future outlook

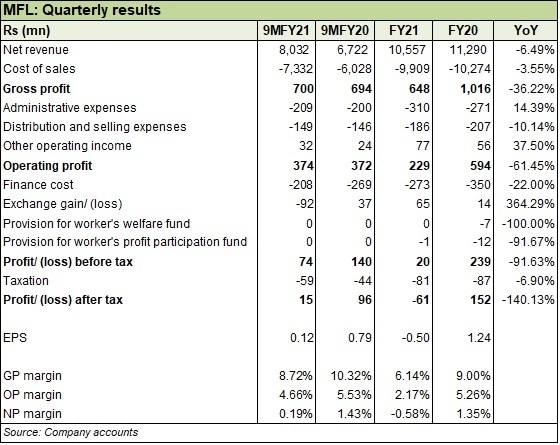

Revenue in FY21 stood at Rs 10.5 billion, registering a year-on-year decline of 6.5 percent. Contrary to last year, when majority of the revenue was earned in the last quarter of FY20, in FY21, the last quarter saw the lowest revenue as demand for basmati rice reduced due to lock downs and restrictions as Covid-19 cases increased. Moreover, production cost also increased, to nearly 94 percent of revenue, due to the inflationary pressure, rise in electricity/gas rates and shortage of gas in winter months that restricted gas supply to the company. In addition, due to currency appreciation, export proceeds were adversely affected and resulted in an exchange loss for three quarters of FY21, as compared to FY20 seeing Rs 65 million in net exchange gain. Thus, the company incurred a loss of Rs 61 million in FY21.

The company has been expanding its product portfolio over the years. During the period, Matco Foods received approval for site plan for its corn starch project and plan to begin construction and installation of machines.

Comments

Comments are closed.