As the world comes out from the depths of weaker energy consumption due to the pandemic in 2020, the rebound in demand is met with global energy shortage due to supply restrictions by OPEC as well as supply chain disruptions, which has raised oil, gas, and coal prices.

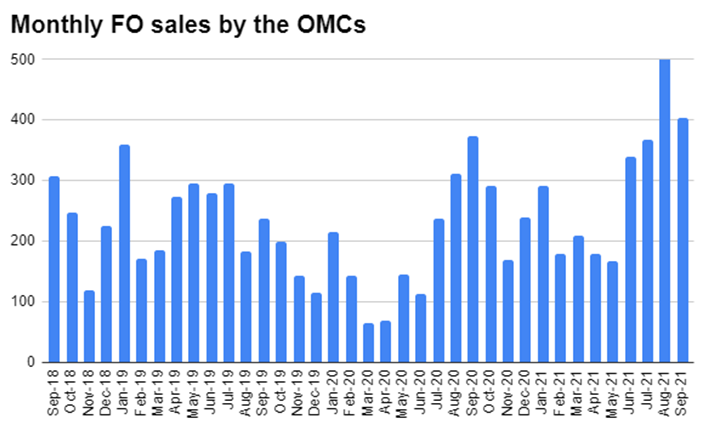

Some impact of higher petroleum product prices is being absorbed by petroleum consumption at home that remained flat in September 2021 on a month-on-month basis. OMC sales for petroleum products remained at 1.96 million tons in September 2021. However, the product-wise breakup shows that the decline was only due to a month-on-month decline in furnace oil sales (21 percent), while motor gasoline sales - despite the upswing in prices – were higher by 7.2 percent (MoM) followed by increase in high-speed diesel sales by 2 percent (MoM).

At the same time, the year-on-year trend shows that the recovery in OMC sales continues, attributable to low base effect from 2020 followed by rebound in 2021 thanks to return of economic activities. Petroleum product sales by the oil marketing segment in September 2021 at 1.96 million tons are up by 29 percent, year-on-year driven by retail fuels HSD and MS (up by 46 and 23 percent year-on-year).

Oil sales in 1QFY22 were above 5.8 million tons with growth of 24 percent year-on-year and double-digit growth in three key petroleum products. Here, growth was led by furnace oil (38 percent YoY), followed by HSD and MS (36 percent, and 14 percent YoY), respectively.

Much of the growth witnessed in petroleum products stem from revival of economic activity such as in large-scale manufacturing, exports, auto sales, and improved agri performance. Other factors such as increased power generation from furnace oil have also brought the black fuel back into mix amid rising prices of LNG. Also, border control has been saving the country from the influx of smuggled petrol and diesel, especially from Iran. While the risks from higher prices persist, the ongoing trend is likely to continue in the coming months, because when measured from the base of 2020, this is mostly improvement.

Comments

Comments are closed.