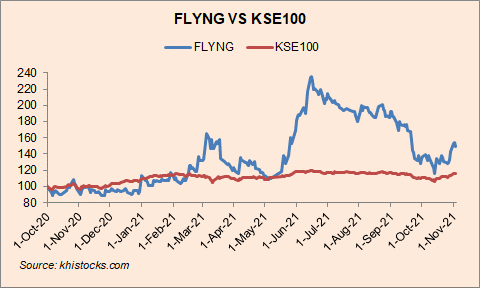

Flying Cement Company Limited

Flying Cement Company Limited (PSX: FLYNG) was established in 1992 under the Companies Ordinance, 1984 (now Companies Act, 2017) as a public limited company. It is part of the Flying Group of Industries that was set up in 1979.

The company is in the business of manufacturing, marketing and selling cement. Its manufacturing plant is located at Khoshab, Punjab. It has an annual capacity of 686,000 tons of clinker and 720,000 tons of cement.

Shareholding pattern

As at June 30, 2021, over 58 percent shares were owned by the directors, CEO, their spouses and minor children. Within this, majority are held by Mr. Momin Qamar. Close to 34 percent shares are held by the local general public, followed by 4 percent in “others”. The remaining about 4 percent shares is with the rest of the shareholder categories.

Historical operational performance

While topline has been fluctuating over the years, profit margins have improved after FY13, until FY19. In FY20, it dropped significantly, before rising again in FY21.

Despite the increase in volumes, with cement dispatches being higher by 2.5 percent and production higher by 2.45 percent, revenue in FY17 fell, albeit marginally, by less than 1 percent. The overall cement industry posted a growth of 4 percent during the year. This was relatively slow due to lower exports. On the other hand, costs were lower, although marginally to nearly 92 percent, from over 93 percent in FY16. The decrease was attributed to lower coal and energy prices. As a result, although topline had declined, gross margin improved to 8.2 percent. This also trickled down to the bottomline, with net margin recorded at 6.5 percent, up from last year’s 5.9 percent, due to other factors remaining more or less similar as a share in revenue.

In FY18, revenue for the company grew by 17.8 percent, while the industry overall posted a growth of 13.84 percent. This was attributed to the rise in demand. During the year, the company added another line to its capacity that would allow production to double to 4,000 metric tons, from 2,000 metric tons. Production cost made 91 percent of revenue, keeping gross margin flat at 8.8 percent. While other income somewhat supported operating margin, the net margin was adversely impacted by the rise in finance expense and taxation; net margin was recorded at a lower 6.25 percent. The rise in finance expense was due to finance obtained for expansion from the National Bank of Pakistan.

The company continued to witness double-digit growth in revenue in FY19 at 12.4 percent, while the overall cement industry’s growth was relatively slow at close to 2 percent. The latter was due to lesser construction activity that suppressed demand. However, exports picked up that largely contributed to industry growth. But the significant rise in production cost to 94 percent of revenue due to increases in input prices and currency devaluation led gross margin to shrink to 5.8 percent. With negligible changes in other elements, net margin also reduced, to 4.3 percent.

The outbreak of Covid-19 in FY20, combined with currency devaluation and high input prices, led the company’s topline to fall by nearly 67 percent; cement dispatches reduced by almost 6 times. The overall industry also saw slower growth at 2 percent. With fixed costs being unavoidable, and revenue lost, production cost exceeded the topline resulting in a gross loss of Rs 462 million, that increased to Rs 531 million as net loss for the year.

Revenue, volumes and growth recovered remarkably for the industry and the company in FY21. Revenue for the company increased by nearly three times, while dispatches were recorded at 388,156 metric tons compared to 86,957 metric tons in FY20. This was attributed to the recovery in demand as lockdowns eased gradually, along with government initiatives to boost construction, and CPEC related activities. With the growth in topline, production cost made 90 percent share, a level last seen in FY07. But the higher taxation kept net margin nearly flat year on year at 4.46 percent.

Quarterly results and future outlook

Revenue in the first quarter of FY22 increased several folds year on year, from Rs 68 million in 1QFY21 to Rs 1.2 billion in 1QFY22. This could partially be attributed to rise in prices, along with demand recovery. The first quarter of FY21 last year was the time when business activities were gradually starting to resume, therefore, demand was unusually lower. With significantly lower production cost compared to that seen in the same period last year, profitability improved. The company posted a net profit of Rs 205 million, compared to a net loss of Rs 41 million in 1QFY21.

While demand and business activities in the economy have resumed and can ensure future sales on the back of government spending on dams, housing schemes and CPEC, profitability faces challenges from increases in interest rates, currency fluctuation, increase in input prices such as coal and energy, in addition to political uncertainty.

Comments

Comments are closed.