Car sales are certainly performing better than they were last year. In the 5M period, passenger cars, LCVs and SUVs cumulatively grew 65 percent. But since July, when demand seemed really robust — as car buyers had a larger selection of cars available with across-the-board price reductions (as a direct result of government slashing duties and taxes), cheaper bank financing due to reduced rates and a general improving economic environment — the trend now is visibly downward facing. In the month of Nov, sales for passenger cars have dropped 24 percent compared to July, 16 percent for SUVs, and 23 percent for LCVs. Slow down may be a result of year-end approaching, but the likelier scenario is that this trend will continue for the rest of the fiscal year.

For one, automakers have raised prices again which was inevitable (read: “Autos: The more things change”, Nov 17, 2021) as they are facing cost pressures from various channels. Imports have become expensive as rupee depreciates. Since dependence on imports for auto makers and auto parts makers is high, the dollar-rupee parity plays a strong role in costs. Freight rates have been at their peaks as well causing goods to be that much pricier. Meanwhile, many automakers have had to contend with a shortage of semi-conductor chips which is a global crisis that began to brew right after covid-led lockdowns began. That crisis has still not subsided. Production — as a result — has stalled for many vehicles which is certainly a huge supply-side obstruction.

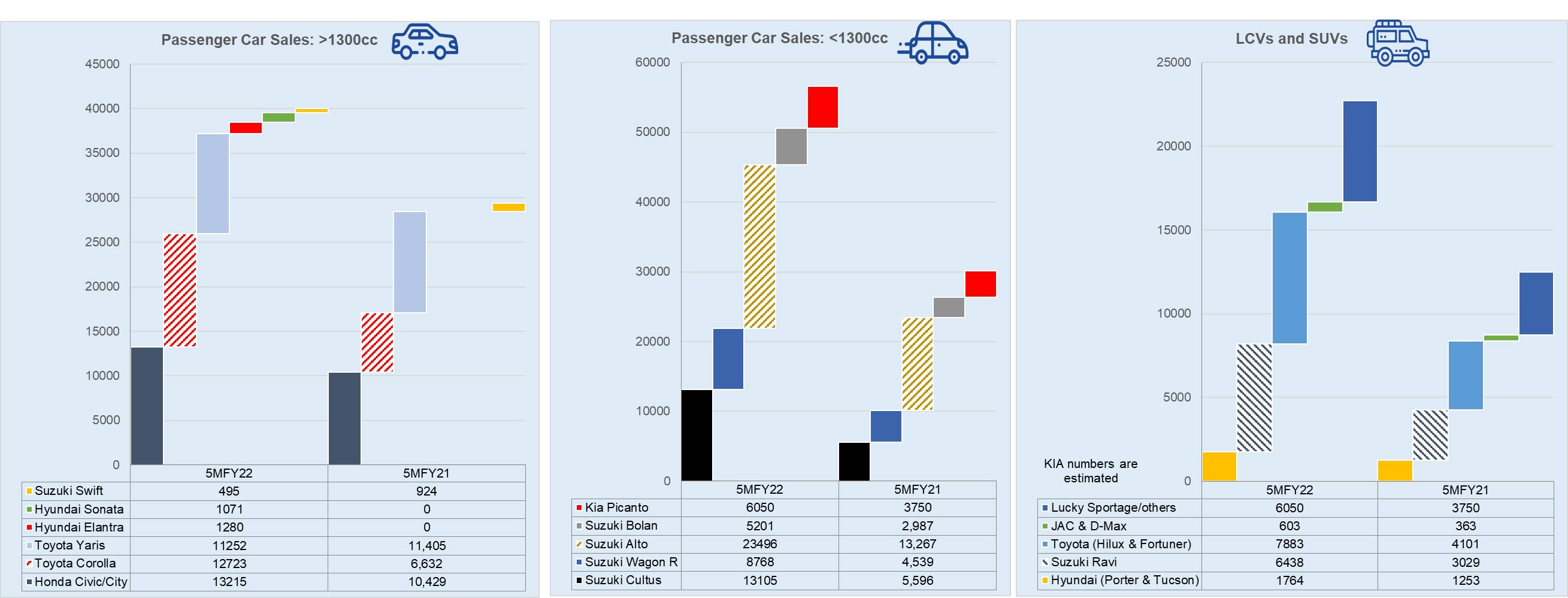

In addition to raised prices, car buyers are also facing restrictions on car financing imposed by SBP to curb the current account from slipping. More importantly though, interest rates have increased over the past few months which will take away the advantage auto loan buyers were enjoying when the year began. The latter one will affect Suzuki buyers greatly as they are more sensitive to price and income changes. Except for Honda that is likely buoyed by the new City sales, both Suzuki and Toyota have witnessed significant drop since July in terms of monthly volumetric sales. Against last year though, all three companies have done remarkably well where Suzuki sales are up 90 percent, Toyota’s 44 percent and Honda 25 percent. The fiscal year for the industry will potentially end in positive growth compared to last year, but with most of the excitement and lustre of a “turnaround” missing.

Though competition right now is not as intense, more players are entering with Kia, Hyundai, and Changan having already secured their place solidly in the market. They are contenders to a growing market share having already proved that there is demand for these vehicles. The latest to join the market is rickshaw maker Sazgar that joined China’s BAIC to domestically produce four BAIC models in Pakistan. The company has already begun trial production of a hatchback and sedan as well as a crossover and a full-powered SUV. According to PAMA, the company has even sold 34 units. Meanwhile, after going back and forth and back again with global Nissan, Ghandhara Nissan decided to sign on with a Chinese partner Chery to launch two SUVs in Pakistan.

While local companies with Chinese partners have a long way to go in terms of familiarizing the car market to Chinese vehicles and get buyers to take a leap of faith on these brands, with the right marketing and outreach and a solid after sales/services network (take cues from Kia), there is a strong chance that more consumers will get on board — these cars are simply more affordable. A proactive approach toward partnering with banks and ensuring banks provide same terms on financing for these cars as well is another important one. Premium brands have the loyalty and reliability factors working for them for decades but they have also become complacent and sat back for far too long. Yaris and City’s success since their launch however does indicate that new assemblers have their work cut out for them.

Comments

Comments are closed.