The momentum in inward remittances is continuing to grow. The number has crossed $30 billion for the first time in a calendar year. It is in fact, up by 17 percent year on year to $30.6 billion in 2021. This growth is on top of the phenomenal growth of 18 percent witnessed in 2020.

Drivers for growth accomplished during 2020 are well-documented. Travel restrictions due to the spread of covid-19 and ensuing lockdowns helped in the conversion of erstwhile informal flows into formal flows transferred through the banking channels. The other reason for higher growth was a helicopter drop of money across western countries to households which enabled many expats to send higher sums to friends and families back home. This trend was not unique to Pakistan—similar jump in remittances was observed in Bangladesh and other countries with a large number of citizens working abroad.

The obvious fear was that this growth was temporary. With the relaxation of lockdowns and travel restrictions and most countries opening their borders, all the while tapering of the fiscal stimuli, it was expected that remittance inflows would begin to decline in FY22. That prediction is thus far holding true for Bangladesh where after 36 percent growth in remittances during FY21, the toll is down by 21 percent in 1HFY22 year on year. Remittances in Pakistan however are showing exceptional resilience and have gone off-script. The inward remittances were up 26 percent in FY21 –much like Bangladesh. But this growth continues surprisingly where the remittances have grown 9 percent during 1HFY22, up to $15.4 billion.

This seems to indicate that the marginal shift in inflows from informal to formal sector may not have been temporary after all and remitters may be preferring formal channels over informal methods of money transfer. Perhaps, the crackdown of hundi/hawala businesses after FATF is doing the trick. The other reason is that Hajj and Umra have yet to resume properly because of which inflows are continuing.

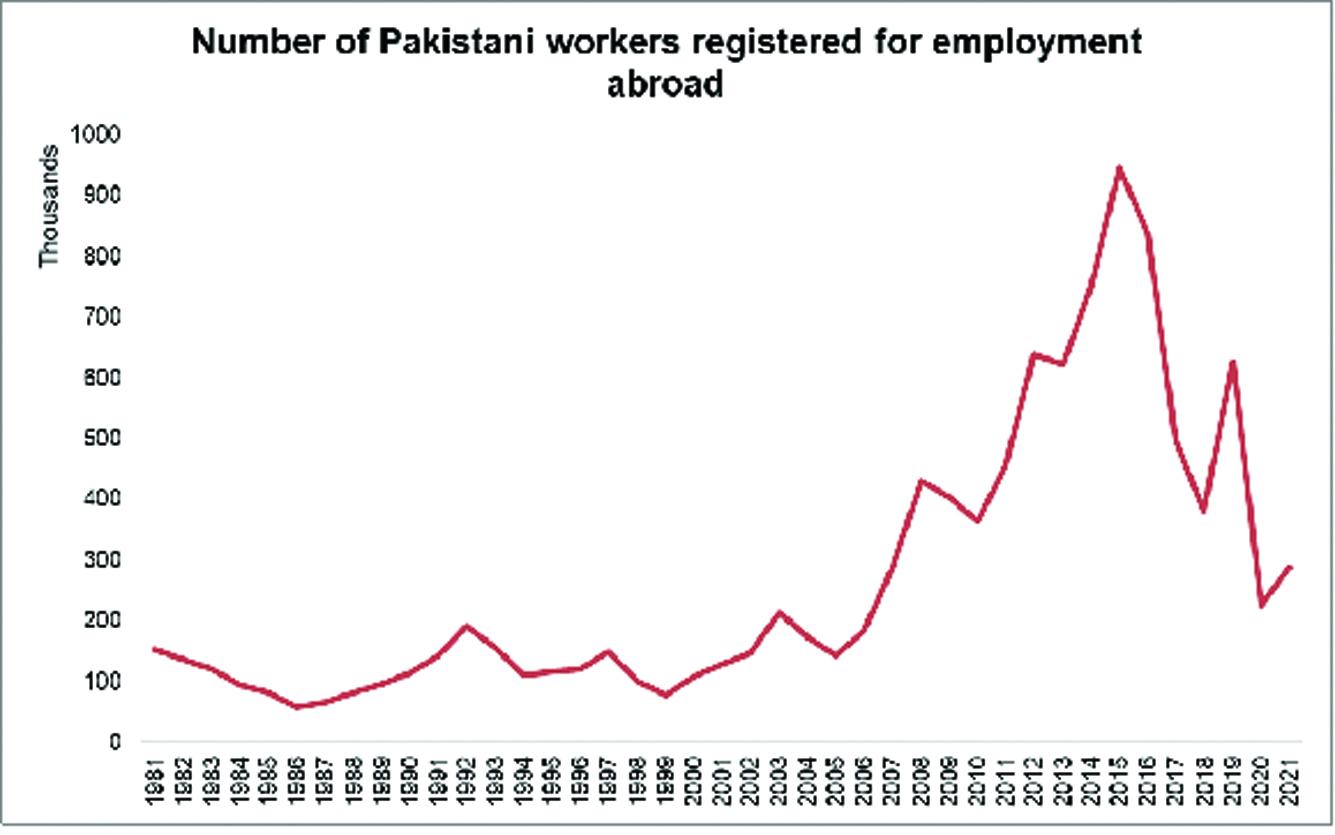

Also, consider that the growth in remittances is despite the fact that the incremental number of people going abroad for work reasons are declining year after year on a gross basis. Data from the Bureau of Emigration and Overseas Employment of Pakistan shows that the number of new immigrants registered abroad peaked at 946,571 in 2015 but since then, this number is on a decline.

The number was a mere 255,213 in 2020 and a little higher; 288,230 in 2021. Unfortunately, there is no data compiled for those individuals or workers abroad that are returning home. But anecdotal evidence suggests that the number of workers coming back has been increasing. This trend of fewer people moving abroad each year will have an impact on the future growth of remittances, though in aggregate, the total number of people working abroad is going up over the growing base. That is comforting.

The distribution of remittances shows another marked change in remit trends. The bifurcation of country-wise breakup shows that the flow from the Middle East is losing momentum while higher growth is emanating from the West. Dec-21 flows depict a decline of 11 percent, year on year, and 5 percent month on month from UAE while the inflows remained flat from Saudi Arabia. In 1HFY22, flows from UAE and Saudi Arabi both are up by mere 2 percent to $3.0 billion and $4.0 billion respectively – these two countries still constitute 44 percent of the total remittances in the 1HFY22. The muted growth in these two countries is compensated by a 24 percent increase in remittances from USA ($1.5 bn in 1HFY22), 14 percent from the UK ($2.1 bn in 1HFY22) and 38 percent from the EU ($1.8 bn in 1HFY22).

At the same time, it is disconcerting to note that there are no signs of more workers going to the West in the last two years. The global stimuli in response to the pandemic was carried out in large part among western economies where the proverbial helicopter drop of money phenomena happened. Naturally, one reason for remittances growth from these economies is folks sending more money to families here. The other reason could be the crackdown of hundi/hawala systems. The third plausible reason could be inflows being invested into Pakistani real estate where returns in the past two years have been mouthwatering. Also, incomes of consultants hired abroad might also be recorded as remittances.

Some may speculate that the growth in RDA (which recently crossed $3 billion) is reflecting in remittances. But in reality, this would be a very small portion as a major chunk of RDA is coming in investment into Naya Pakistan Certificates (NPC) and other banking and capital market products, and as such are not recorded in remittances. Even the holdings in foreign currency in RDA accounts is not part of remittances. Only the chunk which is converted into PKR and spent anywhere (apart from RDA classified investment) may be reflecting in the remittances.

In a nutshell, growth in remittances is continuing to flourish against expectations and this is helping flow bridge the growing trade deficit. However, the worrisome factor is the falling number of new workers going aboard. Pakistan needs to find new labor markets –apart from Saudi Arabia and UAE—and diversify its remittances flow, as these countries are not likely to show the same kind of growth in the foreseeable future that they had exhibited in the last decade.

Comments

Comments are closed.