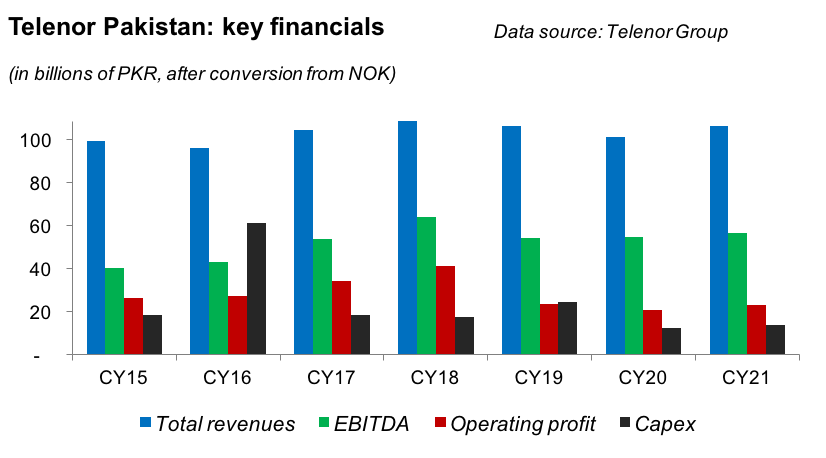

Some solace for the second-ranked mobile network operator (MNO), for the annual topline growth has come home for the first time since 2018! The Telenor Group yesterday released the key financials for all its eight operating markets for the year ended December 31, 2021, and its local subsidiary Telenor Pakistan’s performance has stood out in a positive light. During CY21, the local Telenor entity achieved total revenues of Rs106 billion, which translates into a year-on-year growth of 5 percent.

Across the cellular market, MNOs up and down the subscription ladder have been hard at work to not only try and capture a bigger slice of the the subscription pie, but to also become better at the monetization of their expensive data networks. It appears that Telenor Pakistan has had some success in this regard during CY21. One; the subscription base increased by nearly 2 million in the year, coming really close to the 50 million mark. And two, data revenues grew in strong double digits during the year.

Still, the main sales metric – average revenue per user (ARPU) – continues to struggle, indicating room for the operator to level up its game. ARPU during CY21 stood at Rs170 per user month, lower by about 1 percent compared to the previous year and a whole lot lower when compared with the recent five-year peak of Rs212 per user per month seen back in CY16. With the CY21 topline still 5 percent below the topline back in CY18, it indicates that business has been on a decline in real terms. There is work to do, especially in increasing the market share in the segment of 4G mobile broadband users.

Despite rising energy costs, it was operational efficiencies that helped the Norwegian operator to grow its profitability out-of-proportion than the topline growth. The operating profit increased by 11 percent year-on-year to reach Rs23 billion, as Telenor Pakistan slowly climbs back to peak operating profitability of Rs41 billion that it saw back in CY18. EBITDA, however, grew much in line with revenue growth, yielding Rs56 billion at a yearly growth of 4 percent, with a slight decline in EBITDA margin to 53 percent.

“The challenging macroeconomic situation is driving inflationary pressure, impacting profitability through increased energy prices and indirectly also through the impact on customers’ purchasing power. Several modernisation initiatives are ongoing, including projects which are addressing the energy cost,” the Telenor Group noted in its latest report. While the operator cannot do much about customer spending, those energy-saving initiatives can come in handy, considering the persistent inflationary troubles.

While Telenor Pakistan posted a comparatively better operating performance in CY21, was it good enough to induce cheers at their Norway HQ? The disruptive PKR depreciation, which returned with force during the second half of last year, has served to dilute investment returns across multiple sectors. So is the case for Telenor Pakistan, whose revenues and EBITDA both declined in Norwegian Krone (NOK) terms, by 5 percent and 6 percent year-on-year, respectively. Let’s see how 2022 turns out!

Comments

Comments are closed.