Shell Pakistan Limited (PSX: SHEL) has seen improving volumetric sales in 2021 which was a key factor in driving the improvement in the company’s earnings for the year. The OMC’s sales in the 7 months of the fiscal year 2022 continues to show the rising trend – a growth of over 16 percent year-on-year in 7MFY22 for the petroleum products sold.

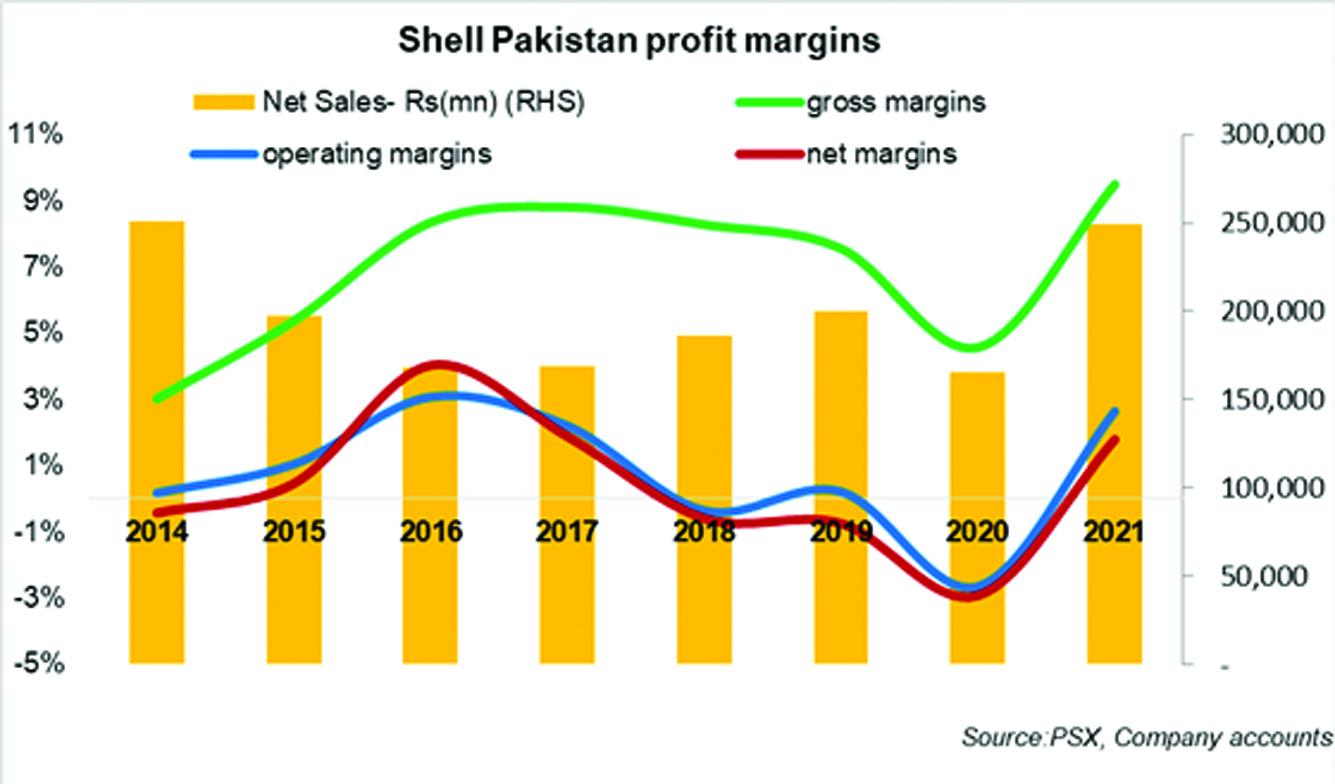

Shell Pakistan announced its financial statements for the year 2021 where earnings turned green after remaining crimson for over a couple of years. From a loss of Rs4.8 billion in CY20, Shell’s profits for CY21 stood at Rs4.5 billion. This was primarily due to 51 percent increase in net revenues for the year. The growth in revenues for Shell Pakistan Limited was a combination of both higher volumetric sales of petroleum products and higher international crude oil prices which resulted in price premium on petroleum products. Therefore, a surge in revenues for SHEL in CY21 emanates from improving product sales mix - especially that of lubricants, as well as the fortnightly pricing of petroleum products.

From an operating loss in CY20 to operating profits in CY21, the company witnessed marked improvement in margins No substantial increase in distribution, marketing and administrative expenses and a decline in finance cost, was offset by a sharp increase in other expenses.

The return to profits in 2021 for SHEL comes after a tougher year 2020 when the company posted three times increase in losses as compared to 2019. 2020 was a difficult year not only for the OMC but the business in general due to weak economic activity and demand resulting from COVID related restrictions as well as significant oil prices volatility along with currency depreciation. On the contrary, 2021 was a year of recovery with remand for petroleum products returning as consumption increased and economic activity resumed.

Comments

Comments are closed.