To power the country’s digital economy, significant and sustained amounts of investment are required. When the pandemic started, nobody had seriously anticipated foreign direct investment (FDI) to come pouring into the Information and Communications Technology (ICT) businesses. While that holds largely true for telecoms-related FDI, the opposite appears to be the case for the IT-based businesses operating in Pakistan.

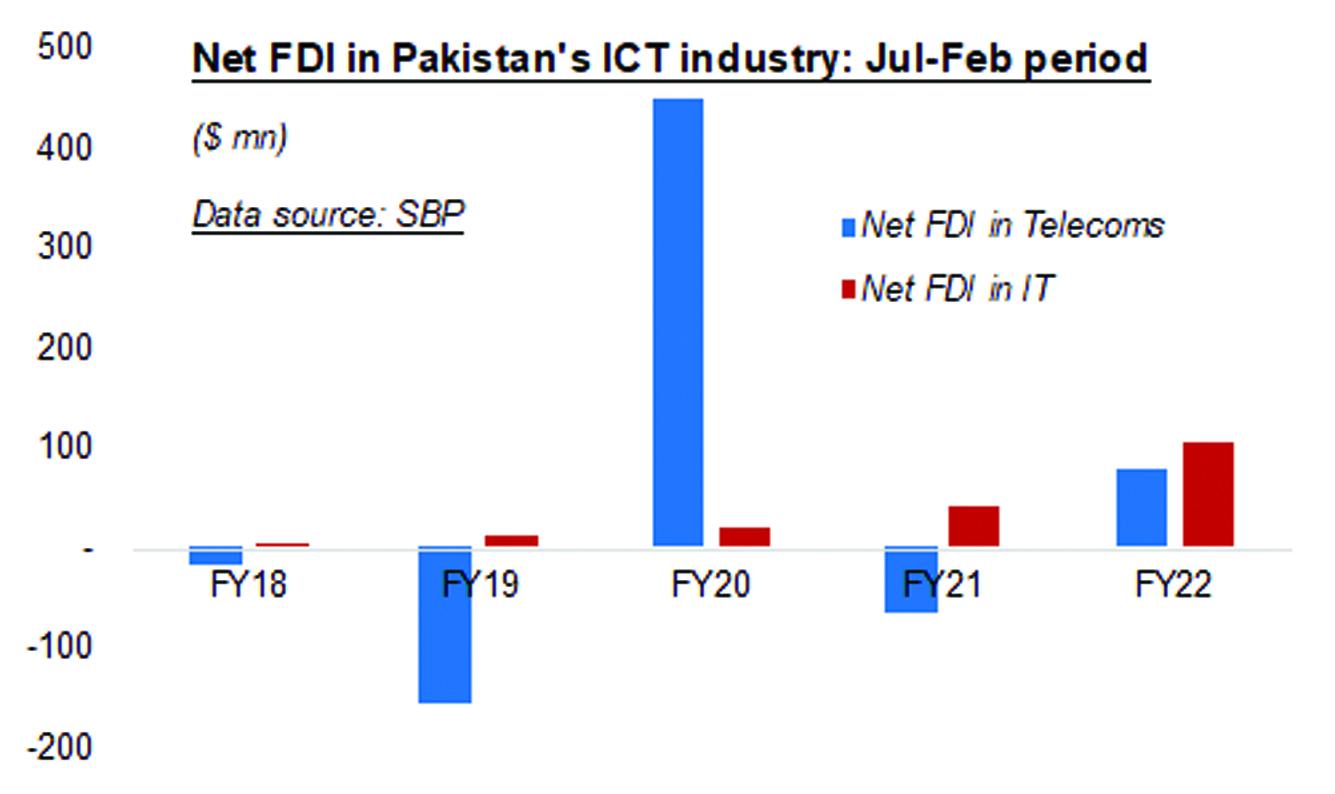

As per the latest data from the State Bank of Pakistan (SBP), the net FDI in the country’s telecom sector stood at $79 million in the Jul-Feb period of FY22. While that is obviously a sharp improvement from negative net FDI of $67 million in the same period of the last fiscal year, the net FDI in telecoms-based businesses has really lagged during the pandemic. (And this is not to suggest that pre-pandemic those inflows were too impressive!)

Over the past two years since the pandemic started, the telecoms sector has been unable to score a mega spectrum auction. (Spectrum auctions have historically boosted FDI inflows in Pakistan). The telecom authorities organized a large auction in September last year, but except for Ufone, other three operators stayed on the sidelines, apparently due to lack of attractive terms and conditions. Instead, the telecom-sector FDI growth during the pandemic has been dependent on partial license-renewal proceeds.

On the other hand, the IT-based businesses, which have historically received very little FDI compared to telecoms, have had some kind of an investment bonanza during the pandemic. Net FDI inflows into Pakistan’s IT sector stood at $106 million in the Jul-Feb period of FY22, as per the latest SBP data. That’s an amount equivalent to two and half times the net FDI proceeds received by this sector in the same period of the last fiscal year.

While several Pakistani IT-based startups in e-commerce, health-tech and logistics (among other sectors) as well as Fintech companies have been on the foreign investment radar pre-pandemic as well, the past two years have been extraordinary, to say the least. Foreign investors seem to be having a “fear of missing out”, as Pakistani startups aim to scale up their digital-disintermediation-oriented business-models in several sectors. Facilitative measures recently taken by the central bank have also helped.

In the two years to February 2022 (two full years of the pandemic), the telecoms sector received total net FDI of $284 million and the IT sector scored net FDI of $201 million. Now in the ongoing fiscal, the IT sector has overtaken telecoms. The telecoms sector is capable to unlock far bigger investments, as there is huge potential for connectivity-related growth in fixed broadband, mobile broadband, and mobile tower business. For that, government must prioritize market development over short-term revenue collection.

Comments

Comments are closed.