April 2022 power generation numbers reaffirm that Pakistan is well and truly back on the economic growth trajectory of FY17 and FY18. Another matter if Pakistan can actually afford such growth – as the worsening external account indicators would suggest. Regardless, the 23 percent year-on-year increase in April 2022 power generation is the highest-ever growth, barring the Covid-induced low base period.

The 12-month moving average generation is nearing 11.5 billion units – growing at 11 percent – a level last seen in August 2018. It remains to be seen if Pakistan opts to deliberately slowdown the economy, much like FY19, which could surely check the double-digit electricity demand growth. For now, rising temperatures, steady growth, and reduced fuel supply to captive power – suggest power generation to break all records this summer.

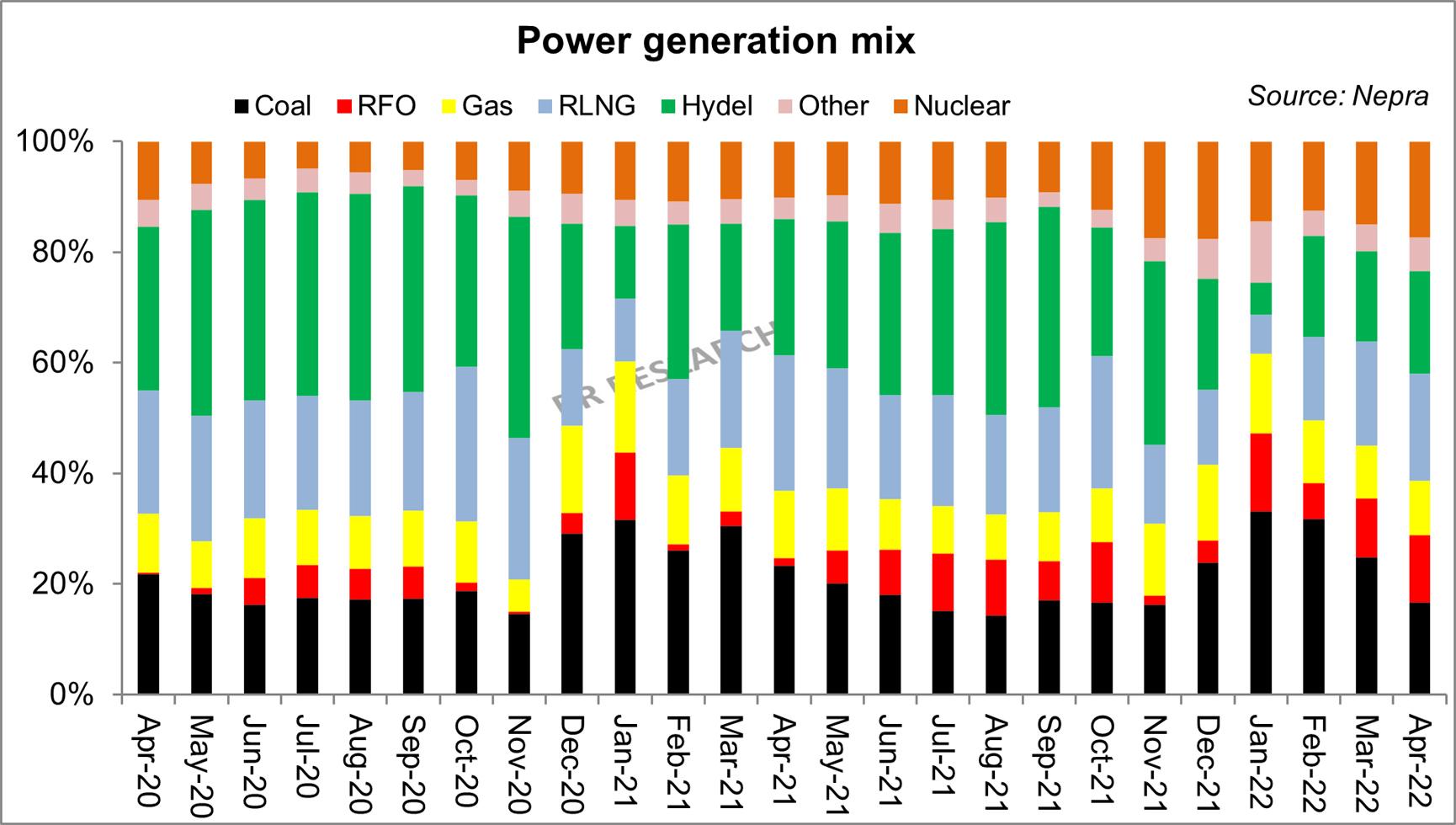

Furnace oil generation at 1.56 billion units was the highest for any April in five years. Some of it was by design, and some by choice. A 12 percent share in power generation had the highest share in fuel cost at one-third, costing Rs44 billion. Hardly a surprise thar April’s fuel bill was the highest for any month ever at Rs134 billion – 113 percent higher year-on-year.

Thankfully, the hydel generation seems to be returning to normalcy – although still distant from historic seasonal highs. Much will depend on water flows in the peak summers, as far as the generation mix is concerned. The onus of generation on furnace oil should come down in May, given Pakistan has arranged 12 RLNG cargoes which should be enough to run all plants near full throttle. That said the extended maintenance of one of the bigger RLNG plants could throw spanner in the works.

All this while, the biggest respite to the generation mix and fuel cost has come from nuclear power. April 2022 saw the highest monthly nuclear power generation at 2.2 billion units – 30 percent higher than the previous high last July. Nuclear power generation had a 17 percent share, second only to hydel and RLNG, which stood at 19 percent each.

Imported LNG for May 2022 has been procured at the highest-ever rates, and the consumer price inclusive of GST goes as high as $28/mmbtu – up from $18/mmbtu in April 2022. With 12 cargoes in the system, May RLNG fuel bill for power generation will undoubtedly lead the way, and another record fuel cost bill is in order. The fuel cost has stayed high by Rs4/unit against the reference tariff for April. May’s monthly FCA could well be in the vicinity of Rs6/unit from the look of things – unless hydel throws in a massive surprise.

Comments

Comments are closed.