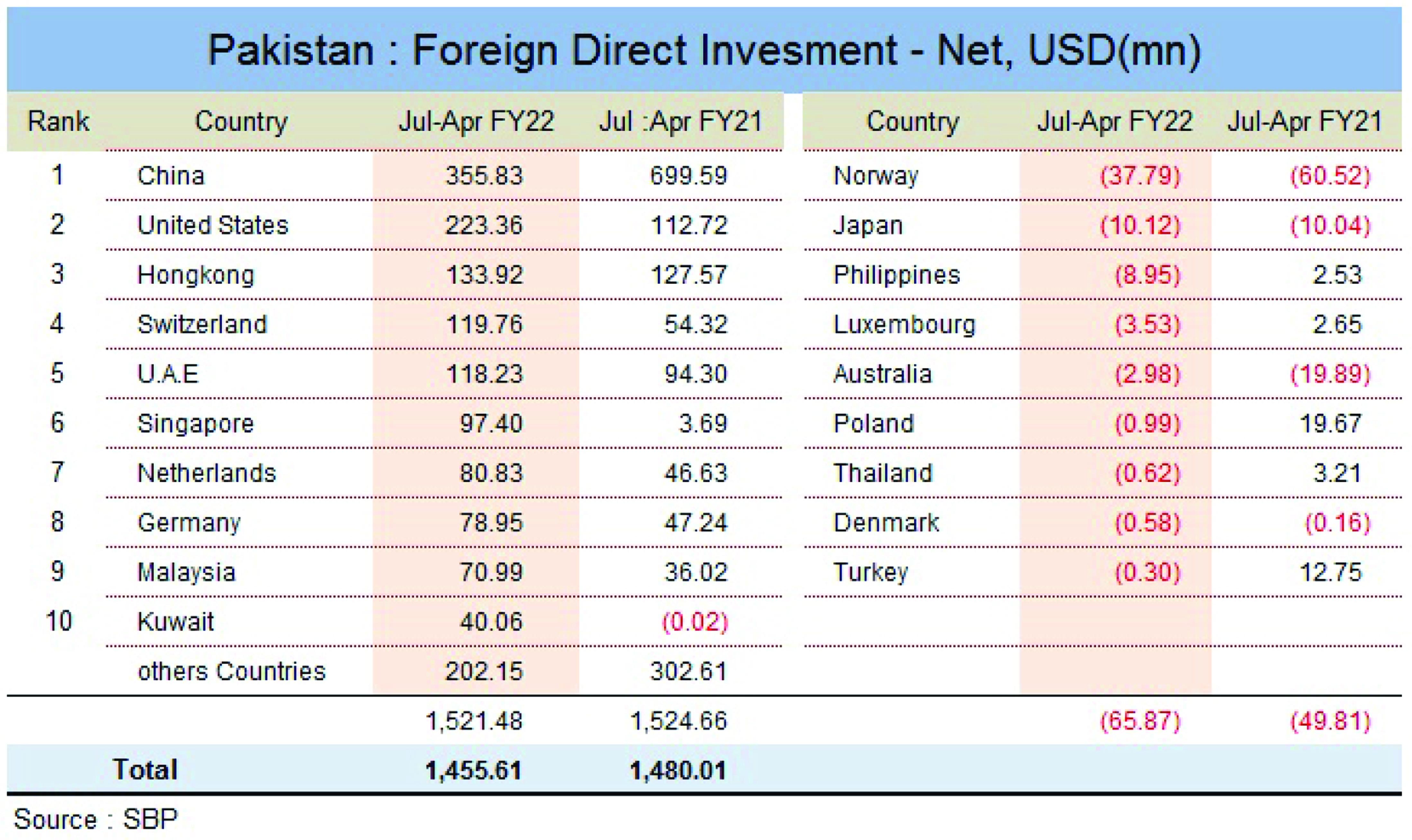

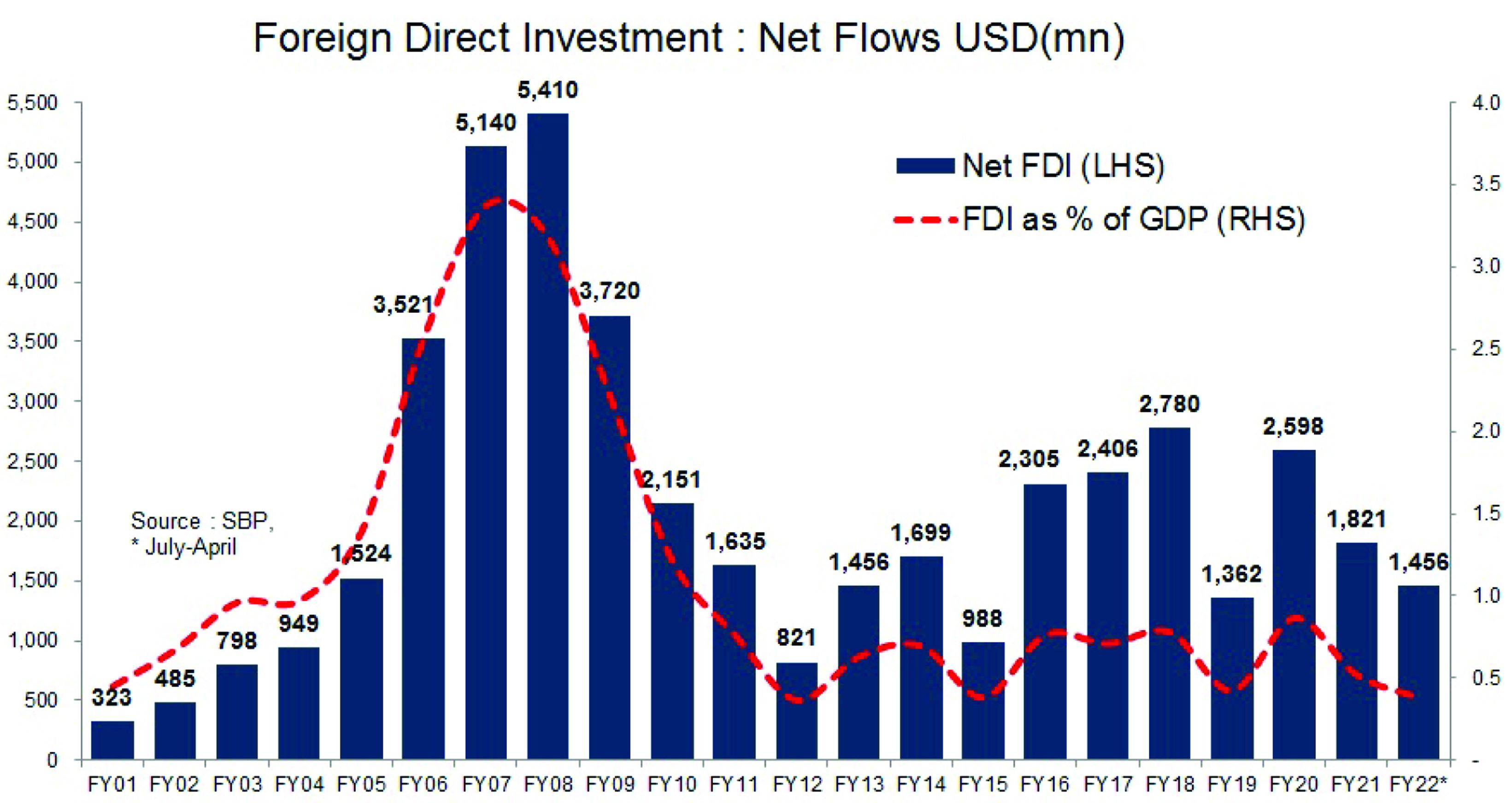

The news is abuzz with India reporting highest ever foreign direct investment of $83.57 billion for 2022. On the contrary, the FDI situation in Pakistan is a sob story. Some are celebrating FDI month-on-month growth of over 660 percent in April 2022 for Pakistan. But a look at year-on-year numbers reveal that foreign direct investment in April 2022 increased marginally by only 0.9 percent versus April 2021.And overall, the FDI in 10MFY22 reduced by 1.6 percent year-on-year.

Not only did the net FDI in April 2022 shows flat growth over previous year with a small base, the inflows in April were down by 21.6 percent and outflows down by 89.6 percent year-on-year, which means that the total inflows coming in April 2022 were also down – definitely not a good sign for FDI. This can also be seen in overall FDI in FY22 so far. During 10MFY22, inflows of foreign investment were down by 16.2 percent, while outflows were down by 35.81 percent, year-on-years.

The overall picture of the foreign investment in the country hasn’t changed much over a long time, especially since inflows from China started declining after key CPEC projects were over. Also, the lack of diversification and failure to increase export-oriented FDI are other factors pulling down FDI in the country. Not only has there been a decline in annual FDI flows, but FDI stocks are also decreasing where ease of doing business and taxation policy also create hindrance.

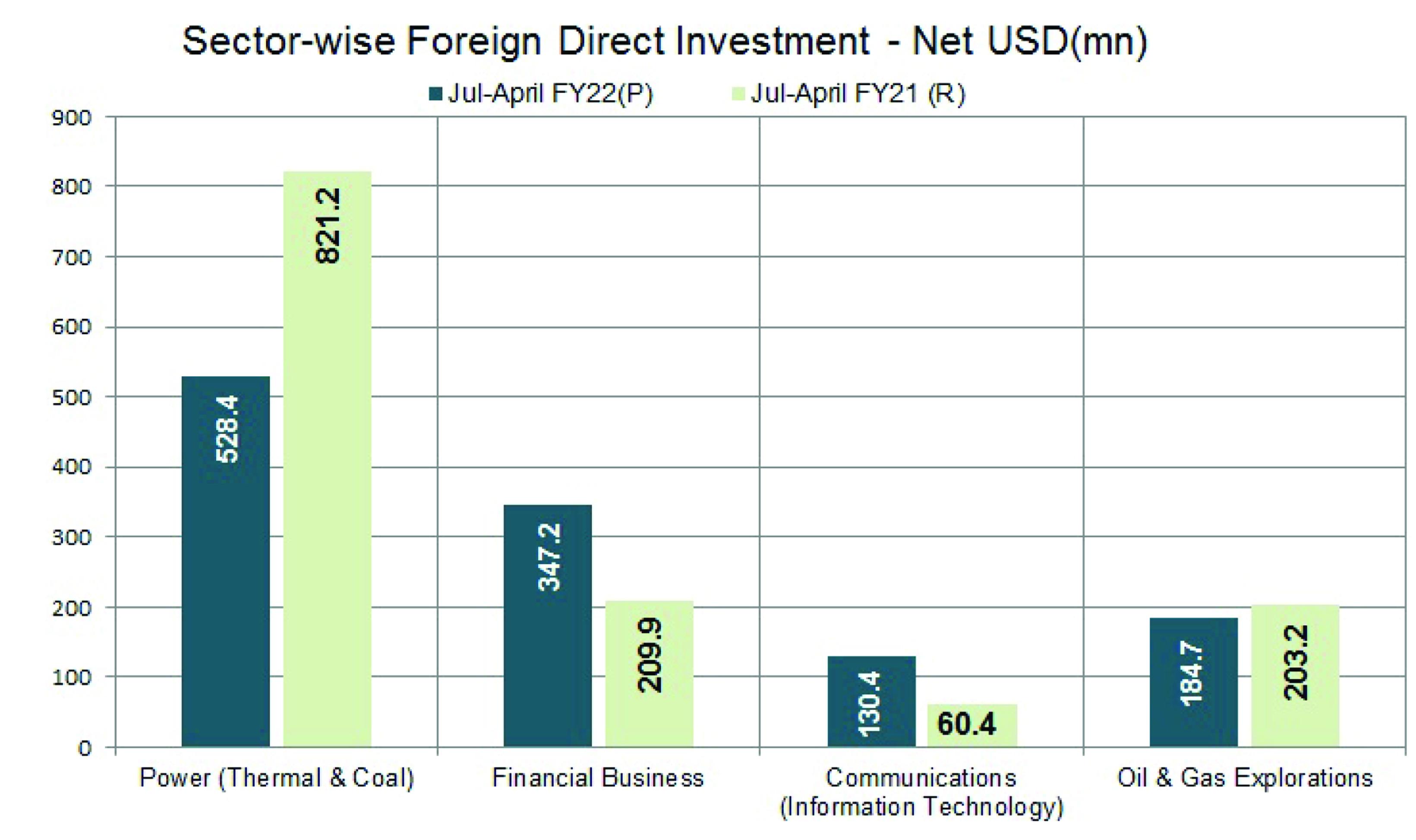

Amid all the inherent structural factors inhibiting growth in FDI for a long time, the political instability and volatility is rocking the FDI boat. Concentrated in power sector, telecom and financial sector, FDI from investing countries like Norway and Denmark contributed to the net FDI outflow in 10MFY22.

Comments

Comments are closed.