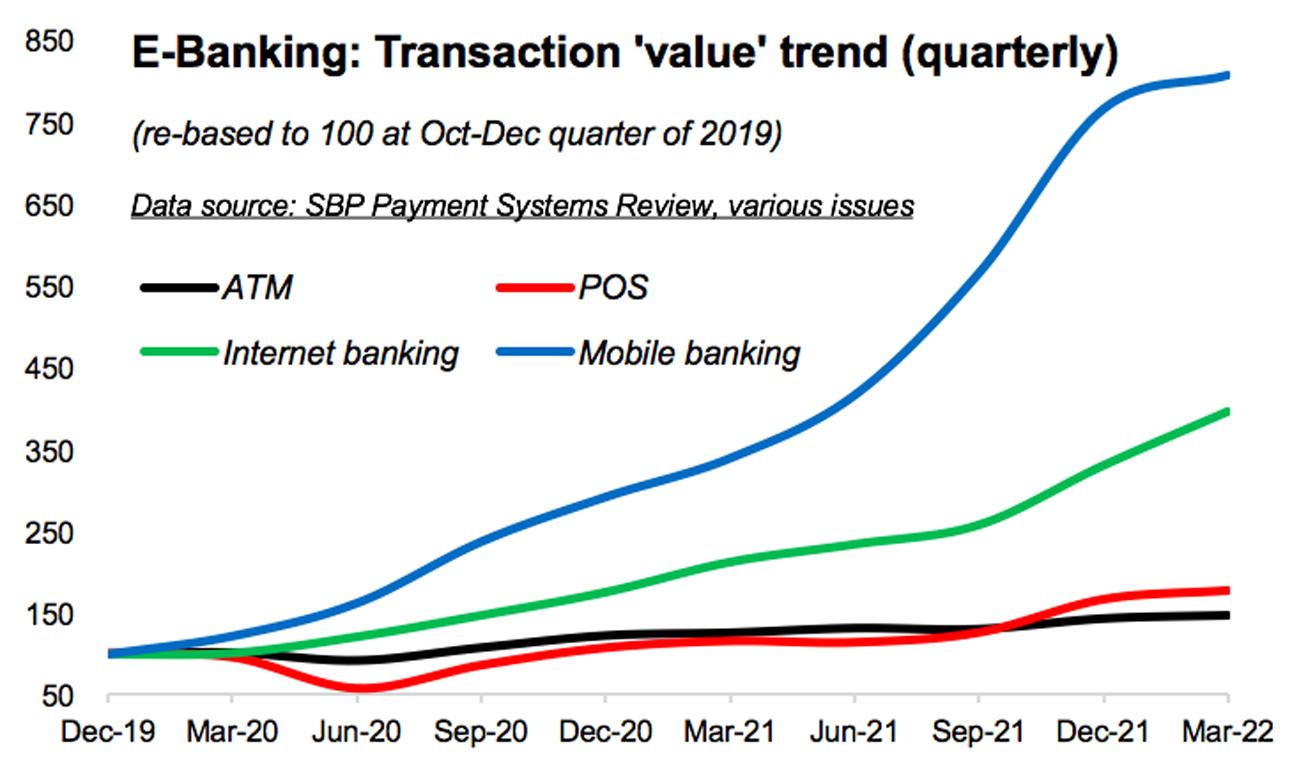

Latest central bank data show that prominent electronic banking (e-banking) channels continue to write their growth story at the tail end of pandemic. In the Jan-Mar quarter of FY23, the four key banking sector alternate delivery channels (ADCs) – ATMs, Point-of-sale (POS) machines, Internet banking and Mobile banking – registered strong growth on a year-on-year basis. Collectively, these four ADCs accounted for some 350 million transactions (37% YoY growth) in this period, valuing Rs8.62 trillion (70% YoY growth).

Mobile banking has lately emerged as the top e-banking channel in terms of transaction value. During the quarter under review, this ADC crossed Rs3 trillion mark, growing 138 percent year-on-year, with transaction volume having nearly doubled to 102 million. Average transaction size stood at Rs30,402 in the analysis period, up 21 percent compared to the Jan-Mar quarter in the previous year. As of March-end 2022, there were some 11.97 million mobile banking users, up by 21 percent from a year ago.

The Internet banking (IB) is following closely behind, with Rs2.9 trillion in value (up 86 percent YoY) generated via some 38 million transactions (56% yearly growth) in 3QFY22. This ADC has the highest average transaction size among the pack, valuing at Rs75,898 in the three-month period (up 19% YoY). There was a 58 percent surge in number of IB users since March-end 2021 to reach 7.83 million as of March-end 2022. Number of banks offering IB was 28 as of March 2022, compared to 27 a year ago. The number of banks offering mobile banking remained constant at 27 between March 2021 and March 2022.

With Rs2.4 trillion of transaction value during Jan-Mar FY22 (17% yearly growth), the ATMs are in the third place among the ADCs. However, these machines come on top when it comes to the transaction volume. ATMs had registered some 171 million withdrawals in the period under review, which reflected a growth of 12 percent year-on-year. Average ATM transaction came in at Rs14,228 in this period, up nominally by 5 percent compared to Jan-Mar FY21. The ATM infrastructure increased by 4 percent between March 2021 and March 2022, reaching a total of 16,897 machines across the country.

While POS ecosystem needs a lift, this channel has shown some promise in recent quarters. In the year till March 2022, the number of POS machines went up by 45 percent year-on-year to reach 96,975 (~30,000 net addition). During 3QFY22, the POS transaction volumes jumped 54 percent year-on-year to reach 38 million, providing a similar rate of growth in transaction value, which reached Rs190 billion in this period. Average transaction size remained almost unchanged at Rs4,953 (3QFY21: Rs4,972).

So far, so good! But now there are several questions over sustainability of this growth. For instance, can e-banking momentum survive the current subdued economic climate? Considering ‘demand moderation’ is the only way out to stabilize macroeconomic indicators, how big a hit will retail spending (and in turn, digital payments) take in coming months? Will banking deposits go down as people spend some of their savings to make up for higher fuel and power prices? As banks may face lower credit demand and trimmed profits, will they lower budgets for front-end/back-end digital transformation? Let’s wait and see.

Comments

Comments are closed.