PSX starts FY23 on a positive note, KSE-100 rises 0.22%

- Market, however, remains volatile due to absence of any triggers

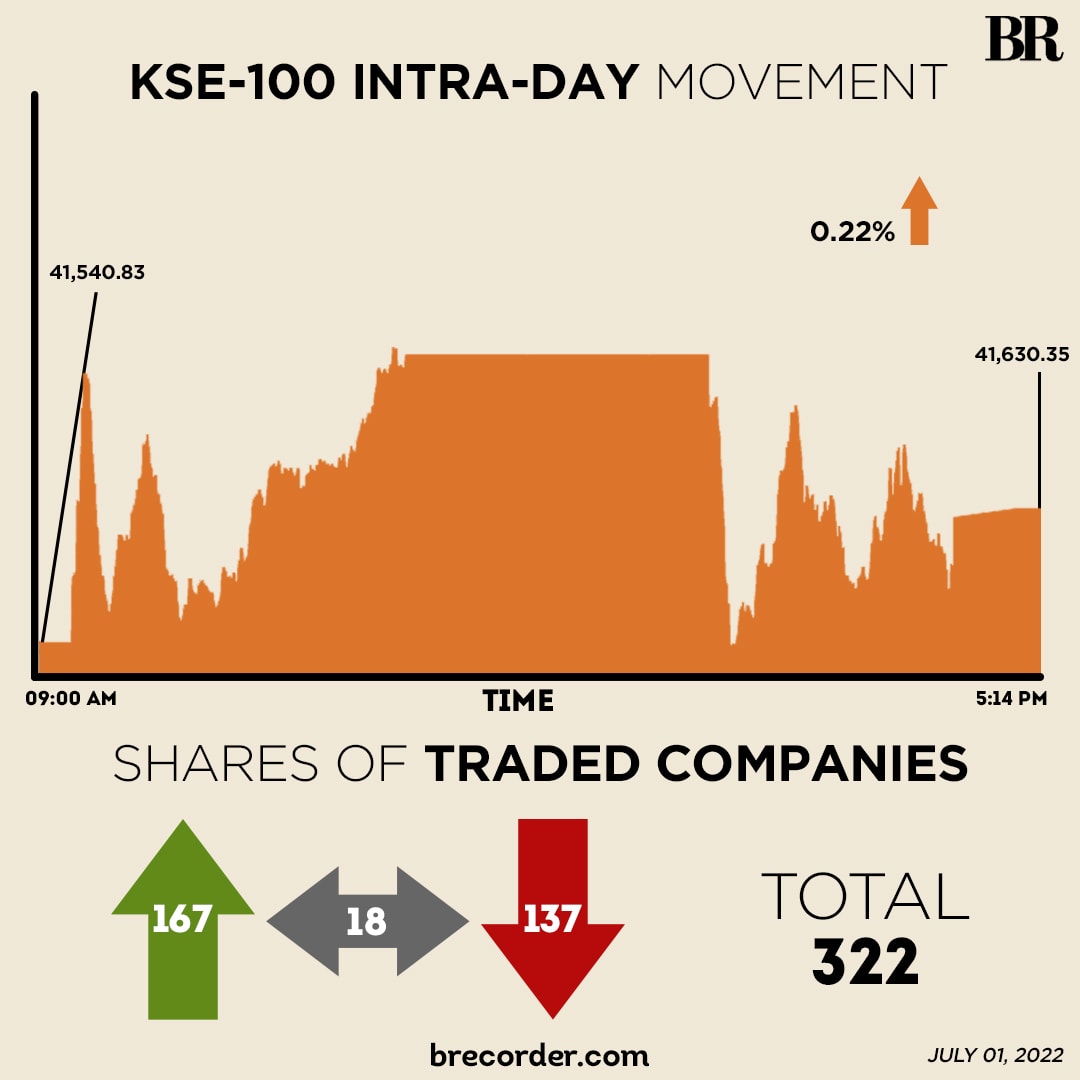

Extending the rally, the Pakistan Stock Exchange (PSX) started the new fiscal year on a positive note and the KSE-100 index gained 0.22% in a lacklustre session on Friday. The market remained volatile due to the absence of any positive triggers.

A mixture of buying and selling pressure made the KSE-100 index oscillate between gains and losses.

At the end of the session, the market closed with an increase of 89.52 points or 0.22% at 41,630.35 points.

KSE-100 rises 0.59% in last trading session of FY22

Trading in the first session kicked off with a spike, however, the market failed to sustain the uptrend and dropped. Towards the end of the first half, a buying spree emerged that lifted the market up by 192 points.

The second session began with a dip as investors weighed sentiment on lofty inflation reading, however, the pessimism faded after some time and the market ended the session with gain.

Despite the optimism, automobile, cement, refinery and fertiliser endured a battering and closed with modest losses. On the flip side, oil sectors recorded sizeable gains.

Chemical, oil and gas marketing companies and refineries sectors took a hammering and saw a modest sell-off. On the flip side, oil and gas exploration, fertiliser, automobile and cement segments closed in the green.

The benchmark KSE-100 index lost 1.41% on a weekly basis.

KSE-100 Index sees largest decline after 8 quarters

A report from Capital Stake cited that volatility marred the PSX on Friday. Indices swayed both ways in search of a direction while volumes contracted from last close.

Topline Securities, in its report, stated that lacklustre activity was observed as the index traded sideways with low volume through the day to close at 41,630 level.

On the economic front, the consumer price index (CPI) based inflation increased by 21.3% in June 2022 on a year-on-year compared to an increase of 13.8% in May 2022.

Inflation in Pakistan hits 21.3%, highest since Dec 2008

On a month-on-month basis, it increased by 6.3% in June 2022.

Moreover, the government of Pakistan also raised petrol prices by Rs14.85 from Rs233.89 to Rs248.74 per litre.

Govt jacks up petrol prices by another Rs14.85 per litre, takes price to Rs248.74

Sectors driving the benchmark KSE-100 index north included banking (89.37 points), fertiliser sector (47.26 points) and oil and gas marketing (12.31 points).

Volume on the all-share index contracted to 154 million from 192.9 million on Thursday. The value of shares traded rose to Rs4.03 billion from Rs6.79 billion recorded in the previous session.

Agritech Limited was the volume leader with 19.8 million shares, followed by Azgard Nine with 9.1 million shares, and G3 technologies with 8.7 million shares.

Shares of 322 companies were traded on Thursday, of which 167 registered an increase, 137 recorded a fall, and 18 remained unchanged.

Comments

Comments are closed.