Pakistan Oilfields Limited (PSX: POL) is a key player in the local E&P oil and gas sector and is a subsidiary of the Attock Oil Company Limited (AOC). It is engaged in the exploration, drilling and production of crude oil and gas in the country and produces crude oil, natural gas, and LPG that it markets under its brand name POLGAS as well as its subsidiary, CAPGAS (Private) Limited. POL also produces solvent oil and sulphur and has a vast pipeline network for transporting the crude oil to the Attock Group’s refinery, and its associate company: Attock Refinery Limited (ATRL).

Shareholding pattern

More than half of the company’s shareholding rests with the Attock Oil Company (AOC), which is the group. Attock Oil Company is vertically integrated oil Conglomerate Company. A category-wise breakup of the shareholding is shown in the illustration. Besides Attock Refinery Limited, POL’s other associate companies include National Refinery (NRL), Attock Petroleum Limited (APL), Attock Cement Limited, Attock Gen. Limited, and Attock Information Technology Services.

Past performance

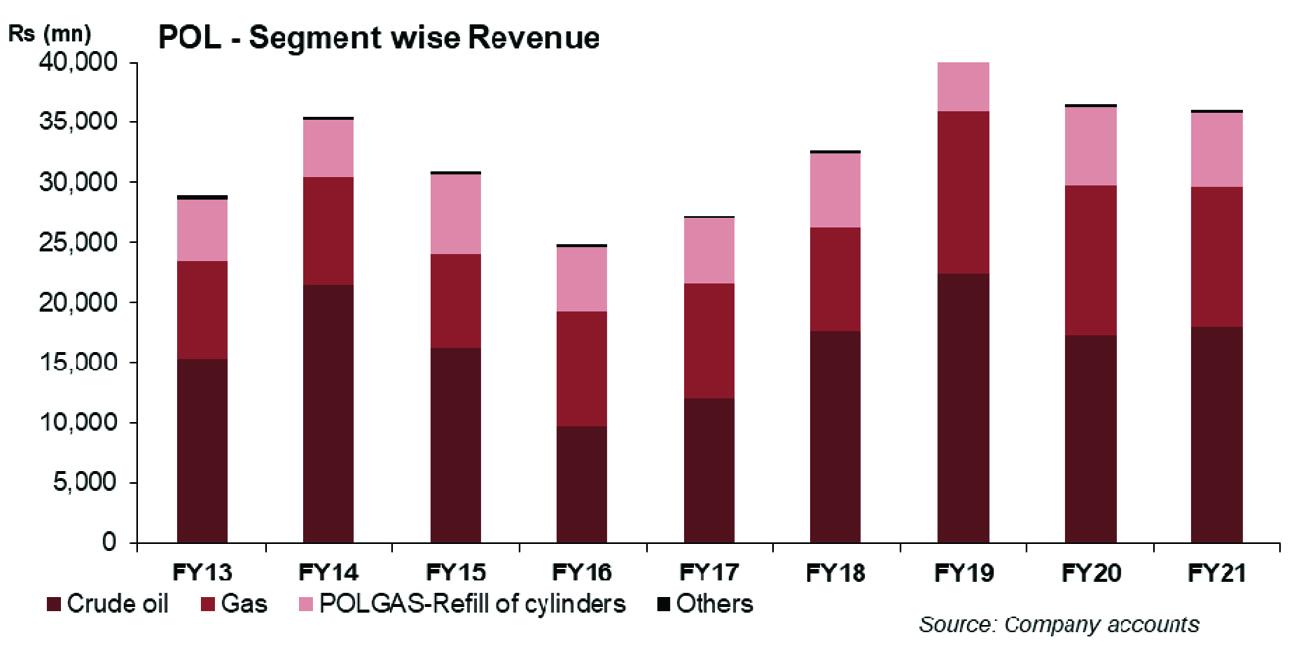

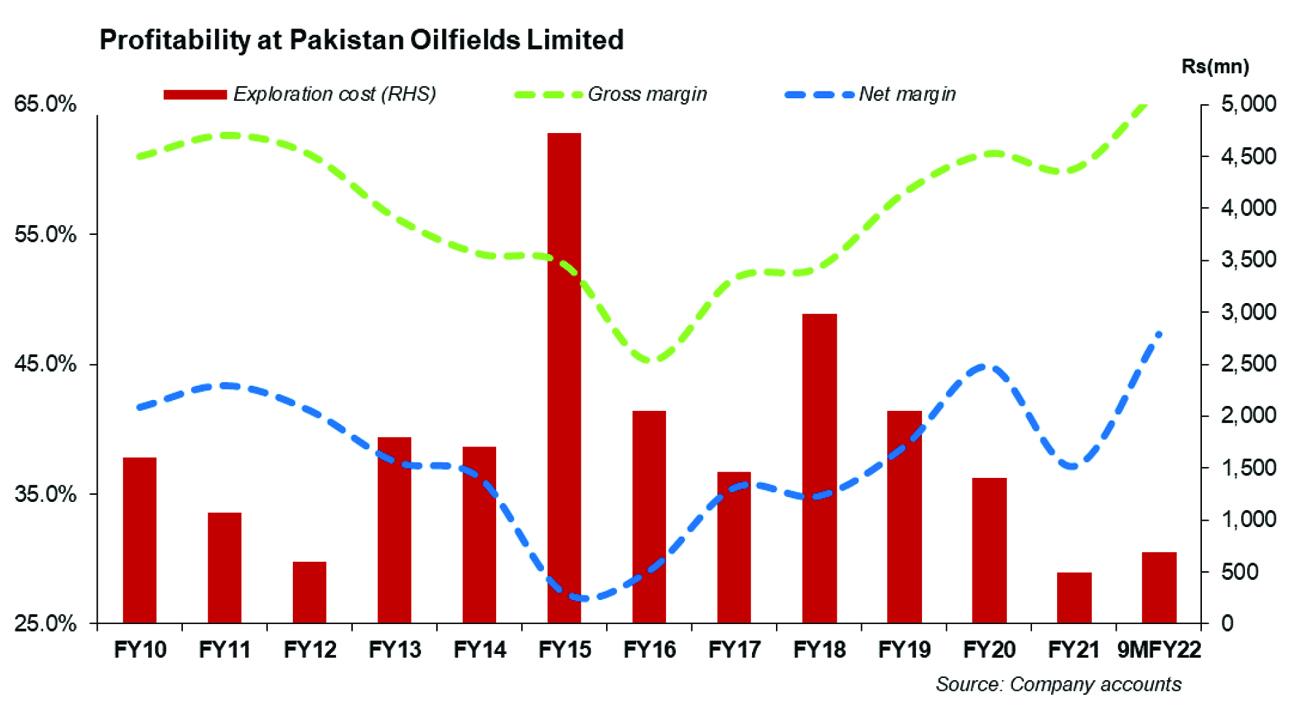

Pakistan Oilfields Limited has mostly been an oil-heavy company. A look at the company’s past six years show that POL’s revenue growth in FY16was constrained as the oil prices touched historic lows at that time, which also impacted the bottomline that fell by 14 percent, year-on-year. The E&P company’s volumetric growth was also affected by slowing down production by around 2-3 percent. However, lower exploration and prospecting expenditure partially offset the decline in profits.

FY17 turned out better as the oil prices recovered. POL’s revenues and earnings were up by 10 percent and 34 percent, year-on-year respectively after declining in the two previous years. However, the company’s production flows again dropped during the year. On the other hand, exploration costs remained under control.

The company registered an improvement inFY18 as POL made new discoveries and new exploratory successes. Three of its development wells were also successful in the fiscal year. Revenues climbed by over 19 percent, and earnings grew by 17.6 percent, year-on-year. Growth in revenues came from better crude oil prices as well as the highest crude oil production in the last decade. Exploration costs remained on the higher side due to higher operational activity, seismic data acquisition, and also dry and abandoned wells. The firm’s bottomline benefitted with exchange gains due to depreciating currency.

FY19 was another year for higher oil prices. And significant domestic currency devaluation also bolstered the earnings for the company. POL’s topline grew by 25 percent, year-on-year, which came from around 14 percent year-on-year increase in international crude oil prices. However, volumetric sales remained tepid especially that of crude oil with only slight increase in gas volumes. POL’s earnings for FY19 jumped by 48 percent, year-on-year; and apart from oil prices, lower exploration and prospecting costs and higher currency depreciation helped lift the company’s bottomline. The main factor behind lower exploration and prospecting was the absence of a dry well and also lower seismic acquisition.

FY20 was marred by COVID-19 and the lockdown, as well as the crash in oil prices which were the key factors for slower growth in earnings of the oil and gas exploration and production sector. POL’s revenues came down by 13 percent, year-on-year, where the 4QFY20 saw a 48 percent decline in sales revenue – a period when the pandemic struck the country. The decline in revenue was due to falling volumetric sales as well as oil prices. During FY20, oil and gas production for POL plummeted by 13 and 9 percent year-on-year, respectively, while the average oil prices tumbled by 25-26 percent year-on-year. Exploration and prospecting expenditure remained lower in FY20 due to the absence of any dry well during the year. With lower interest rates during the year, other income and finance costs also decline for POL. POL’s earnings in FY20 were hence flat.

FY2’s highlight remained slow hydrocarbon production as well as weak international crude oil prices. These factors along with exchange losses affected the sector’s profitability in FY21 including POL. Overall, POL’s revenues in FY21 were flattish, declining by one percent year-on-year. The company’s earnings were lower by around 18 percent year-on-year primarily due to exchange loss, lower income on bank deposits and higher taxation due to lesser exploration and development cost. During the year, production of crude oil and gas were lower by 0.77 percent and 2.5 percent year-on-year, respectively, while LPG production was higher by 1.58 percent year-on-year.

FY22 and beyond

9MFY22 performance for POL has been a mix of currency depreciation and oil prices due to elevated oil and global uncertainty. FY22 saw record high crude oil prices due to Russia-Ukraine tensions as well as supply concerns. POL’s earrings in 9MFY22 were seen climbing by 83 percent year-on-year, which came primarily from the topline due to higher international crude oil prices. Revenues of the company grew by 37 percent year-on-year for 9MFY22 respectively. Oil prices were higher by 72 percent year-on-year in 9MFY22. Besides higher prices, currency depreciation of 11 percent also added to the topline. However weak production statistics during the period for oil and gas continued to curtail in the topline growth.

Higher exploration and prospecting expenditure that increased by four times in 9MFY22 versus 9MFY21 was due to increased seismic activity. Finance costs also jumped. And other income witnessed a big incline due to exchange gains, which resulted in growth in other income of around 39 times year-on-year in 9MFY22.

Comments

Comments are closed.