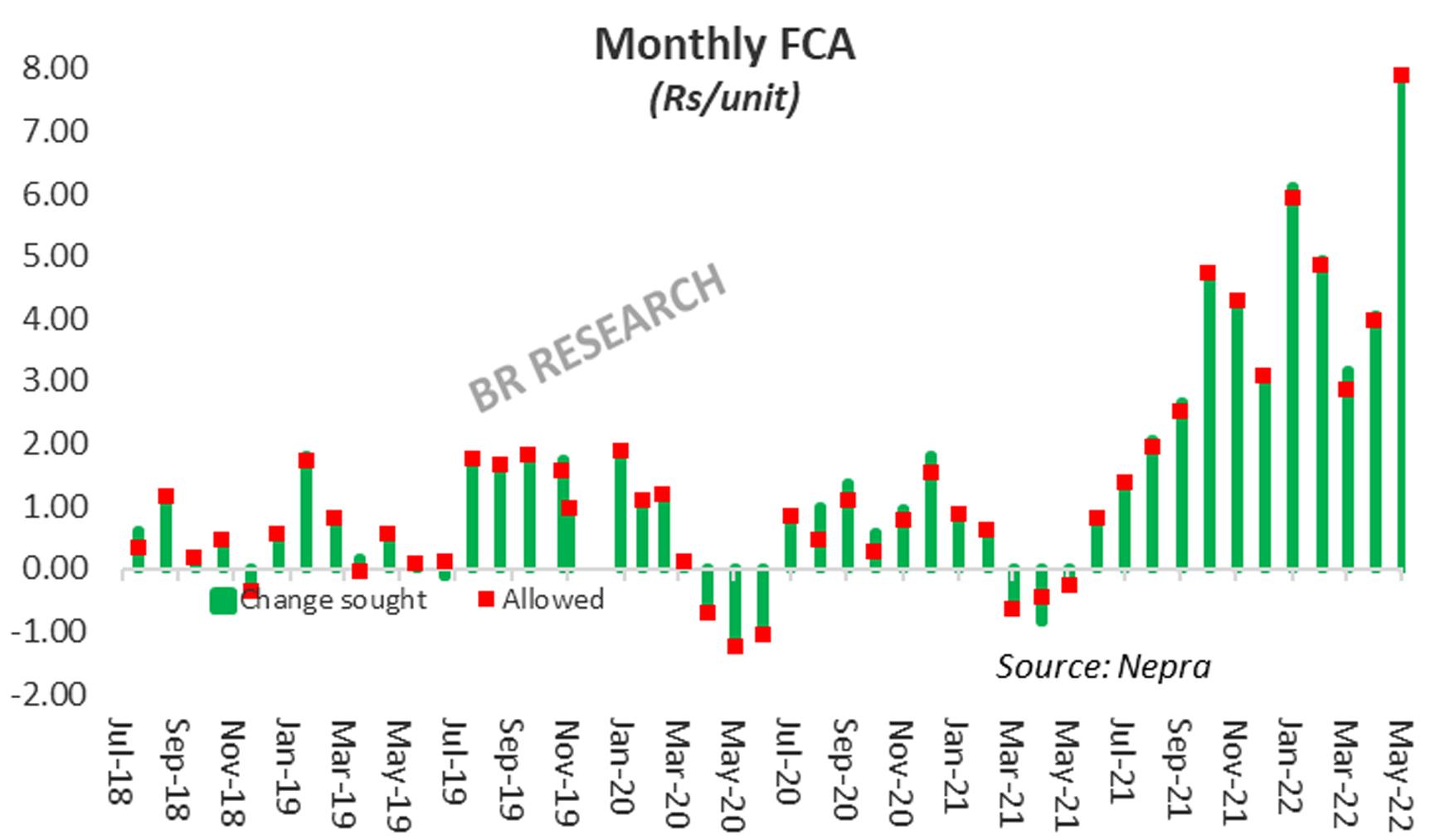

The power regulator approved Fuel Charges Adjustment (FCA) for May 2022 to be collected in July 2022, to the tune of Rs7.9/unit. This is by far the highest ever monthly upwards adjustment, as the fuel bill of a billion dollars for May 2022 warranted the action. The reference fuel tariff stood at Rs5.93/unit, whereas the actual fuel cost came at Rs13.84/unit. That was the highest ever monthly fuel cost and the highest ever adjustment required for any month.

Truth be told, most of the upward adjustment was unavoidable, and the authorities could have done precious little. That said, the situation is a consequence of neglect over the years, continuous disregard of the regulator’s stern warnings to fix the system, disregard for the merit order of dispatch, and in hindsight, an ill-informed policy of overburdening the system’s reliance on imported fuel for power generation.

It did not feel this bad earlier because the commodity prices were largely under control and hovered close to the reference prices. As the rupee started to lose value, coinciding with the commodity super cycle, all hell broke loose. For a country, that had proudly announced doing away with furnace oil-based power generation four years ago, a fuel bill of Rs43 billion on account of furnace oil based power generation had no business in 2022.

The decision to import LNG at all costs was a tricky one. Not having it could have caused prolonged hours of load shedding (that was later witnessed in June and the ongoing month). Generating power on RLNG cost Rs28/unit, and that came at a time when hydel generation was struggling to keep up the pace. Worse still, the upwards adjustment comes at a time when consumers face a significant hike in base tariffs spread over three months starting from July. The relief package is also over, and the quarterly tariff adjustment also starts with effect from July.

Could this have been planned and spread better? Certainly. But pressed by the IMF, there is little choice that the government has. The regulator, in its determination has also pointed out glaring issues that need immediate attention, and most are of structural nature. The part load operation of the RLNG plants continues to cause losses, and an inquiry in the matter has been suggested by Nepra.

Similarly, the abysmal performance of Genco-II caught the attention of the regulator, as Guddu power plant operated at only 41 percent utilization factor. It has been ongoing since more than a year as one of the turbine stays damaged. The negligence has cost a loss in tens of billions of rupees, as the pressure then shifts to costlier power plants. About time the focus shifts from pricing disguised as reforms, to the technical issues that are no less important.

Comments

Comments are closed.