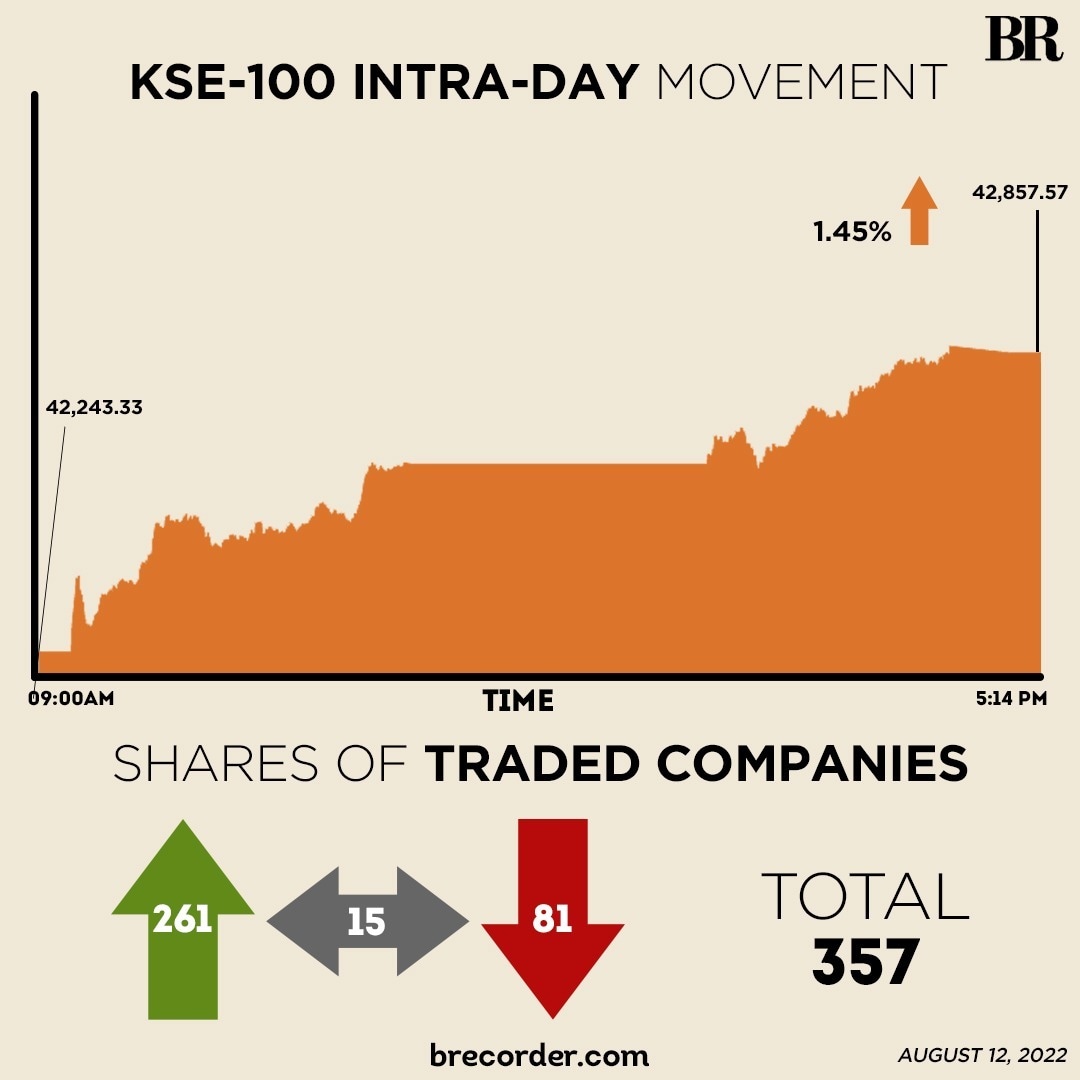

KSE-100 posts 614-point gain, edges close to 42,900

- Registers increase of 1.45% on positive triggers

The Pakistan Stock Exchange (PSX) saw a return of investor confidence amid positive news on the International Monetary Fund (IMF) front and an appreciating rupee, as the KSE-100 Index gained 614 points on the final trading day of the week.

Both volume and value of shares traded improved from the last session.

Trading began on a positive note and the index remained in the green zone throughout the day, as the KSE-100 inched to 42,873.57, up by 630 points.

At close, the KSE-100 index settled at 42,857.57, with a gain of 614.24 points or 1.45%. On a weekly basis, the benchmark index gained 1.81%.

KSE-100 snaps 5-session winning streak, closes 0.59% lower

A report from Capital Stake stated that indices accumulated gains throughout the session. “The rupee’s strong recovery and expected inflows boosted investor confidence,” it said.

Market sentiments were further bolstered after reports that Pakistan has received a Letter of Intent (LoI) from the IMF, moving closer to disbursement of the next tranche for the combined seventh and eighth review.

Meanwhile, the rupee maintained its upward trajectory for the ninth consecutive session against the US dollar and settled at 215.49 in the inter-bank.

On Friday, brokerage houses also said that they expect the State Bank of Pakistan (SBP) to keep the policy rate unchanged at 15% in the upcoming announcement scheduled to be held on August 22.

Sectors dragging the benchmark index higher included banking (148.99 points), oil & gas exploration (114.94 points) and automobile assembler (46.20 points).

Volume on the all-share index increased to 373.85 million from 281.73 million on Thursday. Similarly, the value of shares traded inched up to Rs10.6 billion from Rs7.8 billion recorded in the previous session.

Cnergyico PK was the volume leader with 49.76 million shares, followed by WorldCall Telecom with 28.36 million shares, and Pak Refinery with 27 million shares.

Shares of 357 companies were traded on Friday, of which 261 registered an increase, 81 recorded a fall, and 15 remained unchanged.

Comments

Comments are closed.