Bannu Woollen Mills Limited

Bannu Woollen Mills Limited (PSX: BNWM) was set up in 1960 as a public limited company under the Companies Act, 1913 (now Companies Ordinance, 1984). The company manufactures and sells woollen yarn, cloth and blankets.

Shareholding pattern

As at June 30, 2021, around 34 percent shares are held under the associated companies, undertakings and related parties within which a major shareholder is M/S Bibojee Services (Pvt.) Limited. The local general public owns over 51 percent shares, while the directors, CEO, their spouses and minor children own 5 percent shares. Within this, the CEO, Mrs. Shahnaz Sajjad Ahmed is a major shareholder. The remaining over 9 percent shares is with the rest of the shareholder categories.

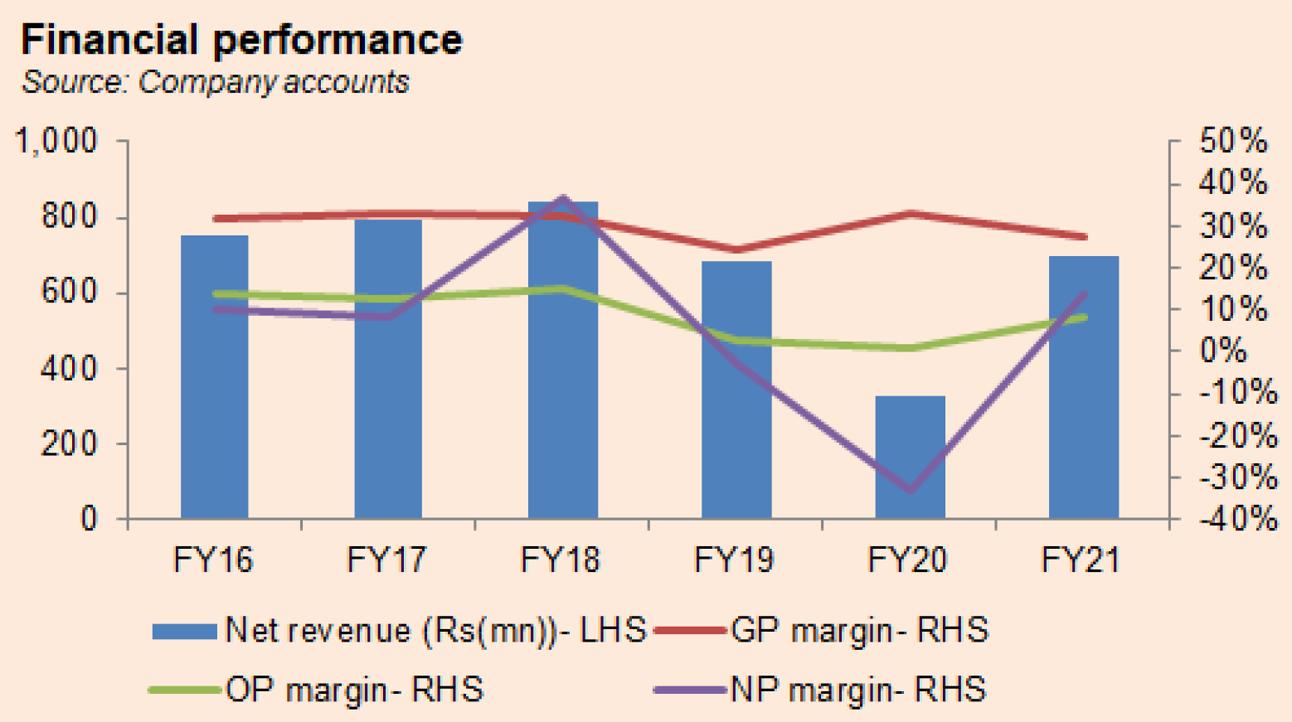

Historical operational performance

More often than not, the company has seen a declining topline. While gross and operating margins have remained stable, net margin peaked in FY18, declined until FY20, before improving again in FY21.

Topline posted a growth of nearly 6 percent in FY18 despite production being lower by nearly 3 percent. The latter was attributed to a 43 percent lower production of blazer cloth. Sales division reveals that revenue from fabrics and blankets increased. Additionally, revenue from fabric lawn purchased for resale grew to Rs 23 million, from Rs 6.4 million in the previous year. But owing to a rise in production cost, albeit marginally, to over 67 percent, up from last year’s almost 67 percent, gross margin declined to 32.5 percent. However, net margin peaked to 36.7 percent due to abnormally high share of profit from associated companies that stood at Rs 339 million for the year. At Rs 308 million, the bottomline was also recorded at an all-time high.

In FY19, revenue recorded the biggest contraction seen thus far at over 18 percent. This was largely due to lower demand in the fabric and blanket segment. Low demand was attributed to shorter winter periods and a reduction in its intensity as well. As a result, inventory of finished goods increased that created higher working capital requirements. Thus, the board of directors reduced two production shifts that would resume later, in the second half of the year. Production workforce was also reduced to curtail expenses. Nonetheless, as a share in revenue, production cost climbed further up to 75.6 percent, thereby reducing gross margin to 24.4 percent. Higher costs were attributed to currency depreciation that increased the burden of expenses of imported raw materials. Coupled with this was the share of profit that fell to Rs 1 million, eventually leading the company to incur a loss for the first time, of Rs 17 million.

Topline fell further in FY20 by almost 52 percent. Sales revenue from fabric and blankets nearly halved year on year, from Rs 782 million in the previous year to Rs 398 million in FY20. Moreover, sales revenue from fabric lawn slumped due to the onset of Covid-19 that resulted in strict lockdowns thereby adversely impacting demand, and disrupting supply chains. In March 2020, one of the production shifts was allowed to resume of the two that were suspended “to fulfill production orders of mills’ dealers”. Despite the loss in revenue, gross margin peaked at 32.8 percent due to production cost making a smaller 67 percent share in revenue. However, net margin fell to an all-time low of 33 percent due to a rise in finance expense that in turn was due to higher interest rates, and a significant loss from associated companies.

Topline more than doubled year on year in FY21. This was attributed to an increase in sales volumes as well as a better sales mix. As lockdowns eased, business activities resumed gradually that also led to a gradual growth in demand. But with a rise in production cost as currency devaluation led to higher input costs, gross margin reduced to 27 percent. However, net margin improved to 13.7 percent as it saw support from a reduction in finance expense as a share in revenue, and profit from associated companies that stood at Rs 79 million for the year, compared to a loss of Rs 66 million in FY20.

Quarterly results and future outlook

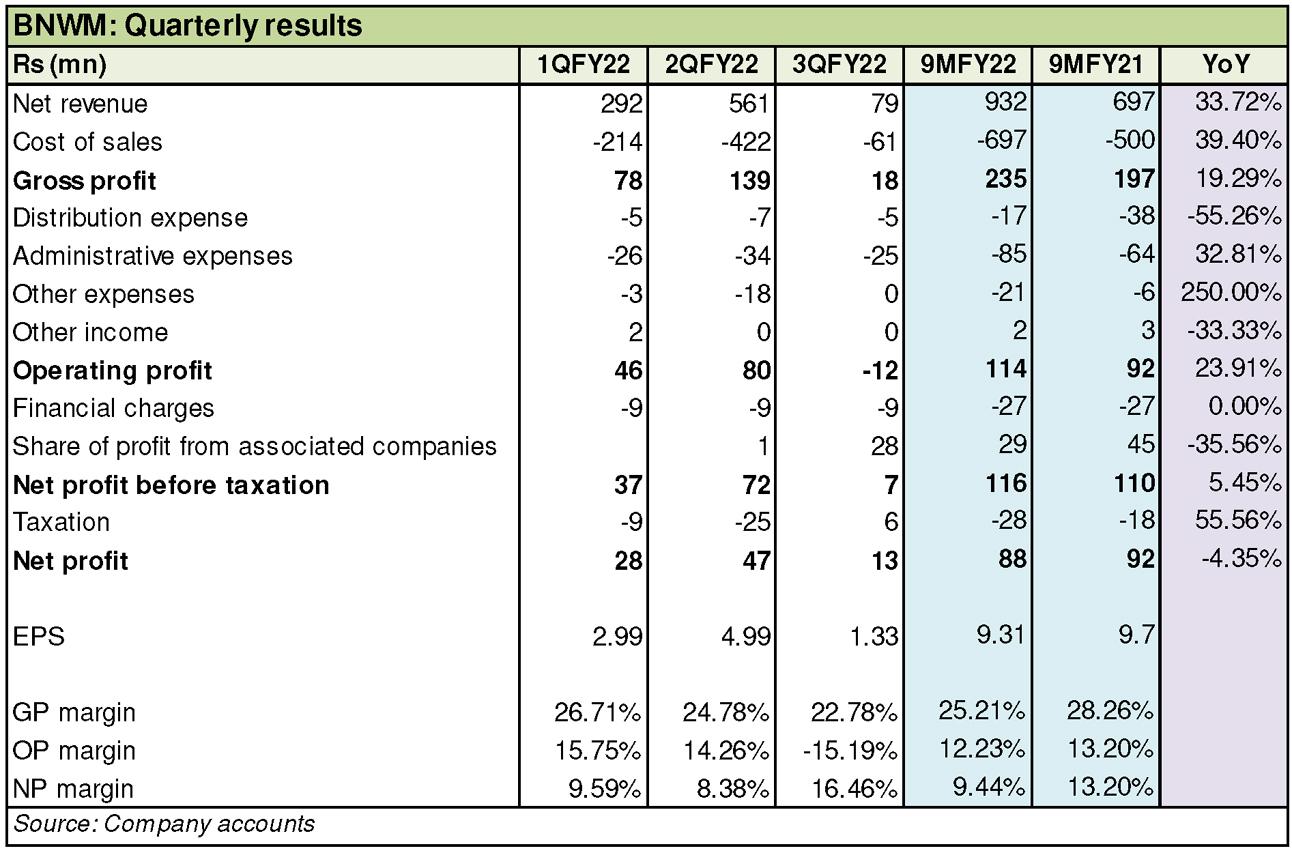

Revenue in the first quarter of FY22 was higher by almost 10 percent year on year due to better volumes. Production for fabric has also been higher by over 89 percent year on year. While production cost was slightly higher in 1QFY22, net margin was better at 9.6 percent due to some support from other income. The second quarter saw topline higher by 51 percent year on year, again on the back of higher volumes. But production cost continued to consume a larger share in revenue affecting profitability. However, net margin was significantly lower at 8.4 percent largely due to negligible support from share of profit relative to that seen in 2QFY21.

In the third quarter, topline was 36 percent higher year on year due to better sales volumes. Production was also higher year on year. While production cost again consumed a higher share in revenue, net margin was better in 3QFY22 at 16.4 percent due to share of profit recorded at Rs 27.7 billion compared to complete absence of the same in 3QFY21. While there has been some improvement in topline, costs have been impacted by a global surge in commodity prices, rising inflation, currency depreciation, coupled with political uncertainty on the domestic front, as well as due to the Ukraine-Russia war. These factors have adversely impacted the growth outlook for majority countries.

Comments

Comments are closed.