Century Paper and Board Mills Limited

Century Paper and Board Mills Limited (PSX: CEPB) was set up as a public limited company in 1984under the repealed Companies Ordinance, 1984. The company is part of the Lakson Group of Companies. It began commercial production in 1990. It manufactures and markets paper, board and related products.

Shareholding pattern

As at June 30, 2022, close to 69 percent shares are held under the associated companies, undertakings and related parties. Within this category, SIZA (Private) Limited and SIZA Services (Private) Limited are major shareholders. The general public owns over 13 percent shares followed by over 4 percent held in modarabas and mutual funds and “others”. The remaining roughly 9 percent shares are with the rest of the shareholder categories.

Historical operational performance

The company has mostly seen a growing topline with the exception of a 10 percent contraction seen in FY15. Profit margins in the last six years grew between FY17 and FY21, before declining in FY22.

In FY18, revenue registered a growth of over 23 percent to reach close to Rs 19 billion in value terms. This was largely driven by prices, as volumes grew by 5 percent. Since a portion of higher costs was passed on to the consumer, gross margin grew to 13.2 percent, from last year’s 11.6 percent. With an overall decline in operating and finance expenses as a share in revenue, net margin also inclined to 5.2 percent for the year. In value terms, bottomline at Rs 991 million was the highest seen thus far.

Topline continued to grow in FY19 by 17.3 percent to reach Rs 22.2 billion in value terms. However, sales volumes were higher only marginally by 1 percent at 216,771 metric tons. But the rise in input prices, fuel prices and currency depreciation led to production cost consuming 88 percent of revenue. Thus, gross margin fell to nearly 12 percent. This also reflected in the net margin that also reduced to nearly 4 percent as increased to consume 3.4 percent of revenue. This was due to a tightening monetary policy that increased interest rates, combined with long term financing obtained to conduct capital expenditure.

Although revenue continued to grow in FY20, the rate slowed down to single-digits at 9.5 percent to cross Rs 24 billion in value terms. While the economy saw some stabilization in the first half of the year, the second half was adversely impacted by the Covid-19 pandemic that led to strict lockdowns. As a result, production and business activities for majority sectors came to a halt. But with production cost down to 83.8 percent, gross margin improved to 16 percent for the period. While this reflected in the operating margin, the increase in net margin was curtailed, as it was recorded at 6.25 percent due to an escalation in finance expense. With interest rates remaining high for a large part of the year, finance expense increased to consume 4 percent of revenue. In value terms, bottomline reached a high of Rs 1.5 billion.

Revenue growth recovered in FY21 as it was posted at 17.7 percent to reach close to Rs 29 billion for the year.This was attributed to a surge in online shopping during Covid-19 pandemic that increased the demand for packaging board and corrugated boxes. This is evident by the 8 percent growth witnessed in sales volumes. With cost of production down to 80 percent of revenue, gross margin reached a peak at almost 20 percent for the year. There was also significant contribution by other income that stood at Rs 182 million for the year that raised the bottomline to an all-time high of almost Rs 3 billion. Net margin was also recorded at its highest of over 10 percent. Moreover, with declining interest rates, finance expense also shrunk to consume 1.4 percent of revenue, compared to 4 percent in the previous year.

Recent results and future outlook

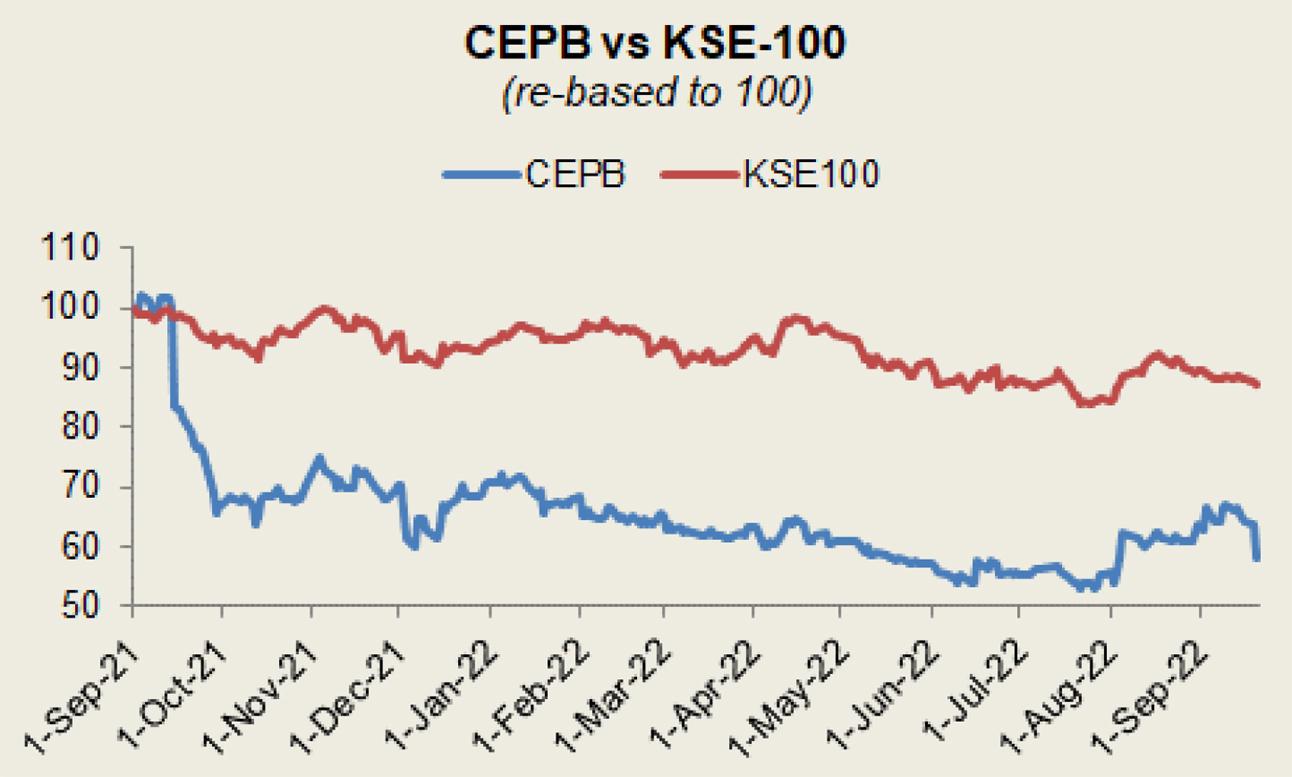

Revenue growth in FY22 stood at an all-time high of 36 percent to reach yet another high of Rs 39 billion in value terms. Production as well as sales volumes grew. The latter depicted a rise of 4.4 percent. However, this did not translate into higher profitability as global factors such as rising commodity prices and Ukraine-Russia war led to supply shocks whereby availability of raw materials became a challenge, in addition to rising costs. Thus, production cost for the company escalated to over 87 percent that reduced gross margin to 12.75 percent. This also trickled to the net margin that was also recorded at a lower 5.7 percent for the year.The company has undertaken several BMR projects that would enhance future production capacity, the benefit of which is expected to materialize in the upcoming quarters. Moreover, there is expectation of sustained demand despite adverse economic challenges, however, rising input costs will continue to be a deterrent to profitability.

Comments

Comments are closed.