A key driver for foreign direct investment is economic growth which cannot come when the political instability is skyrocketing. Such are the times in Pakistan where economic growth has nosedived amid staggeringly high political instability and volatility. And this has debilitated the already miniscule foreign investment that the country was attracting.

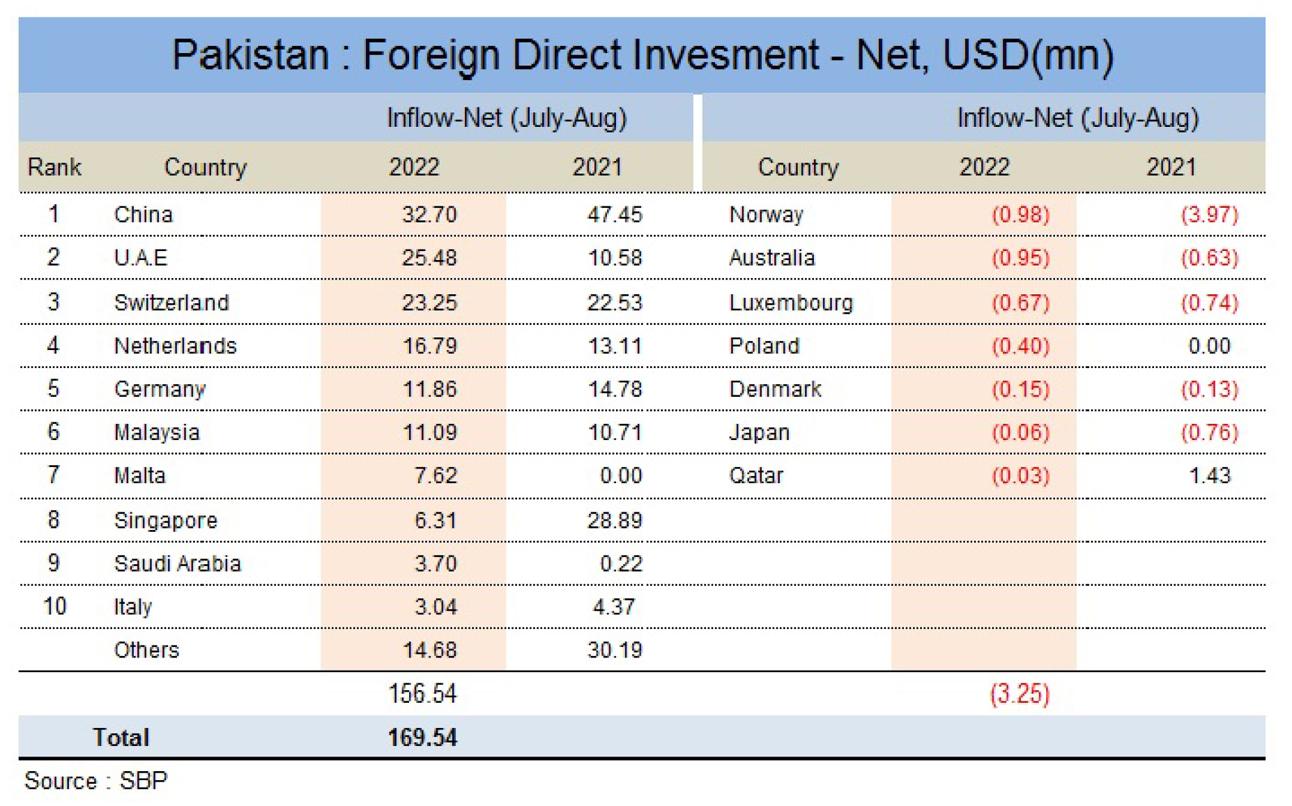

Foreign direct investment in the country has slipped by over 26 percent in the first two months of FY23 as per the central bank’s recent announcement. Pakistan attracted net FDI of $169.5 million in 2MFY23 versus $229.5 million – a decline of around $60 million. While some are celebrating the month-on-month growth in Aug-22 net FDI – which was around 88 percent - net FDI fell by 12 percent year-on-year during Aug-22 alone, amounting to $110.7 million. While a month-on-month growth holds little significance as July was a tepid month overall, some growth in the coming month could be witnessed on monthly basis due to the agreement with the IMF. However, with the overall political instability at its peak with no relief around the corner, the FDI is likely to remain small and dreary

Sector-wise, the power sector, financial business and communication sector were the key sectors that attracted FDI in 2FY23. Country-wise trends show that China continue to remain the largest foreign investor but the Chinese investment was seen slipping sharply by over 30 percent during 2MFY23. As Chinese investment has come down over the last year or so due to a myriad of reasons like CPEC early project completion, and CPEC phase 2 slowdown, UAE has been seen closing the gap with the share of FDI from China (China’s share in FDI stood at 19 percent, while UAE’s share was 15 percent in 2MFY23) . FDI from UAE climbed by over 140 percent in 2MFY22.

Despite the growth in country representation, FDI in Pakistan is peanuts, wand will continue to fall further if the instability and volatility remains a key feature of the economy.

Comments

Comments are closed.