Siemens – of higher new and backlogged orders

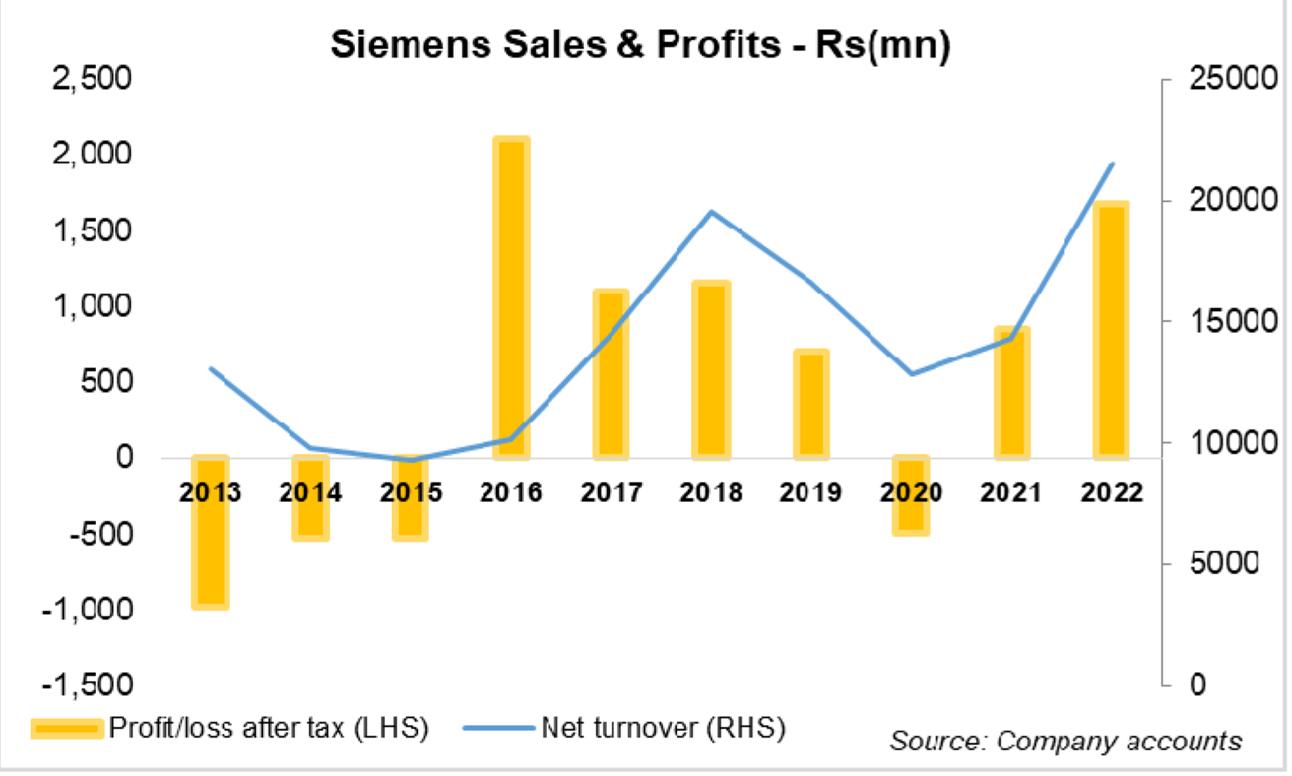

Siemens Pakistan Engineering Company Limited (PSX: SIEM) announced its financial performance for FY22 ending on September 30, 2022 with a whopping jump in profits. The company’s earnings for the year were up by almost double. It operates in gas & power (G&P), smart infrastructure (SI), and digital industries (DI) divisions.

SIEM’s sales revenues increased by 50 percent year-on-year, and the company’s gross profits were seen rising twice during 2022.This rise in gross profits continued to reflect in operating profits and net profits despite higher raw material cost, higher logistic costs, significant increase in marketing expenditure as well as other operating expenses, colossal growth in allowance for expected credit loss, and a decline in other income along with missing gain on the disposal of assets in 2022 unlike 2021. The growth in the company’s earnings stemmed not only from the backlog of orders from 2020 particularly during the pandemic, but also significant growth in new orders. A significant portion of the company’s growth in new orders came from new contract with K electric in the transmission business to build KANUPP-K Electric Interconnection Grid Station

In the last fiscal year (2021), SIEM posted recovery in the post COVID times led by energy business. Total new orders too doubled versus corresponding year. However, despite the revival and recovery cycle and continued rise in the orders for Siemens Pakistan in the last two years, the political and economic volatility and uncertainties overshadows the progress. The company in its Director’s reports for 9M-2022 report highlighted that the new regulatory requirements to seek SBP approval for each import transaction presents a significant challenge for the company, which has affected the approval process for projects and orders.

Comments

Comments are closed.