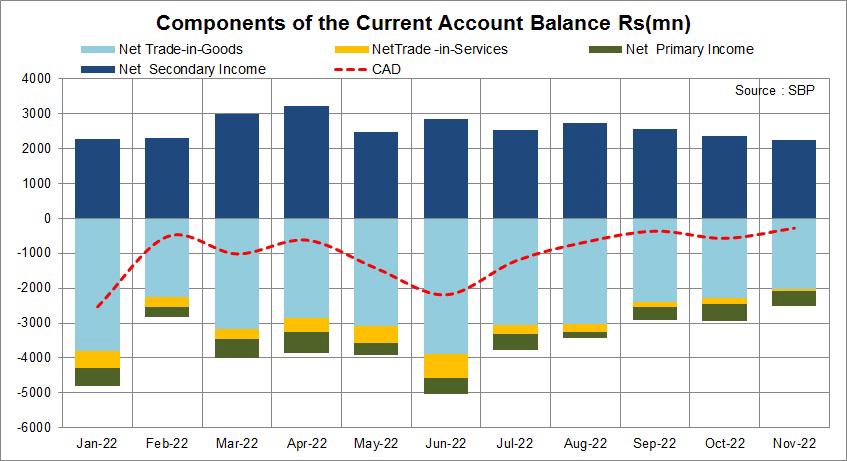

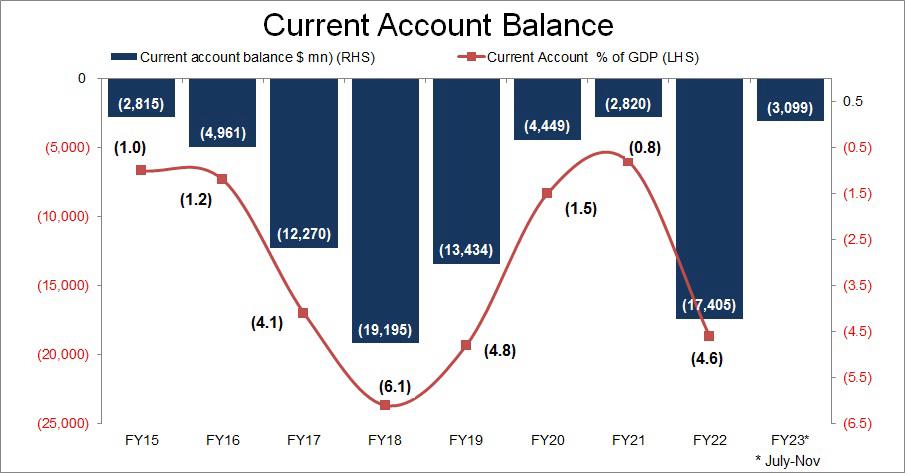

The current account is one element that is coming under control. The deficit is down to $276 million in Nov-22 – that is the lowest deficit since April-21. In Jul-Nov 22, the deficit is reduced to less than half (at $3.1bn) from the same period last year. The full-year deficit is to be contained at $6-7 billion from $17.4 billion last year. However, the decline is not coming down without the cost of massive job loss and creating solvency risk in the domestic private sector.

The story is simple. The SBP and MoF started controlling imports before the impact of increase in interest rates and inflation (due to currency depreciation and other supply-side factors) began curtailing the demand. Now it appears that the demand is curtailed significantly. However, due to SBP reserves falling below $7 billion, the control on imports has graduated onto the next level.

Lately, banks have been reluctant to honor contract-based imports. Here the relation between buyer and seller is strong enough to have imports without LC. Banks are not liable for these payments. Then the LCs’ opening restriction is going to the next level. Bank treasurers are not happy with opening LCs of $50 million or so of petroleum products, as they fear they might not have dollar liquidity at the time of confirmation. If the situation continues like this (without fresh inflows), the banks may stop (or reduce) opening LCs of oil and gas in the next few weeks and that may translate into shortage of fuel in 2-4 months.

The other problem is that many businesses are temporarily shutting down – and those who are operating are at reduced capacity. At this point, these businesses are slashing costs by lying off people. If the situation continues like this, the businesses may find it hard to repay back banks and for those who would be operating find it hard to get working capital. A severe liquidity crunch in the domestic private sector is in the making, and that is unhealthy for banks as well.

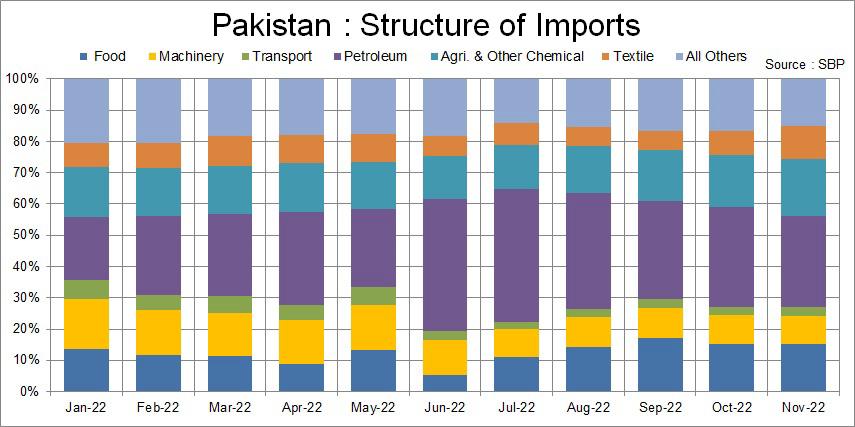

Let’s hope that external funding gaps are being bridged, and things get better from this. But for that to happen it is imperative for the IMF programme to be back on track. Anyhow, the current account control is being achieved. The imports are down by 16 percent in 5MFY22. The imports (based on SBP payment data) are down to $4.2 billion – lowest since Nov-20. But the trend may not continue in Dec, as imports based on the custom data (PBS) stood at $5.1 billion. This implies that the payment of these imports in the next 1-2 months will be reflected in SBP’s statistics. That is a worry.

The petroleum imports (PBS) are moving up. They stood at $1.6 billion in Nov – up by 38 percent from the previous month. The petroleum imports (mainly diesel) remained low in Sep and Oct, as higher inventories were built up at peaking prices. And now these are being replaced to pick the pace again in Nov. The local refineries are reducing the production due to lower demand of furnace oil (a by-product of Pakistan’s age-old refineries) due to falling power demand. And without exporting excess FO, refineries have reduced production of other products which is increasing the reliance of imports on diesel instead of crude. The premium on diesel, meanwhile, is higher which is resulting in an unnecessary drain on foreign exchange.

The story of many other imports is simple. SBP is curtailing machinery and many other imports. And even at these lower volumes, SBP is meagerly allowing payments. For example mobile phone imports stood at $291 million in 5MFY22 on PBS data (actual basis) while the number stood at a mere$87 million on SBP payment-based data. Mind you, the actual imports are about one fourth of what they were same period last year; yet the payment is a small fraction of it. This implies either the payments are stuck in the pipeline or phone importers are using alternate informal channel to import. There are many other incidences of growing informal imports. Textile and other big players are finding it hard to import spare parts and small inputs directly due to restrictions. However, the import agents can provide them at doorsteps, as they are paying informally. These are netted by remittances by using hundi hawala channels, and that is depicting a decline in remittances -down by 10 percent in Jul-Nov to $12.0 billion. It is down by 14 percent in Nov to $2.1 billion and the banking channel checks confirm that there is a further decline in first two weeks of December.

The story of exports is not great. Exports are down by 2 percent in 5MFY22 to $12.1 billion. Textile exports are low due to reduced orders and delays in arranging raw materials, spare parts, and other imports. The control has an indirect impact on the exports too as is the case with remittances. Then the growing gap between the interbank and open market exchange rate resulted in exporters delaying the inflows and remitters moving to informal channels. That is pushing SBP to have further controls over imports to maintain a low current account deficit. It’s a tough situation and not much can be done apart from rationalizing the exchange rate and arranging the external account financing gap.

Comments

Comments are closed.