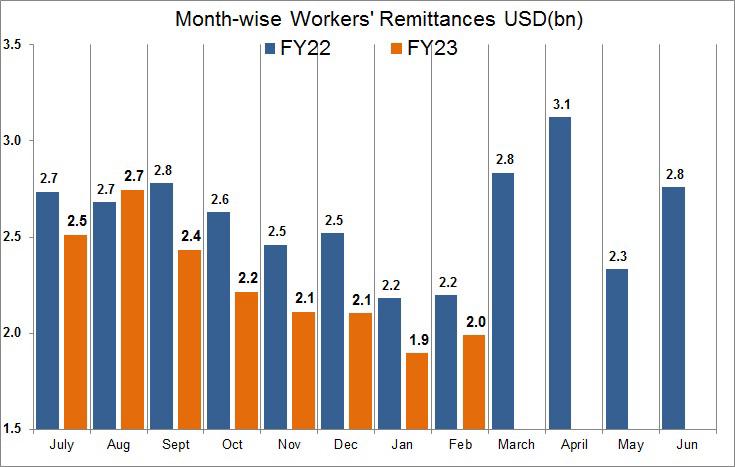

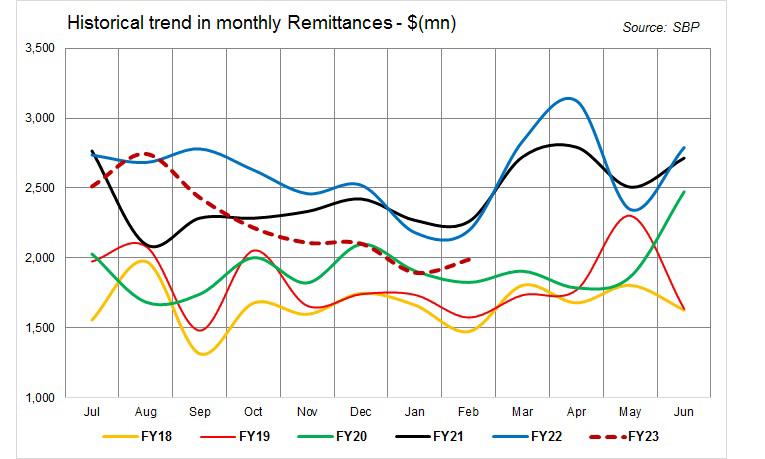

While remittances for February 2023 were seen rising on a month-month basis to $2 billion in the recently announced data by the central bank, the trend of falling remittances continues on a year-on-year basis. Remittances in Feb-23 were up by 5 percent month-on-month, but down by 9.5 percent year-on-year.

The rise came after remittances in Jan-23 slipped to a 32 month low; remittances in Jan-23 were recorded at $1.89 million. Despite the improvement in February month-on-month inflows, remittances remained comparatively lower. During the first eight months of the fiscal year (8MFY23), remittances fell by 11 percent year-on-year.

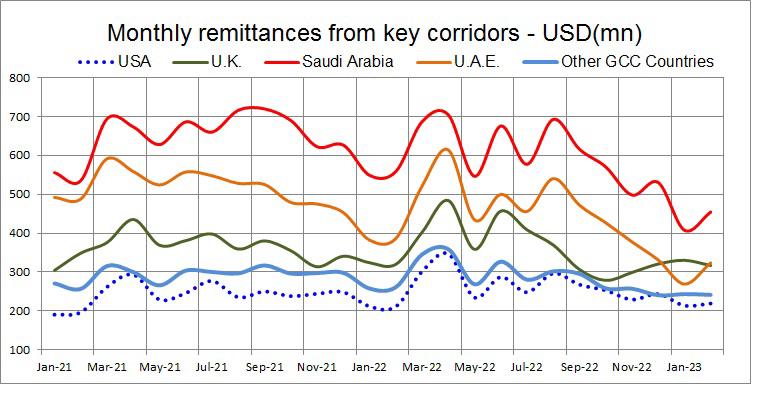

The month-on-month increase in remittances are said to have come from the uncapping of the currency exchange rate to market price recently from Rs230. Also, the upcoming month of Ramzan spurred some inflows. This can be seen in the month-on-month uptick in flows from Saudi Arabia and UAE.

The drop in remittances over the last six to seven months has been mainly caused by currency fluctuations. The artificially cheap dollar price in the interbank market drove many to the unregulated black market, as did overseas Pakistanis transferring money home. As the use of hawala and hundi continued to provide better rates to senders, the large gap in interbank, open market, and illegal market rates for the dollar became a key reason behind declining remittances through legal channels.

The recent uncapping of the exchange rate has given some boost to the remittances; and the coming month of Ramzan and Eid-ul-Fitr will likely keep inflows buoyed above $2 billion for March 2023.

Comments

Comments are closed.