Ghani Glass Limited (PSX: GHGL) was incorporated in Pakistan as a limited liability company in 1992. GHGL is a company of Ghani Group which carries over 50 years of rich experience in the local and global markets. The company’s principal business is the manufacturing and sale of glass containers, float glass and value-added glass. GHGL caters to the needs of diverse industries such as pharmaceutical, food and beverages, R&D and other value-added industries. Besides catering to the needs of local market, GHGL exports to over 26 countries globally.

Pattern of Shareholding

As of June 30, 2022, the company has a total of 839.39 million shares outstanding which are held by 3764 shareholders. Directors, CEO, their spouse and minor children have the highest stake of 52.72 percent in the company. This is followed by local general public holding 36.78 percent shares of GHGL. Joint stock companies account for 2.44 percent of GHGL’s outstanding shares. The remaining shares are held by other categories of shareholders, each having an ownership of less than 1 percent shares.

Historical Performance (2018-22)

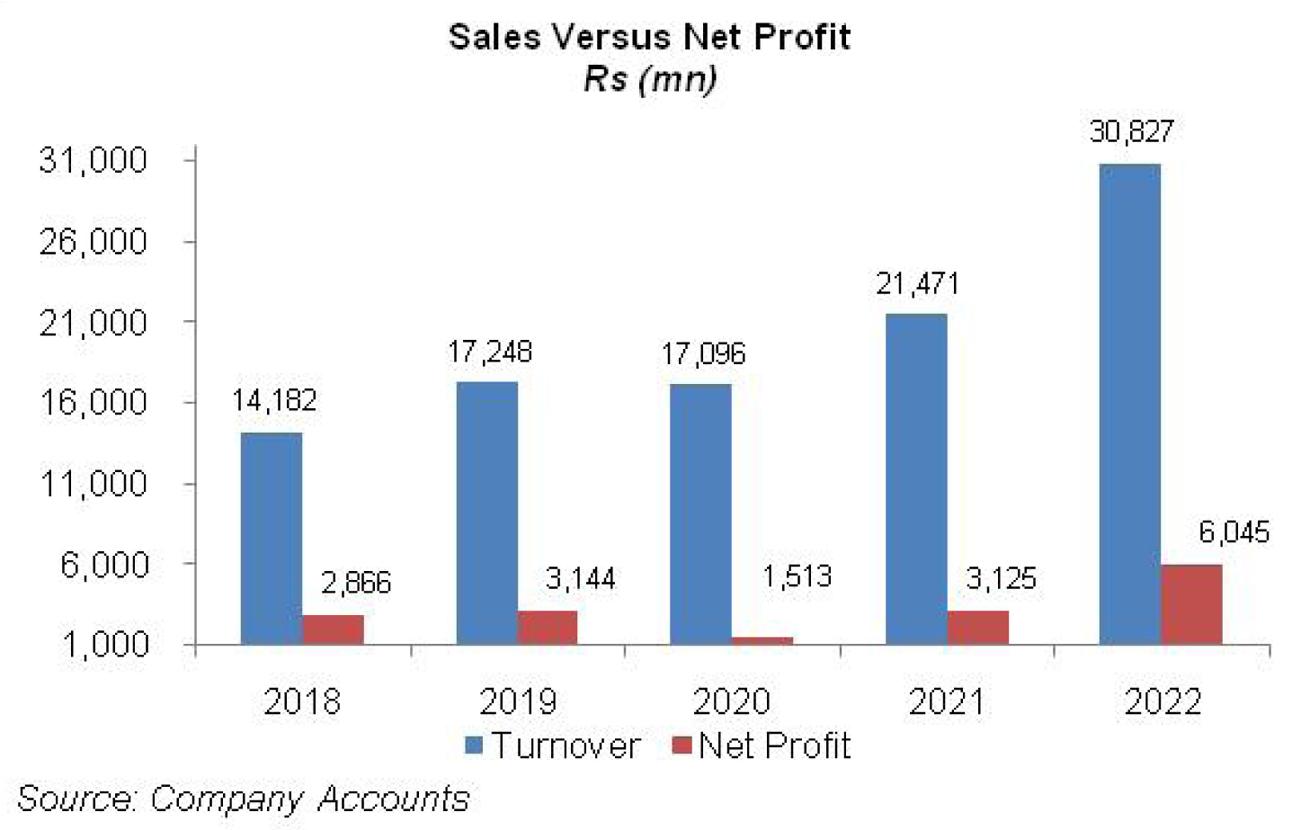

Except for a marginal dip in 2020, the topline of GHGL have been riding an upward trajectory in all the years under consideration. The bottomline also plunged only in 2020. Margins which started contracting since 2019 reached their lowest ebb in 2020 and recovered thereafter. While the GP margin reached its five-year high of 29 percent in 2022, the same couldn’t be trickle down to the NP margin due to exorbitant rise in operating expenses. A sneak into the financial statements will provide the striking details of the company’s financial journey over the years.

In 2019, GHGL attained a 22 percent year-on-year growth in its revenues. However, high cost of production particularly raw materials consumed as well as fuel, gas and electricity took its toll on the GP margin which shrank to 25 percent in 2019 from 28 percent in the previous year. Operating expenses also grew in line with inflation while other income contracted by 27 percent year-on-year due to high-base effect as there was a surplus on the sale of fixed assets in the previous year which had magnified the other income account. One striking fact about the company is that it is operating on a 0:100 debt-to-equity ratio. The company receives advances from its associated undertakings for the supply of goods and interest-free loans from the sponsor directors to meet the working capital requirements. Hence, finance cost of the company is very thin i.e. Rs.12.5 million in 2019 which mainly comprises of bank charges. During the year, the share of profit of an associate company grew by a tremendous 117 percent year-on-year, buttressing the bottomline which grew by 10 percent year-on-year; however, NP margin nosedived to 18 percent in 2019 versus 20 percent in the previous year.

2020 was characterized by stunted economic activity – both locally and globally - on the back of COVID-19. GHGL was also obliged to shut down its operations to comply with the lockdown requirements by the government. Not only did the local market of GHGL showed lackluster demand, exports were also disrupted due to restrictions on the movement of goods and people in many export markets of the company. This resulted in inventory buildup and higher fixed cost during the year. The sales of the company posted a meager 1 percent year-on-year dip in 2020; however, high cost of sales squeezed the gross profit by 40 percent year-on-year with GP margin sliding to 15 percent. While the company kept a strict eye on its operating expenses, provision on receivables from trade debts grew significantly from Rs.3.97 million in 2019 to Rs.113.75 million in 2020 due to static business activities on its customers’ front. Other income also thinned down by 40 percent year-on-year on the back of low exchange gain as export sales remained lackluster during the year. OP margin for the year clocked in at 8.5 percent as against 18 percent in 2019. Finance cost grew during 2020 on account of unwinding of liability against the right of use asset. The much needed support to the bottomline was provided by share of profit of associate which grew by 79 percent year-on-year in 2020. Yet the bottomline couldn’t help but plunge by 52 percent year-on-year with NP margin standing at 8.9 percent.

In the subsequent years post COVID-19, the company regained its lost growth momentum. The topline magnified by 26 percent and 44 percent year-on-year in 2021 and 2022 respectively with GP margin touching 22 percent and 29 percent respectively in 2021 and 2022. It is to be noted that the operating expenses which slid down in 2020 have started popping up in 2021 and 2022 particularly freight and forwarding charges and sales promotion expense, among others. Other expenses also grew on account of WWF and WPFF on the back of high profits. The company, however, made net exchange losses during the years. Other income did exceptionally well in both 2021 and 2022 mainly on the back of profit on Islamic saving accounts and scrap sales. While the company booked reversal for credit loss against trade debts in 2021, it again booked provision worth Rs. 96.53 million in 2022 which mainly accounts for expected credit loss charged on balance due from Ghani value glass limited, a related party of GHGL. The share of profit from its associate company RAK Ghani also dropped in both the years. Finance cost of GHGL amplified in 2021 by over 300 percent year-on-year and then dropped by 13 percent year-on-year in 2022. The increase in finance cost is due to unwinding effect of GIDC payable to SNGPL. The bottomline of GHCL grew by a stunning 107 percent and 93 percent year-on-year to clock in at Rs.3.2 billion and Rs.6.04 billion respectively in 2021 and 2022. The annexed graphical representation will give a further clarification of the trajectory of Net profit and EPS in absolute terms in all the years under consideration.

Recent Performance (1HFY23)

The topline of GHGL grew enormously by 39 percent year-on-year in 1HFY23 to clock in at Rs. 19.37 billion. The growth came on the back of increase in both local and export sales with local float glass category bagging the highest revenue for the company. High cost of production on account of rising raw material cost due to Pak Rupee devaluation coupled with high fuel and power charges squeezed the GP margin of the company by 200 bps to clock in at 28 percent in 1HFY23 despite a 29 percent year-on-year growth in gross profit.

Selling and distribution expenses continued to magnify which might be on the back of freight and forwarding charges as export sales grew during 1HFY23. Other income also marginally grew during 1HFY23 while other expenses slid. While operating profit grew by 26 percent year-on-year, OP margin plunged to 19 percent in 1HFY23 versus 21 percent during the same period last year. A major support to the bottomline came on the heels of share of profit of associate which grew by over 17 times to clock in at Rs. 206.78 million during 1HFY23. The net profit for the period grew by 34 percent year-on-year to clock in at Rs. 3.77 billion with NP margin at 19.5 percent in 1HFY23 versus 20.3 percent during the same period last year. The EPS of GHGL grew to Rs. 4.5 in 1HFY23 from Rs. 3.34 in 1HFY22, signifying a year-on-year jump of 35 percent.

Future Outlook

GHGL’s diversification into tableware project has been initiated which is receiving traction. This will fuel the sales growth in the coming times. While high cost of production and operating expenses will continue to suppress the margins of the company, there are other avenues which could counteract the same to buttress the bottomline. Firstly, the company needs to be more focused on expanding its export portfolio. This will provide tremendous exchange gain to the company amidst sharp devaluation of Pak Rupee and will also offset the exchange loss the company is making. Secondly, the company must park its excess liquidity in saving accounts to boost its “other income” as upward revision in discount rate has made this avenue very lucrative. Investment in associate companies to increase its share of profit from associates is another opportunity area for the company. Let’s see how the company turns the tables in its favor amidst rising economic headwinds.

Comments

Comments are closed.