Investor optimism lifts KSE-100 by nearly 1%

- After days of depressed trading, benchmark index sees a bull run

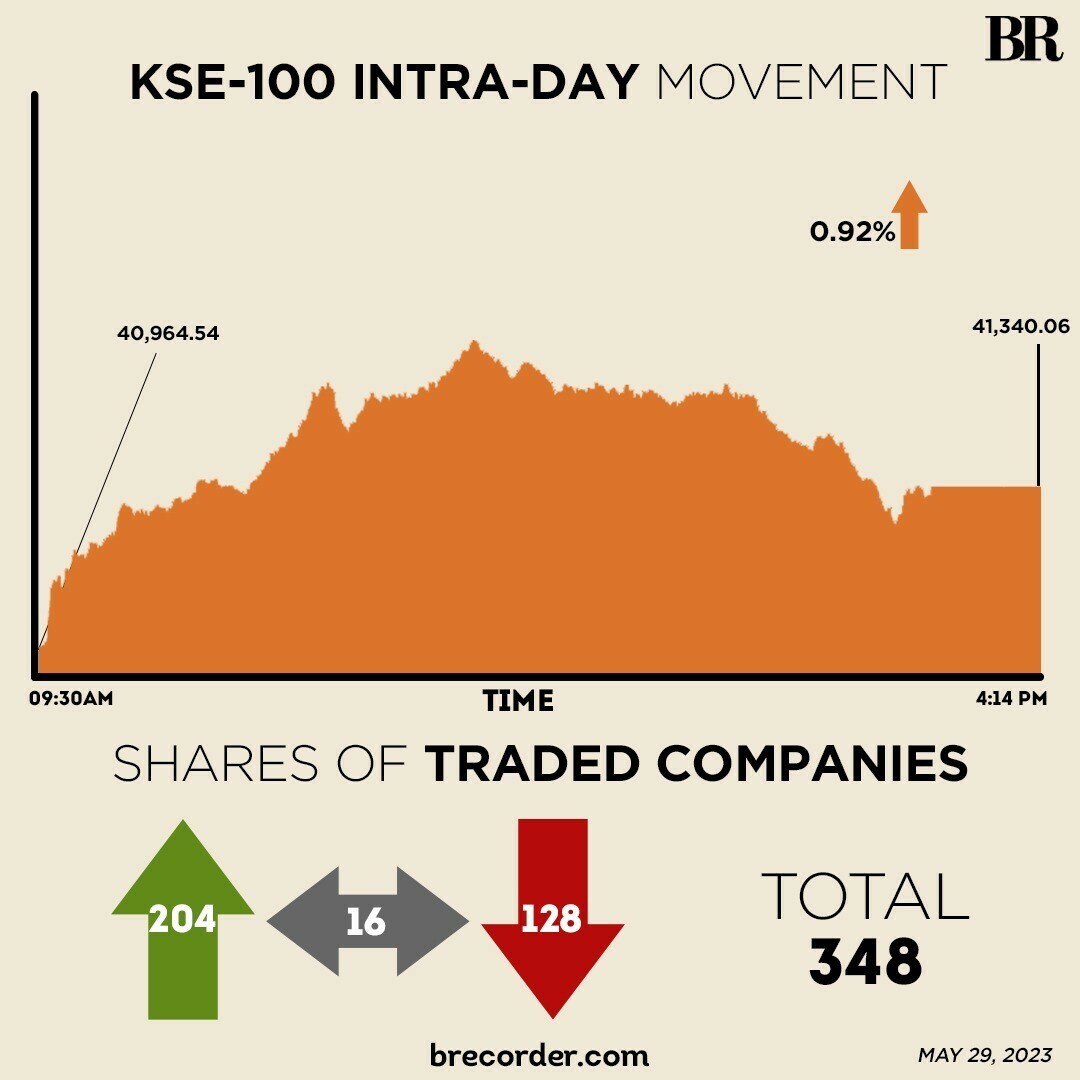

The Pakistan Stock Exchange (PSX) witnessed a bullish trading session on Monday and the benchmark index KSE-100 gained 0.92% after a handful of rangebound sessions last week.

Investors’ sentiment turned positive over budget proposals being put forward by the government and they made fresh buying.

The KSE-100 index closed the trading session at 41,340.06 level, an increase of 375.52 points or 0.92%.

KSE-100 loses 0.16% in range-bound session

Trading began with a jump and the market rose past 41,500 points in intra-day trading. Few of the gains were shaved off towards the end of the session.

Across-the-board buying was witnessed with index-heavy sectors including automobile, cement, chemical, oil and gas exploration companies and OMCs trading in the positive.

Market experts attributed the positive trend to news pertaining to inflows from multilateral and bilateral lenders.

“Reports of funds from Saudi Arabia, and disbursement of funds from World Bank pertaining to floods has given a breather,” Saad Khan, Head of Research at IGI Securities, told Business Recorder.

“Market is also reacting to government proposal of imposing taxes on companies’ reserves in the upcoming budget. Investors are now eyeing to see heavy dividends and bonuses,” he added.

“Market rising in expectations of investor-friendly budget and especially measures related to tax on reserves that may force listed firms to pay more to shareholders,” Mohammed Sohail, CEO Topline Securities, wrote in a note.

In a key development, Finance Minister Ishaq Dar said on Sunday the country will share its upcoming budget details with the International Monetary Fund (IMF) in order to unlock stalled funds. “They have asked us for some more details like the details of (the) budget, we will give that to them,” Dar said in an interview with private TV channel.

The IMF’s $1.1 billion funding to Pakistan, which is part of the rescue package agreed in 2019, has been held up since November.

Lately, speculation over Pakistan’s IMF programme has increased given the Extended Fund Facility is due to end in June.

A report from Arif Habib Limited stated that bulls triumphed at the PSX to begin the week.

“The market opened in the green and continued to trade with fervent sentiments as rumours of a possible tax on corporate reserves account made highlights in the market, as the investors opted to add value to their portfolios making the bourse reach an intraday high of 684.59 and eventually close in the green,” it said. “Throughout the trading day, investors were active across the board as robust volumes were recorded, with third-tier equities dominating the volume board.”

A report from Capital Stake underlined that positivity surrounded the PSX on first trading session of the week.

“Indices accumulated gains all day long, while volumes jumped up from last close,” it said. “News of financial support from Saudi Arabia and hopes of an investor-centric budget helped investors regain confidence in the market.”

Sectors painting the benchmark KSE-100 index in green included technology and communication (114.25 points), fertiliser (56.82 points) and oil and gas exploration (53.20 points).

Volume on the all-share index more than doubled to 346.4 million from 168.5 million on Friday, while the value of shares traded fell to Rs6.4 billion from Rs6.8 billion recorded in the previous session.

WorldCall Telecom was the volume leader with 193.9 million shares followed by Maple Leaf Cement with 10.9 million shares and K-Electric with 8.9 million shares.

Shares of 348 companies were traded on Monday, of which 204 registered an increase, 128 recorded a fall and 16 remained unchanged.

Comments

Comments are closed.