Budget 2023-24: ‘high earners’ to pay a higher income tax as govt revises rates

- Budget proposals originally maintained income tax rates before govt amended the Finance Bill

After facing scathing criticism from the International Monetary Fund (IMF), the government of Pakistan revised the budget measures and imposed a higher income tax on what it sees as ‘high earners’ of the salaried group.

Business Recorder takes a look at how the tax payment will change for the salaried group in the coming fiscal year.

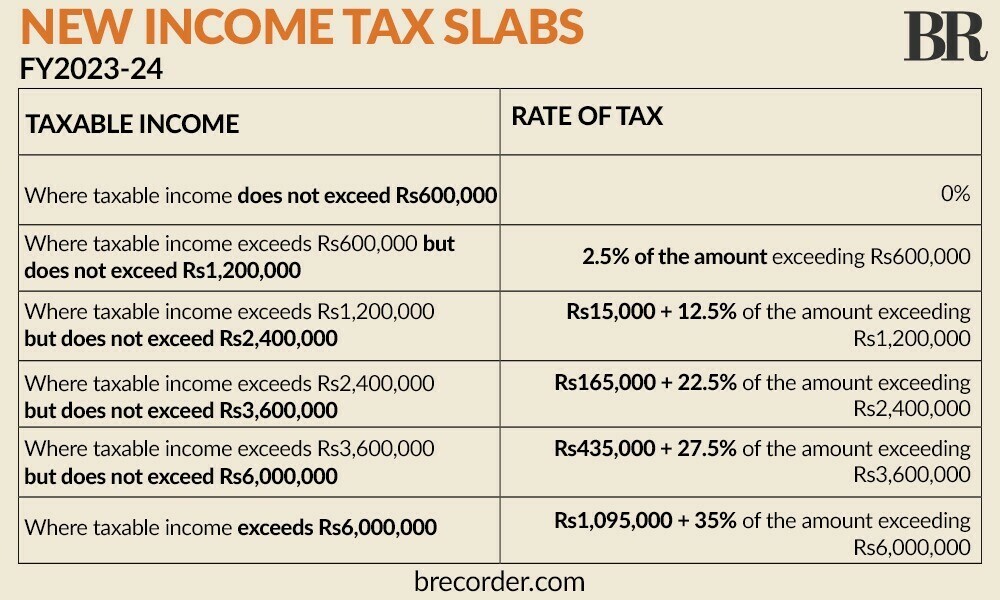

Here are the new income tax rates:

-

The new income tax slabs for the salaried group under the amended Finance Bill 2023 revealed that a higher rate of income tax would now be applicable where annual taxable income exceeds Rs2,400,000 (Rs200,000 per month).

-

According to the amended Finance Bill 2023 issued by the Federal Board of Revenue (FBR) on Sunday, where taxable income exceeds Rs2,400,000 but does not exceed Rs3,600,000, the rate of tax would be Rs. 165,000 + 22.5% of the amount exceeding Rs.2,400,000.

-

There is no change in income tax rates for salaried individuals where taxable income exceeds Rs1,200,000 but does not exceed Rs.2,400,000.

-

Under the new slab, where taxable income exceeds Rs3,600,000 but does not exceed Rs.6,000,000, the rate of tax would be Rs 405,000 + 27.5% of the amount exceeding Rs.3,600,000.

-

The revised income tax slab for salaried class revealed that where taxable income exceeds Rs6,000,000, the rate of tax would be Rs 1,095,000 plus 35 percent of the amount exceeding Rs 6,000,000.

Here are the old income tax rates:

Comments

Comments are closed.