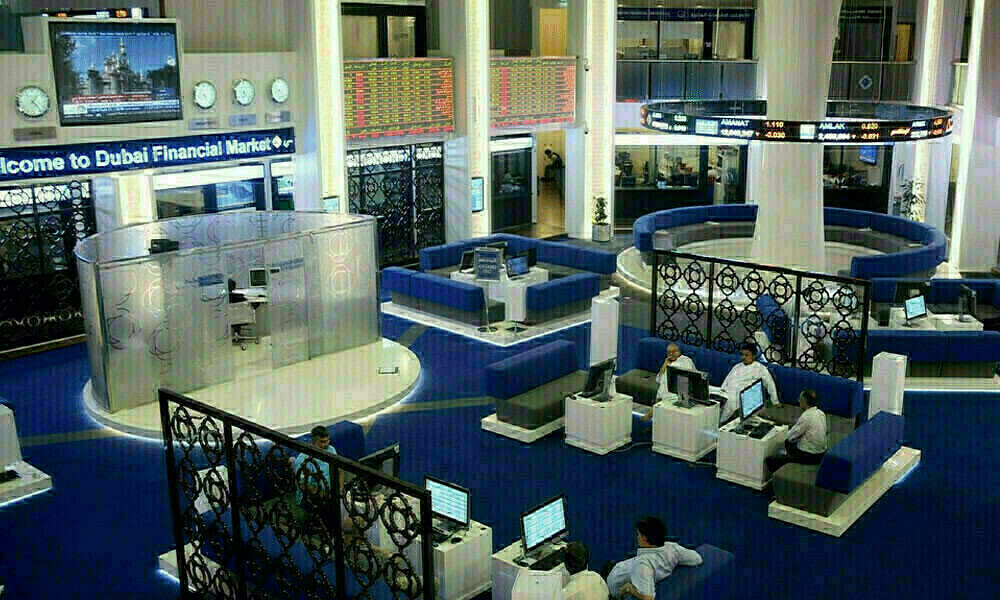

Stock markets in the Gulf ended lower on Thursday due to concerns that sweeping U.S. reciprocal tariffs will worsen global trade tensions and could tip the world into recession.

On Wednesday, U.S. President Donald Trump unveiled a 10% baseline tariff on all imports, and higher duties on dozens of countries, including some of its biggest trading partners.

Saudi Arabia’s benchmark index - which resumed trading after a four-session Eid break - dropped 1.2%, weighed by a 1.4% fall in Al Rajhi Bank and a 4.9% slide in Saudi Arabian Mining Company.

Among other losers, oil giant Saudi Aramco retreated 1.7%.

The decline in the Saudi bourse was primarily influenced by the negative sentiment pervading regional and global markets in the wake of Trump’s tariff announcements, said Joseph Dahrieh, Managing Principal at Tickmill.

“The concurrent decline in oil prices further weighed on the Saudi market’s performance.”

Oil prices - a catalyst for the Gulf’s financial markets - fell 6% as OPEC+ speeding up its unwinding of oil output cuts in May compounded already-heavy losses following Trump’s announcement of sweeping new tariffs on Wednesday.

Most Gulf markets rebound amid US tariff news

Dubai’s main share index declined 1.7%, dragged by a 9.7% slump in blue-chip developer Emaar Properties, its biggest intraday fall since March 2020, on trading ex-dividend.

According to Dahrieh, despite solid fundamentals and relatively low exposure to oil price volatility, the persistent negative sentiment can continue to impact Dubai’s stock market performance.

In Abu Dhabi, the index fell 0.8%.

Outside the Gulf, Egypt’s blue-chip index – which also reopened trading after a four-session Eid holiday – closed 1% lower, with Commercial International Bank losing 3.3%.

Meanwhile, Egypt’s non-oil private sector slipped into contraction in March, marking the first downturn of 2025 as demand weakened, S&P Global reported on Thursday.

Stock exchanges in Qatar and Oman remained closed for Eid.

----------------------------------------- SAUDI ARABIA fell 1.2% to 11,883 Abu Dhabi down 0.8% to 9,258 Dubai dropped 1.7% to 5,027 EGYPT slipped 1% to 31,700 BAHRAIN declined 0.6% to 1,950 KUWAIT eased 0.4% to 8,595 -----------------------------------------

Comments