Packages Limited and International Finance Corporation (IFC) have agreed the redemption of 8.0 million preference shares at more than Rs 5.3 billion, according to a stock filing. Preference shares, also called preferred stock, happen to be an equity stock that pays a fixed dividend and has no voting privileges. The Lahore-based listed packaging firm would make the redemption at mutually agreed Rs 663 per share.

"We have today agreed the redemption of 8,000,000 preference shares," said Adi J Cawasji, company secretary at Packages. The redeemable shares are half of the company's 16.18 million convertible stocks the IFC held under Subscription Agreement the two sides had signed on March 25, 2009.

BR100

16,313

Increased By

5.8 (0.04%)

BR30

52,359

Increased By

821.6 (1.59%)

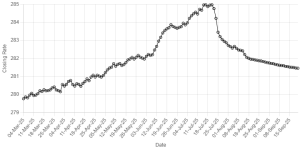

KSE100

158,037

Increased By

83.9 (0.05%)

KSE30

48,251

Increased By

52.4 (0.11%)

Comments

Comments are closed.