Shahtaj Sugar Mills Limited was incorporated in Pakistan on March 27, 1965 as a public limited company under the Companies Ordinance with a registered office situated in Karachi. The company was listed on Karachi and Lahore Stock Exchanges, (now Pakistan Stock Exchange) since 1972 and is engaged in the manufacture of sugar from sugarcane. Molasses is the only significant by-product contributing to the company's revenues.

The mill is situated in the district of Mandi Bahauddin in the province of Punjab. It went into commercial production in November 1968. Original plant and machinery of this mill was imported from Italy. It started with a crushing capacity of 1,500 tons per day on double carbonation double sulphitation (DCDS) process. This was later expanded to 4,000 tons per day and the process was also changed to Defection Remelt Phosphitation (DRP). The company completed another major BMR-cum-expansion program in 1996, aiming to double the capacity of the plant to remain one of the leading sugar mills of Pakistan. Present crushing capacity of the mill is 8,000 -10,000 tons sugarcane per day.

Shahtaj Sugar is managed by a competent and experienced board of directors with seven independent directors out of ten. It claims to fully comply with all International Accounting Standard as applicable in Pakistan. M/s. Ernst & Young Ford, Rohdes, Sidat Hyder & Company are the auditors of the company since its inception.

Pattern of shareholding The directors of the company between themselves own the single last shareholding among any of the shareholding categories of the company. The company belongs to the Shahtaj Group and sponsors of the group Mahmood Nawaz and Muneer Nawaz along with their spouses own approximately 4 million shares of the company, which adds up to 25 percent. The figures quoted are as per MY17 financials.

Other significant holdings are held by group company Shezan Services Limited, JS Growth Fund, NIT, and State Life, all of which hold between 5 to 10 percent share in the company.

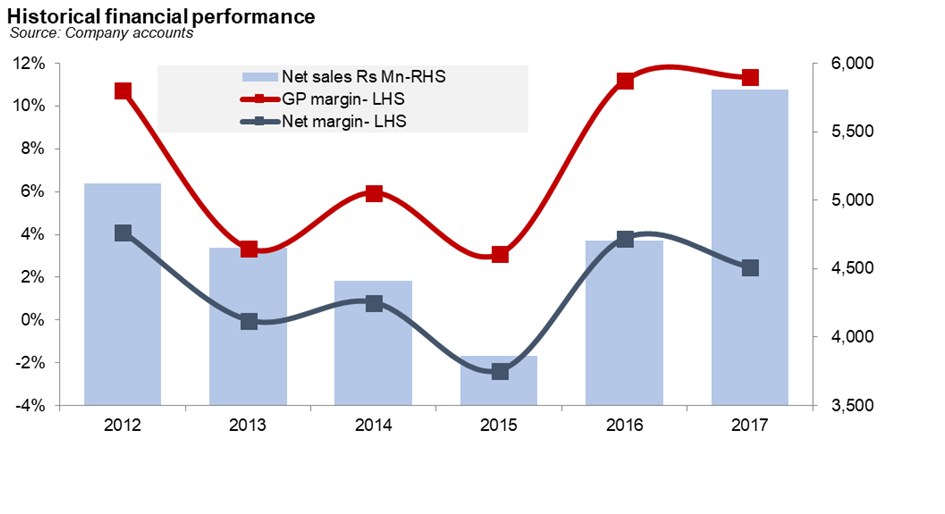

Historical performance With the price of sugarcane fixed by the provinces at exorbitantly high rates, the sugar industry has been suffering and a lot of sugar mills are in the red. Shahtaj is a midsize unit which has recorded undistinguished performance historically. Company's financial performance has suffered during the 2013-2016 period due to subdued sales because of lower than industry rate of sucrose recovery.

A cursory look at Shahtaj segments confirms that the company has been earning most of its revenue from sugar production whereas molasses contribution to revenue is only marginal.

Recent performance The company recorded an exceptional year for its sales turnover as it achieved highest ever levels of crushing, production, and recovery since its inception. Sugar prices during the year were less than last year but cost of production had also gone down due to better recovery and reduced cost of sugarcane procurement for the current season which resulted in better operational results for the year as compared to last year.

During the year, aggregate sugarcane crushing was higher by 60 percent, and total sugar production increased by 32 percent due to extended recovery season of 134 days compared to 97 days last year. Average sucrose recovery declined by 27 bps due to unfavorable weather conditions, massive early logging of sugarcane and sowing of unapproved varieties of sugarcane by growers which resulted in sucrose recovery.

As per the Director's Report, the higher sales are attributable to better sugar prices, timely receipt of sugarcane and export subsidies, and increase in sugar production, which has brought up the gross profit ratio. Moreover, cost savings came because of oil and lubricants, chemicals, and packing material.

Outlook: The company began crushing at the end of November 2017, and as per disclosure in its annual accounts has crushed more than 150,000 tons of cane at a recovery rate of 8.73 percent which is lower than last year, hence production clocked in at a lower level than MY17. Financials note that price indications are depressing as sugar selling price is significantly less than last year due to bumper production of sugar during the year and carryover stocks of last crushing season.

Keeping in view the availability of sugarcane, it would be expected that the production would be less than last year. The Punjab government has not increased the price of sugarcane and it is again fixed this year at Rs.180/- per 40 kg.

Once again, the country is looking at a surplus of sugar and the federal government has recently allowed export of sugar up to 225,000MT without any export subsidy, valid until 31st March 2018. Since global sugar prices have plummeted, the export subsidy is keeping the local players competitive, especially given the glut in domestic market.

The company has disclosed in its Notes to Financial Statements section that it is in the process of setting up a bagasse-based power project of installed gross capacity of 32 MW. Initially it is expected generate electricity of 22.85 MW and supply 15 MW to the National Grid.

In this respect, two steam turbines of generation capacity of 16MW each have been installed. The company has established letters of credit for the purchase of equipment related to technical equipment. It has also been granted generation license and upfront tariff for 30 years by NEPRA.

Financial close for the power project has been achieved and bankers to the project include syndication loan with MCB, UBL and Bank Al-Habib Limited (MCB is the lead bank).

=========================================================== Pattern of Shareholding (as on September 30, 2017) =========================================================== Categories of Shareholders % =========================================================== Directors and their spouse(s) and minor children 42.31% Executives 0.10% Associated Companies 2.38% Shezan Services (Private) Limited Modaraba & Mutual Funds 9.44% MC FSL-Trustee JS Growth Fund Public sector companies 12.98% Investment, Insurance Companies & NIT 9.72% General Public 23.07% Total 100% ===========================================================

Source: Company accounts

Comments

Comments are closed.