Japan's manufacturers most confident in seven months despite trade war worries: Reuters Tankan

Business confidence among Japanese manufacturers was at its highest in seven months in August thanks to a firm global economy, a Reuters poll showed on Friday, but the service sector's mood hit its lowest since 2016, casting doubt on the robustness of domestic demand.

The mixed results of the monthly poll, which tracks the Bank of Japan's closely watched tankan quarterly survey, underscore the fragility of an economy that has emerged from a first-quarter contraction. The Reuters Tankan found manufacturers' sentiment was expected to rise further over the coming three months despite concerns over global trade tensions and market turmoil stemming from some emerging economies.

Service-sector sentiment is also expected to recover from August's deterioration, which was caused in part by abnormal weather such as the flooding rains and heat waves that struck various parts of Japan this summer. In the Reuters poll of 483 large- and mid-sized companies, some exporters of cars and machinery makers expressed concerns over trade tensions between the United States and China and other trading partners.

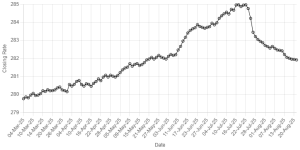

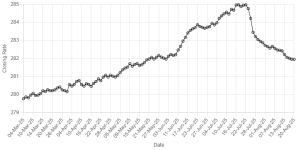

"The effects of punitive US tariffs against China are a matter of concern for us as well," a manager of a transport equipment maker wrote in the survey. Some 261 firms responded on condition of anonymity in the Reuters Tankan conducted August 1-14. The sentiment index for manufacturers stood at 30 in August, up five points from the previous month, driven by auto and transport equipment companies. It was the highest reading since January when it hit an 11-year peak of 35.

The index is expected to rise further to 32 in November. The service-sector index slid to 25 from 34 in the previous month, dragged down by information/communications, retailers/wholesalers, and other service firms. It was the lowest level since December 2016. The index is expected to rise to 26 in November.

The BoJ's latest tankan showed big manufacturers' sentiment soured for a second straight quarter in the three months to June, hurt by rising input costs and as US trade protectionism clouded the outlook for Japan's export-dependent economy. Japan's economy grew at an annualised rate of 1.9 percent in the second quarter on the back of household and business spending, recovering from an earlier contraction. The Reuters Tankan indexes are calculated by subtracting the percentage of pessimistic respondents from optimistic ones. A negative figure means pessimists outnumber optimists.

Comments

Comments are closed.