Pakistan has only one lube refinery, National Refinery Limited (PSX: NRL). The refinery was incorporated in 1963 and was privatised in the year 2005. National Refinery is part of the Attock group, which has another refinery, Attock Refinery Limited (PSX: ATRL). The Attock group is the only vertically integrated oil conglomerate of the country. The group is owned by Ghaith Pharaon family and the oil business has an E&P company Pakistan Oilfields Limited (PSX: POL), the two oil refineries NRL and ATRL, and a downstream oil marketing company, Attock Petroleum Limited (PSX: APL).

National Refinery Limited is engaged in the manufacturing, production and sale of a variety of petroleum products - fuels and lubes. Its key fuel products include motor gasoline, kerosene, JP-1, JP-8, Euro II grade HSD, LPG, furnace oil. Other products include Naphtha that is exported, sulphur, base oils, asphalt and specialty products.

NRL has three refineries for the refining of these products - two lube refineries and one fuel refinery. The first Rs104 million lube refinery was commissioned in 1966 with designed capacity of 3,970,500 barrels per annum of crude processing and 533,400 barrels per annum of lube base oils.

The second lube refinery was commissioned in 1985 and it started with a designed capacity of 700,000 tons per annum of lube base oils, which was expanded to 805,000 barrels per annum after a revamp in 2008. The total cost of the project was over Rs2 billion for the initial refinery and Rs585 million for the enhancement.

NRL's only fuel refinery began operating in 1977 with a designed capacity of 11,385,000 barrels per annum of crude processing. The refinery underwent two phases of up gradation. In the first phase, the capacity of the refinery increased to 16,500,000 barrels per annum in 1990, while the second round of revamping took capacity to17,490,000 barrels per annum of crude processing. The cost of the project commissioned in 1977 was Rs607.5 million, while the two enhancements totalled Rs673 million.

As mentioned earlier, NRL is the only refinery producing lube base oils LBO in Pakistan. Its BTX unit was commissioned in 1985 with design capacity of 180,000 barrels per annum.

The refining segment has been working to introduce diesel desulphurization units to produce EURO II standard HSD. NRL started its HSD Desulphurization and associated in 2007 to produce the desired quality diesel. The total cost of the project has been Rs26.82 billion. In the same year, NRL also commissioned its Isomerisation Unit (Naphtha Block) with a capacity to process 6,793 BPSD of light Naphtha into petrol with a total cost of Rs6.54 billion.

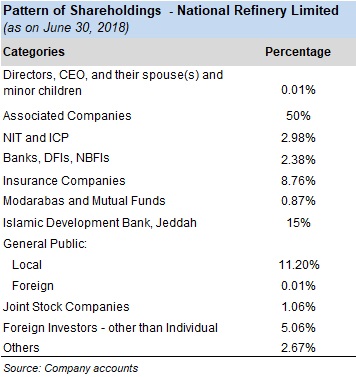

Shareholding pattern

As per the shareholding pattern for the year ended June 30, 2018, 50 percent of the shares are held by the associate companies that include Attock Refinery Limited (ATRL) and Pakistan Oilfields Limited (POL), both holding 25 percent each. The other significant shareholder is Islamic Development Bank Jeddah, holding around 15 percent of the total shares. Local general public holds around 11 percent. A break up of the shareholding is given in the table.

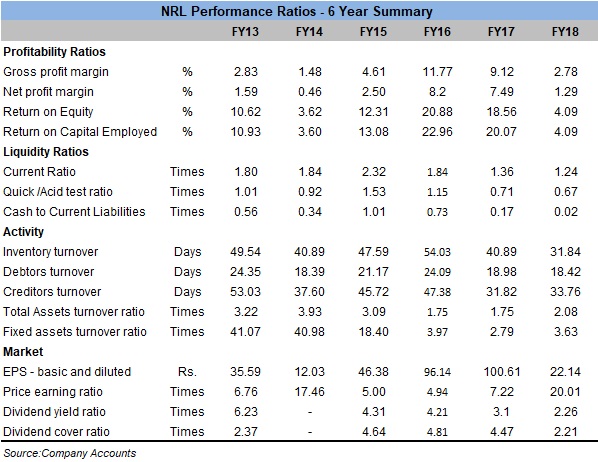

NRL's previous performance

NRL's financial performance has gone from good to weak. Its revenues increased at an impressive rate from FY10-FY14, after which growth eroded due to falling prices of petroleum products amid the supply glut as well as the global geo politics. Where revenues decided to come down post FY14, margins took a flight post FY14, reaching highest in FY15 as compared to the previous three years. The primary reason for the increase in refining margins was the improvement in margins of refined fuel products versus crude oil. Particularly in FY15, the company benefited from lower prices of crude oil as the company invested unutilised funds and gained interest income. At the same time, stable exchange rates helped improve profitability.

NRL being the only lube refinery in the country has seen more reliability in profits coming from the lube segment. The earnings of the segment improved further in FY16. And the fuel segment after four difficult years turned profitable in FY16 versus loss in previous years. Improvement in profitability for NRL came from favourable margins between product prices and cost of crude and improved sales of HSD and Bitumen.

In FY17, NRL saw its revenues climbed once again and the fuel segment's profitability improvement came from improved margins in the international market as well as higher sales volumes by the firm. The net profit of the fuel segment for FY17 also included investment tax credit against investments in DHDS project. Profitability of the lube segment however, declined in FY17 mainly on account of higher feed cost and irregular increase in product prices. This dragged the overall margins. In FY17, NRL commissioned its Diesel Hydro Desulphurization Project, to produce low sulphur (EURO II Standard) High Speed Diesel (HSD).

NRL's bottom-line fell by 78 percent, year-on-year in FY18 due to losses incurred by the fuel segment in the fiscal year versus a profit in FY17. Though the revenues were up by 27 percent, year-on-year, the company's profitability was affected by higher operating cost including depreciation on new units, exchange loss, custom duty on crude oil, and lower return on bank deposits, according to the Annual Report 2017-18. Increase in crude oil and product prices continued to affect the margins especially in case of fuel products. What further affected the profitability were the exchange losses due to currency depreciation. On the positive side, some respite came from elimination of price differential on HSD and higher revenue from increased production and sale motor gasoline - though these were not enough to contain the damage from the higher costs. The firm's performance in the lube segment remained stable. However, decline in production was witnessed due to the turnaround of lube II refinery along with lower demand for lube base oil in the country.

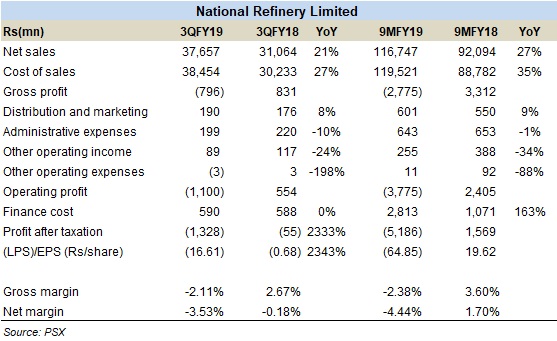

NRL in FY19 so far

Loses worsened for National Refinery Limited as the refinery demonstrated a loss of Rs5.19 billion in 9MFY19 versus a profit of Rs1.57 billion in 9MFY18. The situation in 3QFY19 worsened as NRL's losses in the quarter increased by more than 20 times that of 3QFY18.

Apart from the up-liftment of furnace oil, the decline in refinery's profitability also came from higher crude oil prices in the beginning of the fiscal year and thus higher product prices, squeezing the gross refining margins. In the 2QFY19, substantial decline in crude oil prices resulted in inventory losses. The overall performance was also bruised by the PKR depreciation that wreaked havoc on net margins, shown as exchange losses in the accounts. These remained significantly high in the first two quarters.

While the fuel segment of NRL suffered, the lube segment could also not save the overall profitability of the refinery due to irregular increase in prices of lube products as well as weaker sales volume of bitumen amid lower development activity in the country.

Outlook

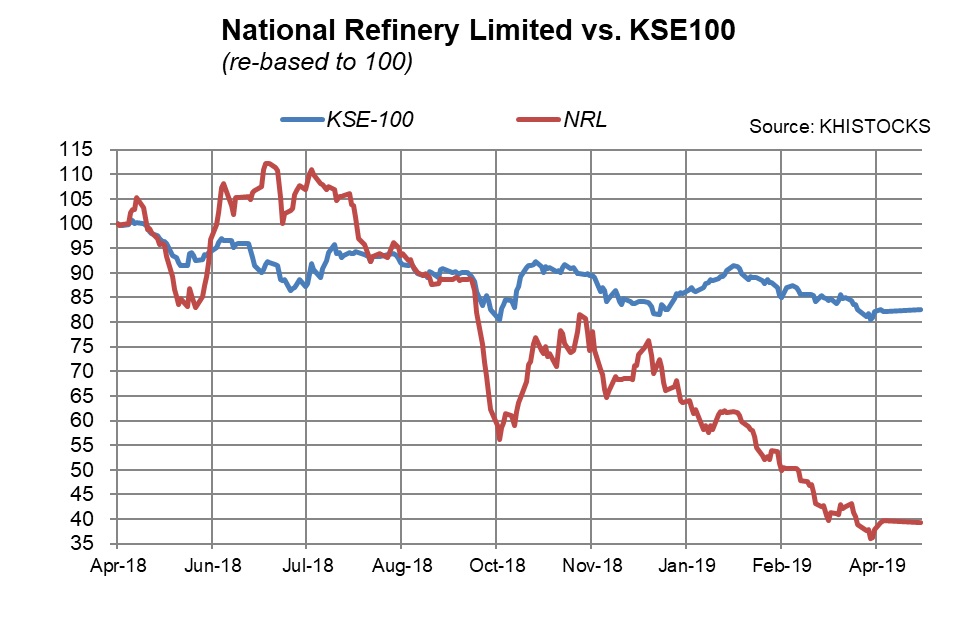

NRL's share prices have significantly underperformed the benchmark index since at least August 2018. And the primary reason for the weak performance of the refinery has to do with the weak performance of the refining segment in general.

The phasing out of furnace oil is the right decision, but it has left refineries in distress. Part of it has to do with inadequate refining capacity and no upgrade in the refining process, while some of it also had to do with ad hoc decision making on the government's part. Coming to furnace oil, the issue had wreaked havoc in the downstream oil and gas sector where the refineries and OMCs were threatening to shut down. Apart from the curtailment of furnace oil, the refinery up gradations plan of the government have also made the environment for refineries tough. Plus, the refineries might be in for some tough competition with UAE and Saudi refinery in the pipeline.

The government has also planned to give a 5-year window and incentives to the existing refineries to upgrade in addition to new refineries.

The medium term plan is that the refineries will export furnace oil for the next two years where the government will give them some financial incentive in the first six months, after which the refineries will compete on their own and decided whether or not to go for deeper conversion.

Comments

Comments are closed.