Bestway Cement Limited (PSX: BWCL) is a market leader in the cement industry, not only in terms of capacity but also in terms of sales. In FY18, the company had 18.6 percent share in the market, which dropped slightly to 18.1 percent in FY19 but still coming up top. The company has successfully acquired several functioning plants which realized into its current positioning in the market today. As a subsidiary of Bestway Holdings, BWCL was incorporated in the UK in the early 80s. The company currently operates five production lines at four different locations.

Hattar, KP which was set up in 1994 with an initial capital outlay of $120 million and a capacity of one million tons later upgraded to 1.27 million tons in 2004. In 2001, the fuel source of the plant was converted to gas from furnace oil and when most cement companies were converted their plants to coal, this plant was also converted to coal with a further investment of $10 million. This conversion to natural gas and then to coal reduced the energy cost component for the company which falls roughly between 60-65 percent of the total cost of production.

The company acquired its second cement plant located in Farooqia, KP by bidding for 85.29 percent of equity of Mustehkam Cement Limited following an offering by the Privatization Commission. This plant had an installed capacity of 0.66 million tons at a cost of $70 million. Bestway further raised its capacity to over 1.2 million tons by investing another $50 million.

This third plant is in Chakwal with a capacity of 1.8 million tons annually while another line of similar capacity was added to the plant in 2006. In 2015, Bestway acquired Pakcem Limited (formerly Lafarge Pakistan Cement Limited with its facilities located in Kallar Kahar. The plant could produce 2.5 million tons annually. The bid was for 75.86 percent of the shares at a value of $329 million. Bestway later acquired another 12.07 percent shares of the company through the public offering process, taking its shareholding in Lafarge Pakistan to 87.93 percent.

Together the four plants and their capacities put Bestway in leading position that was earlier occupied solely by Lucky Cement. The company supplies to north zone of the country and exports to India, Afghanistan and Mauritius. In terms of manufacturing, its primary product is Portland cement, while others include sulphate resistant cement (SRC), tile bond and grout. In terms of expansions, Bestway added 1.8 million tons of capacity at the Farooqia plant which went online in June-18.

Shareholders, acquisitions and efficiency The Bestway Group is a British multinational conglomerate company based in London, United Kingdom operating in the UK and Pakistan. It owns UK's second largest cash and carry chain. The group also has investments in banking, real estate, food and beverage, & rice milling aside from cement. Bestway group is also a joint owner of the Pakistan's third largest commercial bank UBL, and owns one of the biggest rice milling facilities in Pakistan.

Bestway Cement's shareholdings in FY19 have not changed too much since last year. More than 60 percent shares are held by associated companies where Bestway Holdings Limited holds 53.88 percent shares of the company. Meanwhile, Bestway Northern and Bestway Foundation held about 3 percent and 4 percent shares as per notes to the financial statements. The company's directors held 17 percent shares as at June-19 including the Chairman and the CEO's combined 5.6 percent holdings. Another Director Dawood Pervez held 6.3 percent shares. Lastly, the local public held 21.7 percent.

The company has tried to adopt energy efficiency techniques and technology and made appropriate investments to cut down on energy costs. A WHR at the Chakwal Plant in 2009 was followed by similar units at other sites. After acquiring the Lafarge plant, the company set up a 12MW WHR while the latest expansion also came with a 9MW WHR. The company has attempted to shift from conventional fossil fuels to alternative energy solutions. Nearly 30 percent of the energy needs during FY19 were met through the WHRs installed in-house. Meanwhile, Bestway has also installed water conservation systems and will begin to rain harvest through the construction of big rain harvesting reservoirs which would reduce its dependence on ground water.

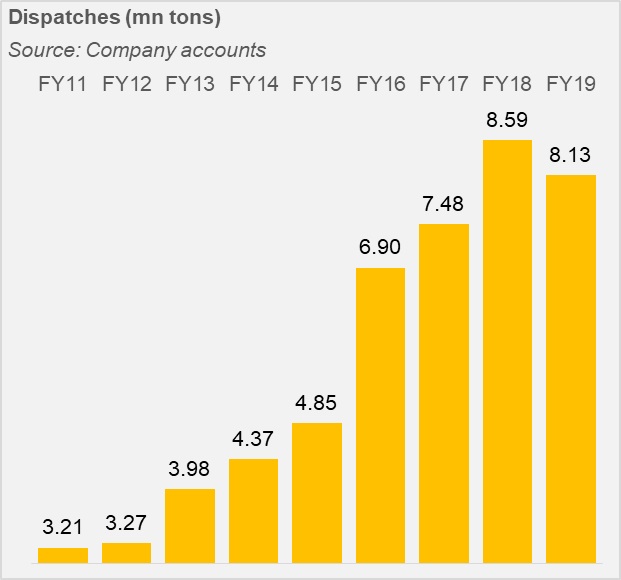

Operational and financial performance Bestway Cement is one of the major success stories in the cement industry and has made the investments to show for it. It merged and expanded into the biggest cement manufacturer in the country. As more plants were added into the mix, the company improved its capacity utilization and market share. After reaching 98 percent capacity in FY17, it embarked on a brownfield expansion and began FY19 with a newly operational plant.

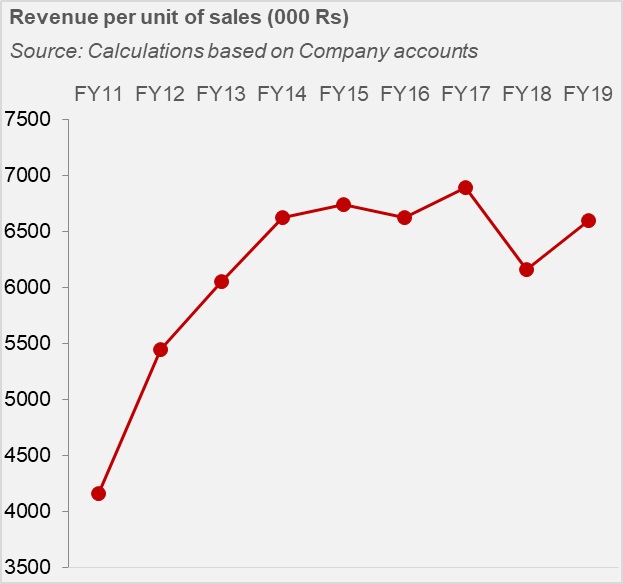

As a player in the north where competition becomes tough when demand recedes, the company has managed to keep its revenue per unit on a growing path, falling only during FY18 when price competition got really tough. Sales and revenue growth have been largely positive-higher in the earlier years and stable over the past few years with a dip during FY18 and only a small improvement during FY19.

Cement demand comes from massive infrastructure projects funded by the government through development spending. Since 2016, the Chinese investment under CPEC had boosted domestic demand significantly as well. As demand for construction of rails, motorways, roads, bridges, buildings, and other real estate developments grew, cement demand grew. The company adjusted its sales mix between local and foreign accordingly-where domestic sales provide better margins, there is a clear preference toward local markets. However, during times of lower domestic demand, exporting markets come as a much needed reprieve.

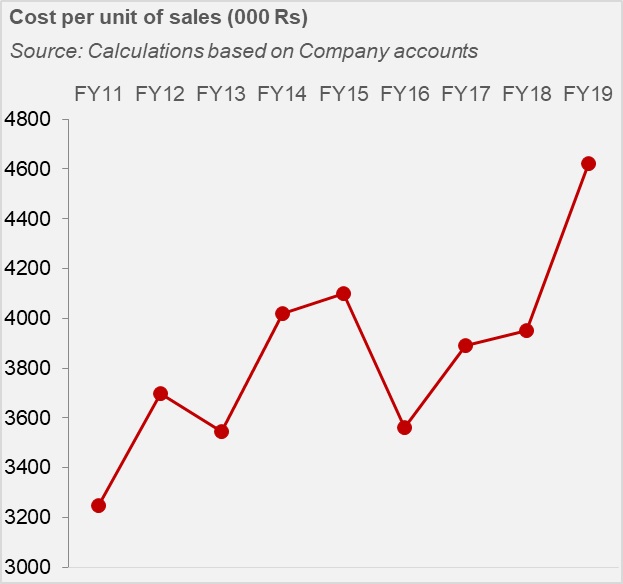

As a coal importer-and given that power takes up more than 60 percent in the cost of production-the company's timely installation of WHRs may have helped cut down a good portion of its costs. However, coal is still mostly imported which means the company remains sensitive to international coal prices, freight costs and currency fluctuations. Commodity price movements have caused costs of production per unit to move mostly up. During FY19, these costs grew by 17 percent for each ton sold. Though coal prices grew only marginally, the rupee depreciated by over 30 percent against the dollar. Meanwhile, higher freight costs may have further put a dampener. Margins as a result suffered. On average, in the past four years, the company has seen margins stand at 39 percent which is higher compared to the 37 percent average in the four years prior to FY16.

Margins have improved but fluctuated with inflationary costs pressures, domestic demand dynamics and prices. The company has managed a healthy cash flow over the years keeping finance costs low and likes to invest cash back into the business. During FY18, the company chose to utilize short term loans for the expansion project "in anticipation of surplus cash flows post completion of projects".

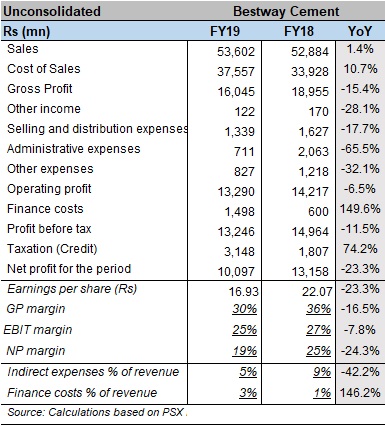

Snapshot of FY19 and outlook During the PML-N regime, spending on infrastructure projects and development led to demand hitting new highs and industry capacity utilized to the maximum. That was when cement companies entered their expansion phased. During that time, exports were falling but the industry was satisfied with the booming domestic market. However, during FY18 and onward to FY19, domestic demand has slumped. The economy is officially in austerity mode which means freeze on any new developmental spending. Regulations such as restrictions on property purchases by non-filers or ban on high rise construction while shrinking economy also did not bode well for commercial and housing related construction.

To make matters worse, demand in key export markets was also found shrinking. India imposed a 200 percent duty on Pakistani goods; the Afghan market became less receptive while other regional markets were not huge to begin with. The cement industry, particularly the north zone was being squeezed from all directions. Bestway still managed to grow revenue slightly despite a decline in sales. This translated however to a 23 percent decline in the bottom-line, the costs of production being the primary culprit.

The company's cost per ton sold rose by 17 percent in FY19 while revenue per ton sold only grew 7 percent. This result in the loss of margins. South African coal prices came down during FY19 averaging $93 per ton in FY18 down to an average of $87 per ton during FY19. But despite lower coal prices, margins reduced as expensive electricity and fuel prices affected margins, while rupee depreciation also put pressure on the cost of imports.

Due to lower exports, the company managed to bring down its administrative and distribution costs to 5 percent of revenues against 9 percent last year. Since it was not exporting too much, distribution costs were lower but the company also significantly cut down on admin costs. However, finance costs as a share of revenues grew to 3 percent in FY19 against 1 percent last year due to borrowings related to the new production line at Farooqia and rising mark-ups as policy rate tightened.

The company is still profitable and though no major development expenditure is upcoming and commercial development is expected to remain somber, the company may very quickly recover from its current slump if demand improves. If Naya Pakistan Housing Program's planned construction pick up, cement demand will automatically rise. It is likely this construction will begin in the north where most of the enthusiasm and activity is being seen in the project. Bestway could be a big beneficiary and may improve its current capacity utilization as well (76% in FY19) while improving revenues. However, when industry enters over capacity and demand is weak, it leads to heavier price competition which will remain a challenge for cement players in the north zone.

BR100

12,000

Increased By

69.2 (0.58%)

BR30

35,548

Decreased By

-112 (-0.31%)

KSE100

114,256

Increased By

1049.3 (0.93%)

KSE30

35,870

Increased By

304.3 (0.86%)

Comments

Comments are closed.